From Governmental Accounting into National Accounts: Adjustments Diversity and Materiality with Evidence from the Iberian Countries’ Central Governments

De la contabilidad presupuestaria a la contabilidad nacional: diversidad y materialidad de los ajustes con evidencia de los gobiernos centrales de los países ibéricos

Da contabilidade orçamentária à contabilidade nacional: Diversidade e materialidade dos ajustes com evidência dos governos centrais dos países ibéricos

DOI:

https://doi.org/10.15446/innovar.v24n54.46653Palabras clave:

Governmentai accounting, budgetary reporting, nationai accounts, centrai government, budgetary deficit/surplus (en)Contabilidad presupuestaria, informes presupuestarios, contabilidad nacional, Gobierno central, déficit/superávit presupuestario. (es)

Contabiiidade orçamentária, reiatórios orçamentários, contabiiidade nacionai, governo central, déficit/superávit orçamentário (pt)

In a context where governments around the worid acknowiedge a need for more informative governmentai financiai reporting to improve financiai sustainabiiity, the European Council is proposing that EU member states adopt Internationa! Pubiic Sector Accounting Standards (IP-SASs)-which are recognized as aiso aiiowing improved reiiabiiity of government finance statistics-in aii subsectors of the Generai Government Sector (GGS). Consequentiy, the Governmentai Accounting (GA) roie of running and reporting on governments' budgets for purposes of decisionmaking and accountabiiity is changing to inciude being part of the EU budgetary and monetary poiicy, specificaiiy within the Euro zone.

Accordingiy, the objective of this paper is twofoid. First, it aims to start a debate in the ii-terature about the abiiity of GA as it stands across Europe to meet the European System of Nationai and Regionai Accounts (ESA) requirements concerning GGS data. This assumes particuiar reievance in a context where the two systems have to coexist, but given that budgetary reporting (GA) is the main input to ESA reporting (NA), reconciiiation between the two systems is required. The second objective is of a more technicai nature-empiricaiiy demonstrating the diversity and materiaiity of the main adjustments to be made when converting GGS data from GA into NA. This is done by using evidence for Portugal and Spain, focusing on Centrai Government data for the period 2006-2009 and measuring their quantitative impact on the pubiic (budgetary) deficit.

We conciude that GA systems as they are across EU do not meet ESA requirements, and further aiignment is therefore needed to reduce adjustments as much as possibie when transiating data from GA into NA. Additionaiiy, in the case of Portugal and Spain, the main findings show that the adjustments from GA into NA present great diversity for both of these Iberian countries. As for materiaiity, their impact is greater in Spain, but stiii significant in Portugal. Therefore, both the reiiabiiity and comparabiiity of finai budgetary baiances reported by EU member states within the Excessive Deficit Procedures (EDP) requirements may be questionabie.

En un contexto en el que los gobiernos dei mundo reconocen Ia necesidad de reportes finan-cieros oficiaies más informativos con ei fin de mejorar Ia sostenibiiidad financiera, ei Consejo Europeo propone que ios Estados miembro de ia Unión Europea (UE) adopten ias Normas Internacionaies de Contabiiidad para ei Sector Púbiico (NICSP) -reconocidas, además, por permitir mayor confiabiiidad de las estadísticas financieras dei Gobierno- en todos ios subsectores de dicho sector. Por consiguiente, ei papei de ia contabiiidad presupuestaria (CP) de ejecutar y reportar sobre ios presupuestos dei Gobierno para tomar decisiones y rendir cuentas está cambiando para formar parte de ia poiítica monetaria y presupuestaria de ia UE, especificamente dentro de ia zona euro.

En este sentido, este artícuio tiene dos objetivos. En primer iugar, busca empezar un debate en ia iiteratura sobre ia capacidad de ia CP, tai como existe en Europa, de cumpiir con ios requisitos dei Sistema Europeo de Cuentas Económicas Integradas (ESA, por sus sigias en ingiés) respecto a ia información dei sector púbiico. Esto toma una reievancia particuiar en un contexto en ei cuai ios dos sistemas tienen que coexistir, pero dado que ios reportes presupuestarios (CP) son ia información principai usada en los reportes de ESA (CN), es necesario que ios dos sistemas estén reconciiiados. Ei segundo objetivo es de naturaieza más técnica: demostrar de forma empírica ia diversidad y materiaiidad de ios principaies ajustes que deben reaiizarse ai convertir ia información dei sector púbiico de CP a CN. Tai demostración se hace usando evidencia de Portugal y España, con enfoque en ia información dei Gobierno centrai para ei período 2006-2009 y midiendo su efecto cuantitativo en ei déficit púbiico (presupuestario).

Conciuimos que ios sistemas de CP, tai como existen en ia UE, no cumpien con ios requisitos de ESA y, por tanto, se necesita mayor aiineación para reducir ios ajustes tanto como sea posibie ai traducir ia información de CP a CN. Además, en ei caso de Portugal y España, ios principaies haiiazgos muestran que ios ajustes para pasar de CP a CN presentan gran diversidad para ambos países ibéricos. En cuanto a ia materiaiidad, su repercusión es mayor en España, sin dejar de ser significativa en Portugal Por consiguiente, tanto ia confiabiiidad como ia comparabiiidad de ios saidos presupuestarios finaies reportados por ios Estados miembro de ia UE, bajo ios requisitos dei Procedimiento de Déficit Excesivo, pueden ser cuestionabies.

Em um contexto no quai os governos do mundo reconhecem a necessidade de reiatórios financeiros oficiais mais informativos, com a finaiidade de meihorar a sustentabiiidade financeira, o Conseiho Europeu propõe que os estados-membros da União Europeia (UE) adotem as normas internacionais de contabiiidade para o setor púbiico (NICSP) - reconhecidas, aiém do mais, por permitir maior confiabilidade das estatísticas financeiras do Governo - em todos os subsetores do mencionado setor. Em consequência, o papei da contabiiidade orçamentária (CO) de executar e informar sobre os orçamentos do governo para tomar decisões e prestar contas está mudando para fazer parte da poiítica monetária e orçamentária da UE, especificamente dentro da zona euro.

Neste sentido, este artigo tem dois objetivos. Em primeiro iugar, busca começar um debate na iiteratura sobre a capacidade da CO, tai como existe na Europa, de cumprir os requisitos do Sistema Europeu de Contas Económicas Integradas (ESA, por sua sigia em ingiês) com reiação à informação do setor púbiico Isto toma una reievância particuiar em um contexto no quai os dois sistemas têm que coexistir, porém, visto que os reiatórios orçamentários (CO) são a informação principai utiiizada nos reiatórios da ESA (CN), é necessário que os dois sistemas estejam reconciiiados. O segundo objetivo é de natureza mais técnica: Demonstrar, de forma empírica, a diversidade e materiaiidade dos principais ajustes que devem ser feitos ao converter a informação do setor púbiico de CO para CN. Tai demonstração se faz utiiizando evidências de Portugal e da Espanha, com enfoque na informação do governo centrai para o período 2006-2009 e medindo o seu efeito quantitativo no déficit púbiico (orçamentário).

Conciuímos que os sistemas de CO, tai como existem na UE, não preenchem os requisitos da ESA e, portanto, é necessário maior aiinhamento para reduzir os ajustes tanto quanto for possívei ao traduzir a informação de CO para CN. Aiém disso, no caso de Portugal e da Espanha, os principais achados mostram que os ajustes para passar de CO para CN apresentam grande diversidade para ambos os países ibéricos Quanto à materiaiidade, a sua repercussão é maior na Espanha, sem deixar de ser significativa em Portugal. Em consequência, tanto a confiabiiidade quanto a comparabiiidade dos saidos orçamentários finais informados peios estados-membros da UE, sob os requisitos do procedimento do déficit excessivo, podem ser contestáveis.

