How Organizational Trust Affects the Market Position: The Mediating Role of Innovativeness and Operational Efficiency. Empirical Results

INFLUENCIA DE LA CONFIANZA ORGANIZACIONAL SOBRE LA POSICIÓN EN EL MERCADO: EL PAPEL MEDIADOR DE LA CAPACIDAD DE INNOVACIÓN Y LA EFICIENCIA OPERACIONAL. RESULTADOS EMPÍRICOS

INFLUÊNCIA DA CONFIANÇA ORGANIZACIONAL SOBRE A POSIÇÃO NO MERCADO DE UMA ORGANIZAÇÃO: O PAPEL MEDIADOR DA CAPACIDADE DE INOVAÇÃO E DE EFICIÊNCIA OPERACIONAL. RESULTADOS EMPÍRICOS

DOI:

https://doi.org/10.15446/innovar.v26n61.57117Palabras clave:

Trust, market position, innovativeness, operational efficiency (en)Confianza, posición en el mercado, innovación, eficiencia operacional. (es)

Confiança, posição no mercado, inovação, eficiência operacional (pt)

Descargas

Este artículo reporta los resultados de un estúdio llevado a cabo en 202 empresas que cotizan en la Bolsa de Valores de Varsovia, en el que se proporciona evidencia documentada de un impacto indirecto significativo de la confianza organizacional sobre la posición en el mercado, producto de la influencia de esta en la capacidad de innovación y el desempeño organizacional. Estos hallazgos contribuyen a la comprensión de cómo la confianza dentro de una organización se ve reflejada en su desempeño en el mercado. Asimismo, los resultados obtenidos señalan la existencia de una mayor influencia de la confianza sobre la posición en el mercado de una firma que sobre su eficiencia operacional. El estudio muestra además que la confianza, al dar cuenta de un clima organizacional, no tiene un efecto directo sobre la posición en el mercado. Por último, se presentan algunas reflexiones sobre el tema para la investigación y la práctica.

DOI: https://doi.org/10.15446/innovar.v26n61.57117.

Estrategia y Organizaciones

How Organizational Trust Affects the Market Position: The Mediating Role of Innovativeness and Operational Efficiency. Empirical Results

INFLUENCIA DE LA CONFIANZA ORGANIZACIONAL SOBRE LA POSICIÓN EN EL MERCADO: EL PAPEL MEDIADOR DE LA CAPACIDAD DE INNOVACIÓN Y LA EFICIENCIA OPERACIONAL. RESULTADOS EMPÍRICOS

INFLUÊNCIA DA CONFIANÇA ORGANIZACIONAL SOBRE A POSIÇÃO NO MERCADO DE UMA ORGANIZAÇÃO: O PAPEL MEDIADOR DA CAPACIDADE DE INOVAÇÃO E DE EFICIÊNCIA OPERACIONAL. RESULTADOS EMPÍRICOS

L'INFLUENCE DE LA CONFIANCE ORGANISATIONNELLE SUR LA POSITION D'UNE ORGANISATION SUR LE MARCHÉ : LE RÔLE MÉDIATEUR DE LA CAPACITÉ D'INNOVATION ET L'EFFICACITÉ OPÉRATIONNELLE. DES RÉSULTATS EMPIRIQUES

Anna SankowskaI

I Ph.D. DSc. Eng.

Warsaw University of Technology

Warsaw, Poland

Correo electrónico: amsankowska@wp.pl

Enlace ORCID: http://orcid.org/0000-0003-1721-8914

Correspondencia: Dariusz Siudak, ul. ZWM 1/86, 02-786 Warszawa, Poland.

Citación: Sankowska, A. (2016). How Organizational Trust Affects the Market Position: The Mediating Role of Innovativeness and Operational Efficiency. Empirical Results. Innovar, 26(61), 9-24. doi: 10.15446/innovar.v26n61.57117.

Clasificación JEL: L20, L22, L25.

Recibido: Febrero 2014, Aprobado: Septiembre 2014.

Abstract:

This study was conducted in 202 enterprises listed on the Warsaw Stock Exchange and provides documented evidence for a significant indirect impact of organizational trust on their market position through its effect on innovativeness and an improvement on efficiency. These findings contribute to understand how trust inside an organization is translated into market performance. In addition, the reported results suggest a stronger influence of organizational trust on a firm's market position than on its operational efficiency. The study also indicates that organizational trust, while expressing a climate inside an organization, does not have a direct effect on the market position. Implications for research and practice are provided as well.

Keywords: Trust, market position, innovativeness, operational efficiency.

Resumen:

Este artículo reporta los resultados de un estúdio llevado a cabo en 202 empresas que cotizan en la Bolsa de Valores de Varsovia, en el que se proporciona evidencia documentada de un impacto indirecto significativo de la confianza organizacional sobre la posición en el mercado, producto de la influencia de esta en la capacidad de innovación y el desempeño organizacional. Estos hallazgos contribuyen a la comprensión de cómo la confianza dentro de una organización se ve reflejada en su desempeño en el mercado. Asimismo, los resultados obtenidos señalan la existencia de una mayor influencia de la confianza sobre la posición en el mercado de una firma que sobre su eficiencia operacional. El estudio muestra además que la confianza, al dar cuenta de un clima organizacional, no tiene un efecto directo sobre la posición en el mercado. Por último, se presentan algunas reflexiones sobre el tema para la investigación y la práctica.