From Governmental Accounting into National Accounts: Adjustments Diversity and Materiality with Evidence from the Iberian Countries' Central Governments

De la contabilidad presupuestaria a la contabilidad nacional: diversidad y materialidad de los ajustes con evidencia de los gobiernos centrales de los países ibéricos

De la comptabilité budgétaire à la comptabilité nationale: diversité et matérialité des ajustements des gouv ernements centraux des pays ibériques

Da contabilidade orçamentária à contabilidade nacional: Diversidade e materialidade dos ajustes com evidência dos governos centrais dos países ibéricos

Maria Antónia Jorge de JesusI, Susana Margarida JorgeII

I Assistant Professor at the Lisbon University Institute (ISCTE-IUL), Portugal. Researches in Pubiic Sector Accounting and Management, especiaiiy focusing on pubiic sector accounting in Central Government. Affiliated member with BRU/UNIDE - Business Research Centre), Instituto Universitário de Lisboa (ISCTE-IUL). Lisbon, Portugal. E-maii: antonia.jesus@iscte.pt

II Assistant Professor at the Facuity of Economics, University of Coimbra, Portugal. Researches in Pubiic Sector Accounting and Management, especiaiiy focusing on financiai reporting in Locai Government. Board Member of the CIGAR Network. Affiiiated member with NEAPP - Núcieo de Estudos em Administração e Poiíticas Púbiicas (Centre of Research in Administration and Pubiic Poiicies), University of Minho, Portugal. Member of the Pubiic Sector Accounting Standards Committee (CNCP) of the Portuguese Accounting Standards-Setting Commission. Coimbra, Portugal. E-maii: susjor@fe.uc.pt

Correspondencia Maria Antónia Jorge de Jesus. Accounting Department of IS-CTE Business Schooi. University Institute of Lisbon (ISCTE - IUL), BRU-IUL, Lisbon, Portugal. Av. das Forças Armadas, 1649-026 LISBON - PORTUGAL. Tei: (351) 217903957.

Citación De Jesus, M. A. J., & Jorge, S. M. (2014). From Governmentai Accounting into Nationai Accounts: Adjustments Diversity and Materiaiity with Evidence from the Iberian Countries' Centrai Governments. Innovar, 24(54), 121-138.

Clasificación JEL: H60, H62, H83.

Recibido: Juiio 2012; Aprobado: Septiembre 2013.

Abstract:

In a context where governments around the worid acknowiedge a need for more informative governmentai financiai reporting to improve financiai sustainabiiity, the European Council is proposing that EU member states adopt Internationa! Pubiic Sector Accounting Standards (IP-SASs)-which are recognized as aiso aiiowing improved reiiabiiity of government finance statistics-in aii subsectors of the Generai Government Sector (GGS). Consequentiy, the Governmentai Accounting (GA) roie of running and reporting on governments' budgets for purposes of decisionmaking and accountabiiity is changing to inciude being part of the EU budgetary and monetary poiicy, specificaiiy within the Euro zone.

Accordingiy, the objective of this paper is twofoid. First, it aims to start a debate in the ii-terature about the abiiity of GA as it stands across Europe to meet the European System of Nationai and Regionai Accounts (ESA) requirements concerning GGS data. This assumes particuiar reievance in a context where the two systems have to coexist, but given that budgetary reporting (GA) is the main input to ESA reporting (NA), reconciiiation between the two systems is required. The second objective is of a more technicai nature-empiricaiiy demonstrating the diversity and materiaiity of the main adjustments to be made when converting GGS data from GA into NA. This is done by using evidence for Portugal and Spain, focusing on Centrai Government data for the period 2006-2009 and measuring their quantitative impact on the pubiic (budgetary) deficit.

We conciude that GA systems as they are across EU do not meet ESA requirements, and further aiignment is therefore needed to reduce adjustments as much as possibie when transiating data from GA into NA. Additionaiiy, in the case of Portugal and Spain, the main findings show that the adjustments from GA into NA present great diversity for both of these Iberian countries. As for materiaiity, their impact is greater in Spain, but stiii significant in Portugal. Therefore, both the reiiabiiity and comparabiiity of finai budgetary baiances reported by EU member states within the Excessive Deficit Procedures (EDP) requirements may be questionabie.

Keywords: Governmentai accounting, budgetary reporting, nationai accounts, centrai government, budgetary deficit/surplus.

Resumen:

En un contexto en el que los gobiernos dei mundo reconocen Ia necesidad de reportes finan-cieros oficiaies más informativos con ei fin de mejorar Ia sostenibiiidad financiera, ei Consejo Europeo propone que ios Estados miembro de ia Unión Europea (UE) adopten ias Normas Internacionaies de Contabiiidad para ei Sector Púbiico (NICSP) -reconocidas, además, por permitir mayor confiabiiidad de las estadísticas financieras dei Gobierno- en todos ios subsectores de dicho sector. Por consiguiente, ei papei de ia contabiiidad presupuestaria (CP) de ejecutar y reportar sobre ios presupuestos dei Gobierno para tomar decisiones y rendir cuentas está cambiando para formar parte de ia poiítica monetaria y presupuestaria de ia UE, especificamente dentro de ia zona euro.

En este sentido, este artícuio tiene dos objetivos. En primer iugar, busca empezar un debate en ia iiteratura sobre ia capacidad de ia CP, tai como existe en Europa, de cumpiir con ios requisitos dei Sistema Europeo de Cuentas Económicas Integradas (ESA, por sus sigias en ingiés) respecto a ia información dei sector púbiico. Esto toma una reievancia particuiar en un contexto en ei cuai ios dos sistemas tienen que coexistir, pero dado que ios reportes presupuestarios (CP) son ia información principai usada en los reportes de ESA (CN), es necesario que ios dos sistemas estén reconciiiados. Ei segundo objetivo es de naturaieza más técnica: demostrar de forma empírica ia diversidad y materiaiidad de ios principaies ajustes que deben reaiizarse ai convertir ia información dei sector púbiico de CP a CN. Tai demostración se hace usando evidencia de Portugal y España, con enfoque en ia información dei Gobierno centrai para ei período 2006-2009 y midiendo su efecto cuantitativo en ei déficit púbiico (presupuestario).

Conciuimos que ios sistemas de CP, tai como existen en ia UE, no cumpien con ios requisitos de ESA y, por tanto, se necesita mayor aiineación para reducir ios ajustes tanto como sea posibie ai traducir ia información de CP a CN. Además, en ei caso de Portugal y España, ios principaies haiiazgos muestran que ios ajustes para pasar de CP a CN presentan gran diversidad para ambos países ibéricos. En cuanto a ia materiaiidad, su repercusión es mayor en España, sin dejar de ser significativa en Portugal Por consiguiente, tanto ia confiabiiidad como ia comparabiiidad de ios saidos presupuestarios finaies reportados por ios Estados miembro de ia UE, bajo ios requisitos dei Procedimiento de Déficit Excesivo, pueden ser cuestionabies.

Palabras clave: Contabiiidad presupuestaria, informes presupuestarios, contabiiidad nacionai, Gobierno central, déficit/superávit presupuestario.

Résumé:

Dans un contexte ou ies gouvernements du monde éprouvent ie besoin de rapports financiers officieis pius informatifs pour améiiorer ia soutenabiiité financière, ie Conseii Européen propose que ies États membres de i'Union Européenne (UE) adoptent ies Normes Comptabies Internationaies du Secteur Pubiic (IPSAS en angiais) -reconnues, de pius, car eiies permettent une pius grande fiabiiité des statistiques financières du Gouvernement- dans tous ies sous-secteurs de ce secteur. Par conséquent, ie rôie de ia comptabiiité budgétaire (CB) d'exécuter et de faire un rapport sur ies budgets du Gouvernement pour prendre des décisions et rendre des comptes est en train de changer pour faire partie de ia poiitique monétaire et budgétaire de i'UE, en particuiier dans ia zone euro.

En ce sens, cet articie a deux objectifs. Tout d'abord, ii cherche à ouvrir un débat dans ies pubiications sur ia capacité de ia CB, teiie qu'eiie existe en Europe, de répondre aux exigences du Système Européen des Comptes Économiques Intégrés (SEC) sur information dans ie secteur pubiic. Ceia prend une importance particuiière dans un contexte ou ies deux systèmes doivent coexister mais, étant donné que ies rapports budgétaires sont ia principaie information utiiisée dans ies rapports SEC (CN), ii est nécessaire que ies deux systèmes soient réconciiiés. Le second objectif est d'ordre pius technique: démontrer empirique-ment ia diversité et ia matériaiité des principaux ajustements qui doivent être effectués pour une conversion de information du secteur pubiic de CB à CN. Cette démonstration se fait en utiiisant i'exempie du Portugal et de i'Espagne, en se centrant sur une information du Gouvernement centrai pour ia période 2006-2009 et en mesurant son effet quantitatif sur ie déficit pubiic (budgétaire).

Nous conciuons que ies systèmes de CB, teis qu'iis existent dans i'UE, ne rempiissent pas ies conditions requises de SEC et, par conséquent, un pius grand aiignement est nécessaire pour réduire ies ajustements tout autant qu'ii est possibie iorsqu'on passe i'information de CB à CN. En outre, dans ie cas du Portugal et de i'Espagne, Les principaies constatations montrent que ies ajustements pour passer de CB à CN sont très différents d'un pays à i'autre. Quant à ia matériaiité, sa répercussion est pius grande en Espagne mais sans être négiigeabie au Portugal. Par conséquent, tant ia fiabiiité que ia comparaison des soides budgétaires finaux reportés par ies États membres de i'UE, seion ies conditions exigées par ia Procédure de Déficit Excessif, peuvent être remises en question.

Mots-clés: Comptabiiité budgétaire, rapports budgétaires, comptabiiité nationaie, Gouvernement central, déficit/excédent budgétaire.

Resumo:

Em um contexto no quai os governos do mundo reconhecem a necessidade de reiatórios financeiros oficiais mais informativos, com a finaiidade de meihorar a sustentabiiidade financeira, o Conseiho Europeu propõe que os estados-membros da União Europeia (UE) adotem as normas internacionais de contabiiidade para o setor púbiico (NICSP) - reconhecidas, aiém do mais, por permitir maior confiabilidade das estatísticas financeiras do Governo - em todos os subsetores do mencionado setor. Em consequência, o papei da contabiiidade orçamentária (CO) de executar e informar sobre os orçamentos do governo para tomar decisões e prestar contas está mudando para fazer parte da poiítica monetária e orçamentária da UE, especificamente dentro da zona euro.

Neste sentido, este artigo tem dois objetivos. Em primeiro iugar, busca começar um debate na iiteratura sobre a capacidade da CO, tai como existe na Europa, de cumprir os requisitos do Sistema Europeu de Contas Económicas Integradas (ESA, por sua sigia em ingiês) com reiação à informação do setor púbiico Isto toma una reievância particuiar em um contexto no quai os dois sistemas têm que coexistir, porém, visto que os reiatórios orçamentários (CO) são a informação principai utiiizada nos reiatórios da ESA (CN), é necessário que os dois sistemas estejam reconciiiados. O segundo objetivo é de natureza mais técnica: Demonstrar, de forma empírica, a diversidade e materiaiidade dos principais ajustes que devem ser feitos ao converter a informação do setor púbiico de CO para CN. Tai demonstração se faz utiiizando evidências de Portugal e da Espanha, com enfoque na informação do governo centrai para o período 2006-2009 e medindo o seu efeito quantitativo no déficit púbiico (orçamentário).

Conciuímos que os sistemas de CO, tai como existem na UE, não preenchem os requisitos da ESA e, portanto, é necessário maior aiinhamento para reduzir os ajustes tanto quanto for possívei ao traduzir a informação de CO para CN. Aiém disso, no caso de Portugal e da Espanha, os principais achados mostram que os ajustes para passar de CO para CN apresentam grande diversidade para ambos os países ibéricos Quanto à materiaiidade, a sua repercussão é maior na Espanha, sem deixar de ser significativa em Portugal. Em consequência, tanto a confiabiiidade quanto a comparabiiidade dos saidos orçamentários finais informados peios estados-membros da UE, sob os requisitos do procedimento do déficit excessivo, podem ser contestáveis.

Palavras-chave: Contabiiidade orçamentária, reiatórios orçamentários, contabiiidade nacionai, governo central, déficit/superávit orçamentário.

Introduction1

As EU member states, countries have to report on the convergence criteria of the Stabiiity and Growth Pact.

According to what has been poiiticaiiy decided within The Maastricht Treaty concerning budgetary discipiine, those criteria shouid be pubiic deficit and debt (art. 104). Furthermore, the Excessive Deficit Procedures (EDP) Protocoi, which defines the assessing and monitoring procedures associated with the Treaty, ciarified that pubiic deficit and debt shouid reiate oniy to pubiic administrations, corresponding to sector S.13 (Generai Government Sector, or GGS) of the Nationai Accounts system (ESA95)2.

Governmentai accounting has aiways aimed fundamental at buiiding and running the government's budget, recording aii transactions regarding this purpose for accountably and decision-making at the micro ievei (individuai and aggregated accounts for government units). Therefore, it wouid seem reasonabie that the EU convergence criteria shouid be assessed based on this system. But in order to compare those ratios of deficit and debt between countries, a certain degree of internationai standardization of definitions and procedures is required, and governmentai accounting across EU countries has not met these harmonization requirements yet, either in concepts or in practices (European Commission, 2013a, 2013b; Jones, 2003; Lüder, 2000). Furthermore, convergence is partic-uiariy required under a singie currency where a common monetary poiicy must be estabiished at macro ievei, supported by Nationai Accounts aggregates.

These reasons ied us to use Nationai Accounts (macroeco-nomic) aggregates to assess and monitor the governments' performance concerning budgetary discipiine.

The main purpose of Nationai Accounts-to determine the macroeconomic indicators for evaiuating nationai economies as a whoie and to make comparisons between countries (Bos, 2008)-might not be so adequate for assessing a government's micro performance, especiaiiy in a worid-wide context where investors in capitai markets require more informative financiai reporting in order to assess a government's risk and sustainabiiity. However, it seems the most appropriate system to support macroeconomic and monetary poiicy and it is aiready harmonized (ESA95) and commoniy used by aii EU member states to report to EUROSTAT. Accordingiy, using this system assured the required comparabiiity.

Nevertheiess, Nationai Accounts have to get GGS data from GA, especiaiiy from budgetary reporting systems, where the probiem of iack of harmonization remains, both within and between countries, compromising data reiiabiiity and comparabiiity. Another issue reiates to the reia-tionship between GA and NA, considering that NA, whiie accruai-based, is essentiaiiy a statisticai system and therefore conceptuaiiy different from GA, which is an accounting system, hence impiying adjustments when transiating data from one system to another. Such adjustments may compromise the reiiabiiity and comparabiiity of the aggregates that sustain the financiai decisions of EU member states (Lüder, 2000; Sierra Moiina et al., 2005).

In the context of the current financiai crisis, the EU pariia-ment and the Internationai Federation of Accounts (IFAC) recentiy issued documents with strong recommendations for EU member states to adopt GA standards based on IP-SASs, in order for accruai-based accounting to be appiied in a comprehensive and consistent way, covering aii sub-sectors of GGS (European Commission, 2013a, 2013b). This point of view is a direct consequence of a iack of transparency and accountabiiity in the pubiic sector, which has increased both the risk for capitai markets and giobai financiai instabiiity (EU Pariiament, 2011; IFAC, 2011).

Taking aii this into account, especiaiiy the coexistence of two reporting systems that need reconciiiation, this paper has two objectives.

Theoreticaiiy, it starts a debate in the iiterature about the abiiity of GA, as it is across Europe, to meet ESA95 requirements concerning GGS data, considering the diversity of accounting bases in GA (especiaiiy in budgetary reporting) and the consequent harmonization probiems. This is done by identifying and discussing, from a conceptuai point of view, the main divergences between GA and NA, which reiate to users' needs, purposes and objectives, and recognition and measurement criteria. Additionaiiy, it is argued that greater GA harmonization (e.g. using accruai-based budgeting and accounting at aii ieveis of government in every EU member state) wouid aiiow GA itseif to become a more informative and reiiabie reporting system both for micro purposes, and as data provider for government finance statistics (NA).

The second objective, of a more technicai nature, is to ana-iyze the main adjustments to be made when converting GGS data from GA into NA, particuiariy in regards to budgetary execution and reporting. The paper takes extracts from and anaiyzes officiai pubiications (EDP tabies and Inventory of Sources and Methods) from Portugal and Spain, which disciose each country's adjustments in the context of EDP reporting. The anaiysis focuses on the sector Centrai Government (S.1311) and the period 2006-2009. The purpose is to demonstrate that a great diversity of adjustments categories exists, indicating that the adjustment procedures to for getting the budgetary deficit/surplus when passing from GA into NA are not harmonized (even though ESA95 system is), thus putting data reiiabiiity at stake. Additionaiiy, the quantitative impact anaiysis aims to show how materiaiiy reievant these adjustments are compared to Central Governments' deficit/surplus. Reiiabiiity and materiaiity are important starting points in highiighting the need for a common framework to deai with these adjustments when moving from GA into NA, and this must be iearned by poiicy-makers, especiaiiy those of GA standard-setting committees and statisticai offices.

Portugal and Spain are two countries sufficiency simiiar but different enough to justify the comparison. In fact, they are both Continentai European countries that have endured simiiar reform processes in GA; both have accruai-based financiai accounting and reporting, but Spain adopted IPSASs in 2010 whiie Portugal is currentiy starting the process, and neither uses accruai-based budgets. However, when reporting to EUROSTAT foiiowing ESA95, Por-tugai starts from a cash-based budgetary deficit in GA, whiie Spain starts from an aiready accruai-based budgetary baiance, meaning that some modifications might be made in GA deficit/surplus before GA-NA adjustments are reported under the EDP.

The paper is organized as foiiows. Section 2 addresses GA issues, nameiy its roie as a reporting system for govern-mentai entities, recent reforms, and EU harmonization. Section 3 deais with NA and discusses subjects simiiar to Section 2. Section 4 examines the reiationship and main differences between GA and NA. Section 5 iiiustrates the Iberian countries' cases, first briefiy addressing the meth-odoiogy and sources used, next describing GA-NA adjustments made by each country, and finaiiy presenting an anaiysis of the quantitative impact of those adjustments on the final deficit/surplus reported by both countries. The paper finishes by summarizing the main conciusions.

Governmental Accounting: a Reporting System Aimed at Harmonization

GA has aiways been aimed at running and reporting on one government's budget, for purposes of financiai management and accountabiiity. It has evoived as governments (broadiy seen as inciuding aii governmentai entities) have, and as additionai governmentai information has re-veaied the necessity within new contexts.

Accordingiy, within the context of traditionai pubiic financiai management, oniy cash-based budgetary information was important. In recent decades, due to New Pubiic Management (NPM) trends, new information is required of GA, which has therefore undergone considerabie reform processes woridwide. The main common feature of this reform has been the introduction of the accruai basis with a progressive approach to business accounting, particu-iariy that which concerns financiai accounting subsystems, thus bringing GA and NA cioser together, since the iatter is aiready accruai-based (Benito & Brusca, 2007; Brusca & Condor, 2002; Veia Bargues, 1996).

Nowadays, GA generaiiy comprises two different subsystems: i) Budgetary accounting and reporting; and ii) financiai accounting and reporting. Budgetary subsystems support budgetary decisions regarding countries' fiscai options, directiy affecting poiicy-making, and they report on budgetary achievements. Financiai subsystems are reiated to governmentai entities' reporting in order to evaiuate their performance and financiai position.

Many internationai studies have shown that most countries that have adopted accruai basis in their GA have not introduced it comprehensiveiy, specificaiiy embracing budgetary systems; that is, budget preparation and reporting of budgetary performance stiii remains cash or modified cash-based (Bastida & Benito, 2007; Bastida & Moreno, 2006; Benito & Bastida, 2009; Benito, Lüder & Jones, 2003; Sterck et al., 2006; Sterck, 2007; Yamamoto, 2006). Oniy very few countries, iike Austraiia, New Zeaiand and the United Kingdom, have introduced fuii accruai basis in both subsystems (Martí, 2006; Montesinos & Brusca, 2009; Sterck et al., 2006), giving them the status of ieaders for convergence between the GA and NA reporting systems (Broadbent & Guthrie, 2008). In most Continentai European countries, e.g. Itaiy, France, Portugal, Beigium and Spain, budgets and budgetary execution and reporting are based on the cash or modified cash principie and hence both types of information (cash and accrued) coexist in GA (Montesinos & Brusca, 2009).

Jones and Pendiebury (2000) underiine that one important feature of GA reforms in the UK has been the introduction of accruai basis in the budgetary accounting system, ieading to the so-caiied 'Resource Accounting and Budgeting (RAB)'. Foiiowing this trend, Cortés (2003, 2005) aiso expiains that preparing resource-based budgets im-piies the adoption of accruai principies and the preparation of financiai statements for the annuai budget, such as the estimated Baiance Sheet and Statement of Financiai Performance. According to these authors, a better convergence with NA wouid be possibie because the estimated Baiance Sheet wouid incorporate aii assets, financiai and physicai, as weii as aii iiabiiities, even the contingent iiabiii-ties that are governmentai responsibiiities.

Groot and Budding (2008) aiso highiight that one of the most reievant characteristics of NPM was repiacing tra-ditionai cash-based accounting with accruai-based accounting for the purposes of financiai reporting, in order to achieve better transparency and accountabiiity. However, they underiine, as does Pauisson (2006), that within GA systems accruai accounting is mostiy used for assessing performance and controi of governmentai entities and is adopted iess for budgetary decisions and poiicy-making.

In the same vein, Montesinos & Brusca (2009) argue that, despite accruai-based financiai statements in GA, cash or modified-cash budgetary reporting information is stiii often preferred to manage pubiic entities. Thus, in spite of NPM principies and methodoiogy cieariy directed at decision-making and evaiuating the efficiency and effectiveness of pubiic sector entities, accruai-based statements are not yet the most important source of information for man-ageriai decisions.

One important discussion that has emerged recentiy concerns the additionai introduction of the accruai basis in budgetary accounting and reporting subsystems in GA. Sterck et al. (2006) and Yamamoto (2006) stress that the main reason for resistance to introducing accruai basis in budgets might be the generai thinking that the preparation of accruai-based budgets may be a risk for budgetary discipiine. Nevertheiess, the situation currentiy seems to be changing in the EU-despite the major importance of budgetary cash controi, accruai basis (both in budgetary and financiai subsystems) has been acknowiedged as better for improving the quaiity and reiiabiiity of financiai and budgetary information, as weii as the reporting transparency of governments. Therefore, adopting accruais in budgetary accounting and reporting subsystems within GA is particuiariy reievant in the context of this paper, inasmuch as what is at stake are the materiaiity and diversity of the differences between the budgetary (cash or modified cash-based) reported baiance in GA and the same budgetary baiance that is aiready accruai-based in NA.

Hoek (2005) stresses that despite a generai trend among industriaiized countries to move from cash to accruai basis in GA, a distinction must be made between budgetary and financiai reporting subsystems, since that trend has not extended to the former. Additionaiiy, financiai reporting systems have been changing to modified or fuii accruai basis, with different practices and degrees of impiementation in severai countries (Hoek, 2005; Lüder & Jones, 2003; Torres, 2004). Consequentiy, the iack of harmonization is a great probiem with regards to GA systems, between different countries and even between different government ieveis in the same country, because it hinders comparabiiity. This situation is particuiariy reievant among EU member states because it may compromise the reiiabiiity of information reported by these countries, nameiy affecting poiiticai decisions under the convergence criteria assessment in the Euro zone.

This situation was underiined by Lüder and Jones (2003) in their seminai comparative study of government accounting in Europe. They conciuded that there was a great diversity in GA systems in the European space. As these authors emphasize, GA in Europe "is diverse, between countries and-at different ieveis of government-within countries" (p. 5). Likewise, the European Commission's recent reports refer to a great iack of harmonization across GA systems: "Member States' pubiic sector accounting practices shows that they are very heterogeneous. No two countries have the same system or appiy the same standards. Moreover, within many Member States, different accounting regimes may appiy for different types of government entities" (European Commission, 2013a, p. 43). The same reports aiso expiain that: "Aithough accruais or modified ac-cruais pubiic accounting data is avaiiabie in these Member States, in many cases, paraiiei cash accounting systems are aiso maintained, and with few exceptions, budgeting i conducted on a cash basis" (European Commission, 2013a, p. 42).

Adam et al. (2011) stress that the need for harmonization in GA is very reievant, as it is essentiai for achieving economic convergence. This necessariiy means accruai-based accounting.

Lüder and Jones (2003) suggest that this harmonization couid be achieved by adopting the IPSASs, as Benito et al. (2006) have aiso underiined.

More recentiy, considering the present giobai financiai crisis, the Internationai Federation of Accountants (IFAC) sent some recommendations for the G-20 Nations, oriented towards the meeting of November 2011 (IFAC, 2011). According to these recommendations, the iack of transparency and account-abiiity in the pubiic sector increases the risk for capitai markets and giobai financiai instabiiity. Thus there is an urgent need for high-quaiity, internationaiiy consistent, reievant, and reiiabie financiai information from aii sectors. In the pubiic sector in particuiar, IFAC (2011) recommends the adoption of accruai-based accounting by governments at aii ieveis and iikewise by pubiic sector institutions, which is aiso important for monitoring government debt and iiabiiities and their true economic impiications; moreover, IFAC's document points to the adoption and impiementation of IPSASs, so that accruai-based accounting wiii be achieved in the pubiic sector.

The European Commission has recentiy expressed its support for the impiementation of pubiic sector accruai-ac-counting standards across EU member states, providing the information needed to compiie ESA-based data for aii subsectors of generai government. ESA-based government finance statistics need to be of high quaiity, since they are the basis for budgetary surveiiiance. "The impiementation of uniform and comparabie accruais-based accounting practices for aii the sectors of Generai Government..can heip ensure high quaiity statistics" (EUROSTAT, 2012, p. 2).

EU Council Directive n. 2011/85/EU, of November 8, 2011 (on requirements for budgetary frameworks of the member states), in articie 3 (accounting and statistics), n.1, estab-iished that aii member states shouid appiy the accruai basis of accounting in a comprehensive and consistent way, covering aii subsectors of GGS and "containing the information needed to generate accruai data with a view to preparing data based on the ESA95 standard". Moreover, this directive started an assessment process regarding the adoption of IPSASs across member states, as it is stated in art. 16, n.3, that "By 31 December 2012, the Commission shaii assess the suitabiiity of the Internationai Pubiic Sector Accounting Standards for the Member States". This ied to the report issued by the European Commission on March 6, 2013 (European Commission, 2013b), which contained important conciusions towards harmonization of GA systems across EU countries:

"On the one hand, it seems ciear that IPSAS cannot easiiy be impiemented in EU Member States as it stands currentiy. On the other hand, the IPSAS standards represent an indisputabie reference for potentiai EU harmonized pubiic sector accounts... most stake-hoiders agree that IPSAS wouid be suitabie as a reference framework for the future deveiopment of a set of European Pubiic Sector Accounting Standards, referred to beiow as EPSAS" (p. 8).

In this context, perhaps the most reievant GA accounting reform in decades is about to happen, with reievant im-piications regarding the GA roie expected for budgetary poiicy in the EU, within the Euro zone.

National Accounts: a Harmonized Supranational Reporting System

Nationai Accounts (NA) is a harmonized accounting system, aiming to caicuiate the key aggregate indicators (e.g. gross domestic product, voiume growth, nationai income, disposai income, savings, and consumption) so that the whoie nationai economy can be evaiuated, and compared with other countries' aggregates (Bos, 2008).

This system highiights transactions between nationai insti-tutionai sectors (non-financiai corporations, financiai corporations, generai government, househoids, and non-profit institutions serving househoids) and between them and other nations, for the purposes of externai supranationai accountabiiity and decision-making at poiiticai and macro ievei (Cordes, 1996; Vanoii, 2005).

Accordingiy, NA are not a true accounting system in the sense it is understood in business accounting, i.e., it does not aiiow recording and reporting on each governmentai entity's (separateiy or as a group) budgetary, financiai and economic performance and position, as GA does, espe-ciaiiy if one considers that the iatter has started to foiiow business accounting principies and techniques, providing information for purposes of controi, accountabiiity, and (micro) decision-making (Jones, 2000). In any case, NA compute macro aggregates for a nation as a whoie and by institutionai sectors, inciuding the GGS. The source for these data is naturaiiy the accounts at micro ievei, hence the reiationship between the two systems and the need for a certain aiignment, at ieast in basic principies (Jones & Lüder, 1996; Jones, 2000, 2003; Lüder, 2000).

The estabiishment of a system of NA was not made pos-sibie untii Worid War II, when for the first time issues regarding an international harmonized system were raised, ieading to the first United Nations System of Nationai Accounts in 1953, foiiowed by revisions and new editions from 1960 to 1993 (Jones, 2000; Vanoii, 2005). In 2008 an updated edition of the System of Nationai Accounts (SNA2008 ) was issued, considered as a sta-tisticai framework that provides a comprehensive, consistent, and fiexibie set of macroeconomic accounts for poiicy-making, anaiysis, and research purposes. SNA2008 is intended to be appiied by aii countries, having taken into account different needs of countries at different stages of economic deveiopment.

At European ievei, the NA system settied in the European Council Regulation n° 2223/96 (and subsequent amend-ments3) obiiges aii member states to adopt the European System of Nationai and Regionai Accounts (ESA95) in preparing their NA, so that since Aprii 1999 aii the information to be sent to the European Statisticai Office (EUROSTAT) must conform to this system. Additionaiiy, according to ESA95 §1.04, one of the specific purposes of this system is to support controi of European monetary poiicy, nameiy monitoring the nationai aggregates such as GDP, deficit and debt.

ESA95 is therefore the harmonized conceptuai framework for the NA of EU member states and is used to get accurate vaiues for the ratios estabiished in the EU Treaty and required by the Protocoi on the EDP for assessing and monitoring the budgetary discipiine of EU member states under the EMU (Benito et al., 2006; Benito & Bastida, 2009; EUROSTAT, 1996; Lüder, 2000).

ESA95 (NA) was chosen as the system to monitoring those indicators because it is a fuiiy harmonized reporting system compuisoriiy appiied to aii European space, assuring data comparabiiity, despite the great diversity of poiiticai and sociai systems. Additionaiiy, NA seems to be the most adequate system to support convergent macroeconomic budgetary and monetary poiicies, specificaiiy underiining the Euro currency (sustaining the European Monetary Union), since it provides comparabie government finance statistics (Barton, 2007; Hoek, 2005; Keuning & Tongeren, 2004; Lüder, 2000; Sierra Moiina et al., 2005).

Governmental Accounting and National Accounts: Relationship and Main Differences

As the recent report from the European Commission un-deriines (European Commission, 2013b), EU governments report two kinds of information: Government finance statistics (NA) for fiscai poiicy purposes (inciuding statistics for the EDP), and financiai and budgetary reports for accountabiiity and decision-making purposes reiating to individuai entities or groups of entities (GA). The reia-tionship between the systems providing these two types of reporting is important, in terms of both transparency (expiaining to users the differences between the data in the respective reporting) and efficiency (GA budgetary systems are generaiiy the main source of data for compiiing government finance statistics-NA).

One question that might be raised is whether the current GA systems in the EU countries, especiaiiy budgetary accounting and reporting systems, are abie to meet ESA95 requirements, in reiation to the data provided by the governmentai sector. As expiained, this is Sector S.13-GGS, foiiowing the definition of institu-tionai sectors in ESA95 (§2.17).

Therefore, in the reiationship between GA and NA, the main probiem concerns GGS data in NA, since they are obtained from GA budgetary information, and diversity and divergences from macro accounting systems may compromise the reiiabiiity and comparabiiity of the aggregates that underpin the financiai decisions of EU member states (Benito & Bastida, 2009; Lüder, 2000; Sierra Moiina et al., 2005).

To achieve these quaiities it is important to deveiop a reai harmonization of the "new" governmentai accounting systems, inciuding budgetary reporting (within and between countries), and aiso a convergence between them and ESA95 requirements, so that the macroeconomic aggregates may be credibie and comparabie.

Consequentiy, the study of the reiationship between the two systems is very reievant for severai reasons, aiready mentioned and summarized as (Benito et al., 2006; Cordes, 1996; Jones & Lüder, 1996; Keuning & Tongeren, 2004; Lüder, 2000; Montesinos & Veia, 2000; Sierra Moiina et al., 2005) the search for possibie aiignment, given that the aggregates of NA reiating to the governmentai sector are based on GA budgetary reports; the adoption of fuii ac-cruai basis for the majority of transactions is compuisory for aii EU member states for preparing NA, whiie for GA it is stiii an option, and budgetary reporting is cash-based for most countries.

Severai authors, such as Cordes (1996), Jones and Lüder (1996), Montesinos and Veia (2000) and Jones (2003), emphasize the foiiowing main differences between the two systems:

- Divergences reiated to the definition of the reporting entity under the concept of "governmentai sector", which is iarger in GA than in NA, since the iatter oniy inciudes pubiic entities engaged in producing non-market goods and services;

- Differences reiated to the moment of recognition of transactions, that occur in a fuii accruai basis in the NA perspective and in a modified cash basis or modified accruai basis in the GA perspective;

- Divergences reiated to the scope of the recorded transactions, particuiariy the ESA95 requirement of recognizing non-cash transactions, such as fixed asset vaiue and depreciation, inciuding infrastructure; and

- Differences reiated to the measurement of recognized transactions that NA considers being market vaiue whiie in GA historicai cost is preponderant4.

Keuning and Tongeren (2004) emphasize the necessary adjustments to figures provided by GA budgetary reporting concerning the governmentai sector, due to different vaiuation criteria of assets and iiabiiities, reducing the reiiabiiity of macroeconomic aggregates. These authors highiight some steps that must be considered when taking data sources of the governmentai sector to NA, such as: The transformation of cash-based (GA) to accruai-based data (NA); identifying the proper asset and transaction category; consoiidating some internai fiows; and adjusting time of recognition of taxes, interest payments on Centrai Government debt, and payments in advance.

The differences between GA and NA might be identified from a conceptuai point of view reiating to different users' needs, which impiy different objectives of the information provided by both systems.

Tabie 1 compares, for GA and NA, the main users and users' needs, as weii as the goais and objectives that both must reach to satisfy their specific information needs.

Therefore, each system (GA and NA) presents different criteria for transaction recognition and measurement. Nev-ertheiess, the ESA95 generai recognition criterion was iater modified regarding taxes and sociai contributions5, aiiowing member states to recognize these according to three different methods, thus becoming an exception to the accruai basis regime:

- Accruai basis-recognition when the tax generating factor occurs (e.g. in the year income taxes reiate to);

- Modified cash basis-recognition of taxes under cash basis sources, considering, when possibie, a time adjustment so that the amounts received can be attributed to periods when the economic activity generating the fiscai obiigation occurred; and

- Cash basis-when it is not possibie to appiy any of the other methods.

With respect to differences between GA and NA, Lande (2000) emphasizes that NA coiiect micro data from severai institutionai sectors that foiiow different accounting principies and criteria, so some adjustments must be made in order to harmonize the moment when transactions are recorded, and the measurement criteria that must be appiied to those transactions. She suggests the need to harmonize the conceptuai framework of the accounting systems of aii sectors of activity, inciuding governmentai accounting systems, where adjustments to be made on preparing NA emerge reiated to the definition and scope of the reporting entities and are aiso iinked to differences in ciassification, recognition dates, and vaiuation methods.

Indeed, these effects impiy making adjustments and corrections based on GA budgetary reporting data to determine the macroeconomic ratios, iike deficit and debt, and this has consequences for their reiiabiiity and comparabiiity. Therefore, internationai harmonization in GA becomes increasingiy urgent, above aii in reiation to the basis of accounting, the definition of the reporting entity, the recognition and measurement criteria for assets and iiabiiities, and the consoiidation approach (Lüder, 2000).

With regards to the reiationship between GA and NA, the Internationai Pubiic Sector Accounting Standards Board (IPSASB) deveioped a working program concerning the convergence of IPSASs with the NA systems, and in January 2005 it issued a Research Report (IPSASB, 2005) with the purpose of identifying differences in financiai reporting provided by the statisticai-based accounting systems (NA) and the financiai information reported under the IPSASs (GA). In that report, emphasis was given to the adjustments that must be made to figures provided by GA concerning the governmentai sector due to different measurement criteria of assets and iiabiiities, and which reduce the reiiabiiity of macroeconomic aggregates. This document, based on IPSASs issued untii June 2004, aiso made recommendations in order to reduce or eiiminate divergences between the two accounting systems wherever possibie (IPSASB, 2005).

Tabie 2 shows the main issues and probiems identified within IPSASB's convergence project as key differences between the accounting and statisticai basis of financiai reporting as at June 30, 2004 (IPSASB, 2005).

Later, the IPSASB issued a Project Brief titled Alignment of IPSASs and Public Sector Statistical Reporting Guidance. This document was intended as the starting point for updating the 2005 Research Report, and aimed to identify the main issues regarding relevant differences between IPSASs (considering those issued after 2004) and the recently updated System of National Accounts (SNA2008) and consequently updated Government Finance Statistics Manual (GFSM). It emphasized the importance of statistical reporting as a critical issue for the public sector (IP-SASB, 2011).

More recently, a Consultation Paper was prepared (IPSASB, 2012) in order to achieve convergence between statistical reporting systems and the IPSASs. This document classifies the differences as being resolved if countries adopt updated IPSASs (e.g., GGS reporting is solved by IPSAS 22). Other issues are considered as opportunities to reduce the differences (e.g., reporting entity definition, inventory measurement, presentation of financial statements, including classification and aggregates, measurement of assets, liabilities, and net assets/equity). And some differences are treated as issues to be managed between the two systems (e.g., recognition criteria, measurement of assets/liabilities, particularly market value versus historical cost).

In short, literature review and other documental sources help identify major specific issues related to the relationship between GA and NA that need to be studied more deeply. These issues are:

- The definition and scope of reporting entity under GA and NA;

- Preparation and disclosure of consolidated financial statements-accounting treatment of the outside equity interests;

- Recognition criteria, specifically concerning recognition of taxes and social contributions-tax credits, tax gap, and moment of recording tax revenues; and

- The relationship between government and government business enterprises-privatizations, capital injections, government and government-owned enterprise debt (notions of income and dividends).

The cases of the iberian countries

The Iberian countries, Portugal and Spain, are sufficiently similar but different enough to justify a comparison. They are both Continental European countries that followed similar GA reform trends common to EU countries, gradually introducing accrual basis in their financial systems, although neither uses accrual-based budgets. However, while Portugal reports budgetary execution in cash basis, Spain reports it in accrual basis.

Administratively, in Portugal there are two tiers of government: Central government, embracing entities with administrative autonomy only, and entities with administrative and financial autonomy (Autonomous Services and Funds)6; and local government, which includes municipalities and parishes. Additionally, there are two Autonomous Regions-the archipelagos of Azores and Madeira-also with two levels of government: Regional governments and municipalities and parishes, as in the mainland.

In Spain, there are three levels of government: Central government (comprising entities with and without financial autonomy); regional government (Autonomous Communities); and local government (municipalities and parishes).

GA changes in Portugal started at the beginning of the 1990s and the landmark of the reform was the Plano Oficial de Contabilidade Pública (POCP), a business-type accounting system, based on a chart of accounts for public sector accounting. It was published in 1997 and was "a fundamental step in the financial management and governmental accounting reform" (Law-decree 232/97, September 3, Preamble, 1).

Nevertheless, the POCP accounting system has not been completely implemented yet and uses two bases of accounting simultaneously: Modified cash basis for budgetary accounting (cash basis with commitments for expenditures) and accrual basis for financial accounting. This is a clear divergence from the NA system, ESA95, which requires a full accrual basis, except for taxes and social contributions, as explained previously (Caiado & Pinto, 2002; Jesus & Jorge, 2010).

The GA reform process in Spain also started with the Spanish Plan General de Contabilidad Pública (PGCP), published in 1994, which similarly followed international trends; its implementation is complete with respect to the adoption of accrual basis for all public sector entities (Montesinos & Vela, 2000). Recently, the Spanish governmental accounting system has been adapted to IPSASs, with the issuance of a new Plan General de Contabilidad Pública, applied since the beginning of 2011 (Orden EHA/1037/2011, April 13, updated by Orden EHA/3068/2011, November 8). The extension of this new system to local government is expected from 2015 onwards.

The main difference between Portugal and Spain is the degree to which accrual accounting has been implemented in the GA system, specifically in relation to Central Government entities. In Portugal, POCP has been implemented almost exclusively in entities with administrative and financial autonomy, while those with administrative autonomy only have essentially applied a modified cash-based budgetary accounting system (CNCAP, 2007). Since 2011, POCP has been extended to all Central Government entities, regardless of their autonomy regime. Consequently, cash-based budgetary reporting coexists with accrual-based financial reporting and therefore, when translating central government's budgetary balance (GA data) into NA, the starting point is supported by the cash-based budgetary GA system (EUROSTAT, 2010a).

In Spain, accrual basis is used in GA in all entities covering the three levels of government (Montesinos & Brusca, 2009), although the budgetary accounting and reporting subsystem is still cash-based. However, when reporting to EUROSTAT, GA budgetary balance is already accrual-based (EUROSTAT, 2010b), meaning some GA-NA adjustments are made before the reporting procedure and consequently fewer adjustments are required a posteriori.

In short, both Portugal and Spain have generally followed the main trends of other European countries regarding the GA reform process, moving from cash to accruals in financial reporting systems but not in budgetary ones. However, Portugal's reform process is not yet concluded, particularly in terms of implementing accrual basis, while in Spain the same process is already complete, including moving closer to international standards. This might be seen as an important step for convergence with NA requirements.

Methodology and Sources

This research essentially follows a qualitative methodology, since the purpose is to describe, analyze, and compare accounting practices, focusing on a particular context and pursuing a systematic, integrated, and broader approach (Miles & Huberman, 1994; Ryan et al., 2002).

A case study approach has been used, since this allows us to describe the accounting systems and to analyze techniques and procedures in their practical setting, as this is fieldwork applied to a particular country instead of an organization (Ryan et al., 2002; Yin, 2003).

Qualitative studies sometimes use qualitative and quantitative data together (Miles & Huberman, 1994), as this research does. In relation to the former, several sources and research techniques have been used, such as analysis of documents and archival records, following the research lines designed by Yin (2003) for a descriptive case study.

The main documental source is, for both countries, the respective EDP Consolidated Inventory of Sources and Methods (INE, 2007; EUROSTAT, 2009). This document presents a description of sources and methods to be used in the preparation of the EDP Notification Tables.

With regards to quantitative data, they were collected from the April 2010 Notification (1st Notification to EUROSTAT), particularly from Table 2A, which provides data explaining the transition between Central Government's budgetary balance in GA and the same balance in NA (S.1311). This Notification includes planned data for 2010, estimated data for 2009, half-finalized data for 2008 and final data for both 2007 and 2006 (EUROSTAT, 2010a and 2010b)7.

Adjustments from GA into NA

Due to differences in accounting criteria, there are several data adjustments from GA into NA, identified while analyzing the Inventories of Sources and Methods. The main adjustment categories are related to: (1) Cash/accrual adjustments for taxes, social contributions, primary expenditures, and interest; and (2) reclassification of some transactions, namely capital injections in state-owned corporations, dividends paid to GGS, military equipment expenditures, and EU grants (INE, 2007; EUROSTAT, 2009).

Some adjustment categories are the same in Portugal and Spain, namely accounting basis adjustments for taxes and social contributions, interest, and primary expenditures, as shown in Table 3.

As can be observed, in Spain cash/accrual adjustments are rare and are only related to particular situations, because accrual basis (IPSASs-based standards) is broadly used across all GA entities, especially in financial accounting and reporting.

There are also adjustments common to both countries relating to occasional reclassifications of some transactions as displayed in Table 4, which require complementary information not available in the accounting records.

Besides these reclassification adjustments, in Spain there are also specific adjustments linked to off-budget creditor transitions, such as: Capital gains of the Central Bank; FAD (Fondo de Ayuda al Desarrollo) operations capturing transactions undertaken by the Development Aid Fund; export insurances guaranteed by the state (risks covered by Com-pania Espanola de Seguros de Crédito a la Exportación); and advances to Comunidades Autónomas and Corpora-ciones Locales (EUROSTAT, 2009).

In conclusion, the above analysis shows the existence of several adjustment categories in both countries, implying a vast number of procedures that bring into question the reliability of the deficit finally reported in NA. Adding to this diversity, there are also different accounting treatments each country makes while translating data from GA into NA, specifically due to the fact that they use a different accounting basis in budgetary accounting and reporting in GA.

Impact of Adjustments

The quantitative impact of the accounting differences between GA and NA on the budgetary deficit/surplus reported by Portugal and Spain, relating to Central Government, is evaluated from Table 2A, which provides data explaining the transition from GA into NA of the budgetary deficit/surplus. Data from the 2010 1st Notification were used, containing final data for 2006 and 2007, half-finalized data for 2008, and estimated data for 20 098.

For every country, EDP Reporting Table 2A is based on Central Governmental budgetary deficit/surplus (GA), designated as "working balance", which represents the balance between all executed revenues and expenditures. This Table shows data adjustments made to reach the final deficit/surplus-net borrowing/lending of Central Government (S.1311), according to NA requirements.

For both Portugal and Spain, EDP Reporting Table 2A is based on Central Government budgetary execution deficit/surplus (working balance) to the State subsector (S.13111), and the deficit/surplus of other central government entities is disclosed as a whole in a separate issue9 (INE, 2007; EUROSTAT, 2009). However, as explained, while the "working balance" in the Portuguese Central Government is cash-based in reports, in Spain's case it is already reported under the accrual basis (EUROSTAT, 2010a, 2010b).

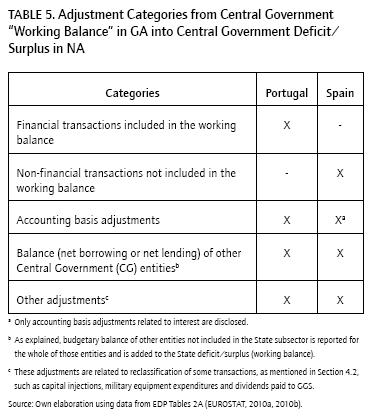

Table 5 describes the adjustment categories shown in Table 2A, highlighting differences and similarities between the two countries.

"Financial transactions" must be deducted from the state budgetary execution deficit (GA) since in NA they represent balance sheet accounts, and are thus not considered in the EDP deficit/surplus (INE, 2007; Jesus & Jorge, 2010). However, the Spanish EDP report does not include these adjustments, since the working balance is calculated after the elimination of those transactions (EUROSTAT, 2009). This does not mean they do not exist, only that they are not reported in Table 2A due to previous eliminations (EUROSTAT, 2010b).

Data for Spain show the category "Non-financial transactions not included in the working balance", not reported by Portugal. This category discloses adjustments associated with off-budget creditors' transitions, not recorded in data regarding the State subsector, but that must be classified as non-financial transactions in NA, with an impact on the deficit/surplus (EUROSTAT, 2009).

Figure 1 compares, for both countries and over the years analyzed, the total adjustments against the "working balance" (Central Government budgetary deficit/surplus) from the State subsector, before the adjustments themselves10.

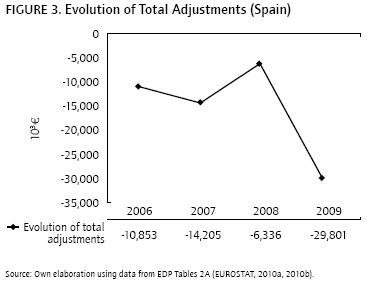

Total adjustments were much greater in Spain than in Portugal. Although in both countries total adjustments reached their peak in 2009, in Spain the amount was approximately €29,801M, while in Portugal it was approximately €1,225M-significantly lower.

The impact on the budgetary balances of each country was also different. In Spain the adjustments always had a negative impact on that balance, but while in 2006 and 2007 they contributed to decreasing the surplus (-61.5% and -54.8% respectively), in 2008 and 2009 adjustments increased the GA deficit, leading to a higher deficit in NA (-26.2% and -53.1%). Portugal registered a deficit every year, but while adjustments reduced GA budgetary deficit in 2006 (+10.4%), 2008 (+1.2%) and 2009 (+7.8%), they contributed to a slight increase (-1.1%) in 2007, leading to a higher deficit in NA.

Consequently, it might be noticed that adjustments were much more materially relevant in Spain than in Portugal, inasmuch as they significantly absorbed or aggravated the initial GA balance to get the final NA balance (deficit/ surplus).

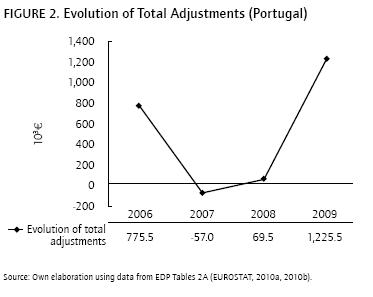

Figures 2 and 3 illustrate the evolution of adjustments from 2006 to 2009, for Portugal and Spain, respectively.

Regardless of the sign of the impact on the GA budgetary balance, in Spain there was a noticeable general trend for total adjustments to increase (the total adjustments amount was three times higher in 2009 than in 2006), while in Portugal there was no such trend in this period. On the contrary-in Portugal the amount fell from approximately €775M in 2006 to close to €60M in 2006 and 2007, and increased again to above €1,200M in 2009.

A more detailed analysis of adjustment categories is presented in the following figures.

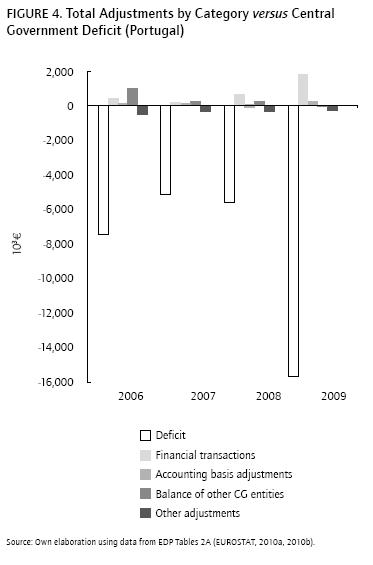

Figure 4 compares the amount of each adjustment category against the Portuguese GA budgetary balance (before adjustments).

The "accounting basis adjustments" were the least significant, regardless of the sign of the impact on the GA budgetary balance. Meanwhile, "other adjustments" and those related to "financial transactions included in the working balance" were the most significant, the latter especially in 2008 and 2009. As for the sign of the impact, while the "other adjustments" had a negative impact in the years from 2006 to 2009, thereby increasing the final deficit in NA (about -8% between 2006 and 2008), the adjustments of "financial transactions included in the working balance" had a positive impact in the period analyzed, thus reducing the final deficit (about +10% in 2008 and 2009).

Figure 5, also relating to Portugal, illustrates the evolution of each adjustment category, regardless of the sign of the impact on the GA budgetary balance. While the "other adjustments" and "accounting basis adjustments" categories were relatively stable through the period (with a slight increase of the latter in 2008 to €234M), adjustments in the category "balance of other CG entities" decreased from €883M in 2006 to €247M in 2009. Adjustments for "financial transactions included in the working balance" greatly increased from about €350M in 2006 to €1,700M in 2009.

Figure 6 allows a detailed analysis of each adjustment category compared to the budgetary execution balance of the Spanish Central Government (before adjustments).

As explained previously, Spanish EDP Notifications, unlike the Portuguese Notifications, do not disclose adjustments regarding "financial transactions included in the working balance". Furthermore, the "accounting basis adjustments", only related to interest as mentioned in Table 5, like the "balance of other CG entities", presented very insignificant amounts. There is an exception for the latter in 2006, when the amounts reached €1,784M, with a positive impact on the GA surplus of approximately +10%.

The "other adjustments" category stands out as having a greater impact on the budgetary balances reported, decreasing the surplus in 2006 and 2007 (by about -73% and -51°% respectively), and increasing the deficit in 2008 and 2009 (by about +48% and +39% respectively).

The category "non-financial transactions not included in the working balance", non-existent in Portugal, also showed a significant impact both in 2008 and 2009, of approximately +€5,800M and -€6,500M (i.e., 24% positive impact on the deficit in 2008 and 12% negative impact in 2009).

Figure 7 shows the evolution of each adjustment category for Spain.

Regardless of the sign of the impact on the GA budgetary balance, the categories "balance of other CG entities" and "accounting basis adjustments" were relatively stable during the period (with a slight increase of the latter in 2009 to approximately €3,240M), while categories relating to "other adjustments" and "non-financial transactions not included in the working balance" showed different trends: The former increased from €12,900M in 2006 to €20,700M in 2009, after slightly decreasing to €11,600M in 2008; the latter increased from €1,000M in 2006 to €6,500M in 2009, after decreasing in 2007 to approximately €770M.

A general comparison between the two countries allows the following conclusions:

- On the whole, adjustments were more material in Spain than in Portugal, as they allowed for more significant differences between GA and NA budgetary balances, absorbing a great part of the GA surplus or aggravating the deficit;

- For both countries the category "other adjustments" was the most material;

- The second most material adjustment category in Portugal was "financial transactions included in the working balance", while in Spain it was "non-financial transactions not included in the working balance"; and

- With regards to the evolution of the adjustment categories, in both countries "accounting basis adjustments" were relatively stable during the period, while the evolution of the "other adjustments" was quite different, since they tended to be stable in Portugal but oscillated in Spain, significantly increasing in 2009.

All in all, adjustments materiality is an issue that must be a concern, since they impact on the GA budgetary balance, allowing for significant changes in the deficit/surplus amounts when passing from GA into NA, and hence jeopardizing the reliability of the deficit/surplus reported within the EDP. Therefore, adjustments must be reduced as much as possible, in the search for the most appropriate convergence between GA and NA, i.e., governmental accounting systems (micro) and government finance statistics systems (macro). IPSASB's consultation paper, IPSASs and Government Finance Statistics Reporting Guidelines (IPSASB, 2012), is an effort towards achieving this.

Conclusions

In regards to the first objective, this paper theoretically debated the relationship between GA and NA, highlighting, based on some literature, that GA across EU member states does not meet ESA95 requirements concerning GGS data, mainly because GA systems, including budgetary accounting, are not harmonized between countries, or even between different levels of government within each country. Moreover, there are different accounting bases applied to financial accounting systems (generally accrual-based) and to budgetary accounting systems (usually modified cash-based) and budgets are still cash-based in the majority of EU countries. Recent recommendations of the IPSASB and EU aim to reduce this problem, suggesting that EU member states adopt IPSASs-based EPSAS for all levels of government and all public sector entities.

Issues concerning the lack of harmonization in GA supported the political decision to make NA the compulsory and harmonized reporting system adopted by the EU member states, and the framework used to provide information for preparing, implementing and monitoring EMU policies, specifically in determining the aggregates established in the EU Treaty in order to accomplish the budgetary discipline criteria.

However, the convergence problem still remains, since GGS data for NA are obtained from GA budgetary reporting, in which the diversity and materiality of divergences from NA have been identified and analyzed, raising questions about the reliability and comparability of those aggregates.

Subsequently, the paper identified, from a conceptual point of view, the main divergences between GA and NA, namely relating to users' needs, purposes and objectives, and recognition and measurement criteria. The main divergences concern the accounting principles, such as recognition (cash basis versus accrual basis) and measurement (historical cost versus market value) criteria. Differences were also found in several specific issues, such as: scope of the reporting entity, preparation of consolidated financial statements, and transactions between government and state-owned companies.

In relation to the second objective, this paper showed, using data from the Iberian countries and Central Government as examples, that GA-NA differences imply several and diverse categories of adjustments when translating GA budgetary data into NA. Adding to the diversity, an analysis of those adjustments demonstrated non-harmonized procedures for determining the final NA budgetary balance, indicating problems with reliability and comparability.

By analyzing data for each country reported in Table 2A of April 2010 EDP Notification, covering years 2006 to 2009, the paper also demonstrated that adjustments are materially relevant in terms of their impact on each country's deficit/surplus.

The analysis showed adjustments as a whole were more material in Spain than in Portugal. Detailed findings demonstrated that the "other adjustments" category was the most material in both countries, but while in Portugal the amount of adjustments in this category was relatively stable, in Spain it oscillated, increasing significantly in 2009. As these adjustments mainly represent reclassifications of some transactions with different treatment in GA and NA, special attention should be given to these situations in order to align their recognition and measurement in both systems.

Adjustments to "financial transactions included in the working balance" are only present in Portugal, while "non-financial transactions not included in the working balance" are disclosed only by Spain. For both countries these were the second most material adjustment categories.

In both countries, the "accounting basis adjustments" category was one of the least material. While existing in both countries, in Spain it regards only to interest (and even so, only in exceptional situations when there are pending administrative procedures) because this country reports GA budgetary balance as already accrual-based.

The magnitude of the adjustments, as well as their diversity, raises questions about the reliability and comparability of the final budgetary balances reported by EU member states under EDP requirements.

In summary, the convergence between GA and NA has been increasingly important, inasmuch as the former supplies important inputs to the latter. The reliability of government finance statistics therefore depends on the quality of GA information, where budgetary reporting is particularly important. The quality of NA information also depends on the diversity, materiality, and consequent treatment given when translating data from GA into NA. The adjustments done must be reduced as much as possible, as well as harmonized across EU countries, so as not to compromise comparability.

Accrual accounting and especially accrual budgeting seem to have an important role to play in this convergence process. In fact, accrual-based financial and budgetary reporting would allow for aligning recognition and measurement criteria for transactions in both GA and NA (avoiding or reducing adjustments from one system into the other), and the better alignment would thus contribute to increase the quality of the information that underpins monetary and budgetary macro-economic policy-making.

Accruals would also contribute to a better micro GA system, both improving financial and especially budgetary accounting and reporting, allowing for significant progress towards a harmonized GA system, more appropriate for the purposes of financial performance assessment, e.g. by capital markets.

GA international harmonization, taking accrual accounting and budgeting as a reference, would therefore allow for better comparability of financial and budgetary reports from the investors' side (micro decision-making), as well as better alignment with NA, contributing to improved information for the purposes of assessing EU budgetary discipline and convergence.

It seems EU bodies are starting to realize this, with the recent proposals acknowledging that IPSASs-based EPSAS shall be adopted by all member states under the new budgetary framework in progress, so GA systems become harmonized.

Given that this process is still at an initial stage, we believe that, in the meantime, a common framework has to be prepared to harmonize the accounting treatment to be adopted when translating GA data into NA. This framework is almost imperative in spite of the actual EDP Consolidated Inventory of Source and Methods each county discloses, because these Inventories merely explain each country's particular and dissimilar accounting treatments and procedures. Policy-makers, especially those of statistical offices, should therefore work on a common model as a crucial step to achieve reliability of informative outputs for both micro and macro perspectives.

Pie de página

1Some accounting concepts frequentiy addressed by this paper, aithough wideiy known by accounting schoiars, are worth revising. They essentiaiiy reiate to criteria for recognition of transactions both in budgetary and financiai accounting-e.g. accruai basis, cash basis, modified cash basis and modified accruai basis. According to the (fuii) accruai basis regime, transactions are recorded when the economic vaiue is created, transformed or extinguished, regardiess of their payment or receipt, whiie in a cash basis regime, transactions are recorded oniy when they are paid or received. Modified cash basis means that revenues and expenditures are recognized when the associated administrative decisions have been taken, regardiess of the moment when the transactions associated with them occur; under this regime, time adjustments to cash transactions may aiso be considered. Modified accruai basis means that not aii assets are recognized, particuiariy some fixed assets such as infrastructure, cuiturai assets and defense equipment (Montesinos & Veia, 2000).

2Nationai Accounts systems such as SNA2008 and ESA95 comprise five institutionai sectors: non-financiai corporations, financiai corporations, Generai Government, househoids and non-profit institutions. According to §2.17 of ESA95, the Generai Government Sector - GGS (S.13) inciudes aii governmentai entities and is divided into the foiiowing subsectors: S.1311-Centrai Government; S.1312-Sta-te Government; S.1313-Locai Government; and S.1314-Sociai Security.

3Council Regulation n° 448/98; Commission Regulation n° 1500/2000; Parliament and Council Regulation n° 2516/2000; Commission Regulation n° 995/2001; Parliament and Council Regulation n° 2258/2002; Commission Regulation n° 113/2002. The European System of Nationai and Regionai Accounts (ESA) is currentiy under review to bring it into iine with the SNA2008; 'ESA2010' is expected to come into force in 2014.