Palabras-clave: Confianza, posición en el mercado, innovación, eficiencia operacional.

Resumo:

Este artigo apresenta os resultados de um estudo realizado com 202 empresas cotadas na Bolsa de Valores de Varsóvia, no qual se proporciona evidência documentada de um impacto indireto significativo da confiança organizacional sobre a posição no mercado, produto da influência da confiança na capacidade de inovação e no desempenho organizacional. Essas descobertas contribuem para a compreensão de como a confiança dentro de uma organização reflete em seu desempenho no mercado. Além disso, os resultados obtidos indicam a existência de uma maior influência da confiança sobre a posição no mercado de uma firma do que sobre sua eficiência operacional. O estudo também mostra que a confiança, ao dar conta de um clima organizacional, não tem efeito direto sobre a posição no mercado. Por último, apresentam-se algumas reflexões sobre o tema para a pesquisa e para a prática.

Palavras-chave: Confiança, posição no mercado, inovação, eficiência operacional.

Résumé:

Cet article rapporte les résultats d'une étude menée sur 202 entreprises cotées à la Bourse de Varsovie. On y fournit des preuves documentées de I'impact indirect significatif de la confiance organisationnelle sur leur position sur le marché, conséquence de l'influence de la confiance sur la capacité d'innovation et de la performance organisationnelle. Ces résultats contribuent à la compréhension de la façon dont la confiance au sein d'une organisation répercute sur sa performance au milieu du marché. En outre, les résultats indiquent l'existence d'une plus grande influence de la confiance sur la position d'une entreprise sur le marché que sur son efficacité opérationnelle. L'étude montre également que la confiance, en tant qu'elle tient compte d'un climat organisationnel, n'a pas d'effet direct sur la position sur le marché. Finalement, on y présente quelques réflexions sur le sujet pour la recherche et la pratique.

Mots-Clé: Confiance, position sur le marché, innovation, efficacité opérationnelle.

Introduction

Scholars have long recognized the significant impact of trust on organizations (McGregor, 1960; Argyris, 1964; Likert, 1967; Zand, 1972; Dwivedi, 1983; Gambetta, 1988; Delbufalo, 2012; Cho & Poister, 2014; Whipple, Griffis & Daugherty, 2014). Extensive research on trust has improved our recognition of its impact on various areas such as team performance (Costa, 2003; Rispens et al., 2007), learning (Sako, 2006), productivity (Dwivedi, 1983; Kramer & Cook, 2004), quality improvement (Hacker & Willard, 2002), employees' satisfaction (Driscoll, 1978; Shockley-Zalabak, Morreale & Hackman, 2010), profitability (Davis et al., 2000; Bibb & Kourdi, 2004), supply chain management (Delbufalo, 2012; Cao & Zhang, 2013; Michalski, Yorov & Botella, 2014) and on the whole on a competitive advantage (Barney & Hansen, 1995). The other way round, distrust drives performance down (Černe et al, 2014).

Thus, trust is a highly relevant phenomenon in organizations and a significant can phenomenon for researchers. In spite of this extensive research on trust organizational implications, scholars have not accounted systematically for how trust affects several performance dimensions at once. Empirical examinations usually concentrated on one trust implication for performance at a time. But not all effects are equivalent. That situation poses an interesting research question about how they vary. In this context, in the highly fragmented and scattered literature, the author can identify two streams of the discussion, which center on two basic dimensions of trust influence that account for a total trust effect on organizational performance. One effect takes the lens of innovation processes related to expanding knowledge pools; the other focuses on operation-based merits of trust. Both exemplify the distinction between two paradigms toward organizational learning, namely exploration and exploitation (March, 1991; Levinthal & March, 1993). While exploitation captures repetition-based improvements of a present state, leading to the decrease of performance variability and operational efficiency, central issues in exploration are experimentation, play, discovery, completely new knowledge and thus, in the end, innovations changing performance means (March, 1991; Levinthal & March, 1993). While the first one is rather short-term, the latter has a longer time horizon and is likely to generate greater returns than an industry average. Both effects should be embraced by an organization as, on the one hand, without exploitation an organization will not be able to realize profits from new knowledge due to poor efficiency, and, on the other, without exploration organizations' products or services will become obsolete.

In this paper it is theorized that the combined effect of trust on exploration and exploitation stems from the relation between trust and creativity, on the one hand, and commitment, on the other, which explains a various impact of trust on innovativeness and operational efficiency. To my knowledge, it has not been tested in any single piece of research so far. Consequently, we have much to learn about the joint effect of trust on innovations and operational efficiency. These two mechanisms of transforming intraorganizational trust into organizational performance expressed by the market position through innovations and operational efficiency will be examined; none has received much attention in scholarly empirical studies so far. Therefore, this study brings novelty to literature by tackling the dual role of organizational trust on firm's innovativeness and operational efficiency. The paper focuses on how a combined impact of innovation and operational efficiency transmits the effects of organizational trust into the market position and thus test alternative theories of how trust affects the market position.

Drawing on trust literature I theorize that intra-organizational trust is coupled with innovativeness, operational efficiency, and in turn indirectly with the market position. This produces an understanding of how organizational trust affects a firm's market position. As such, the causal model proposed in this paper postulates mediation links between organizational trust and market position as will be shown later in the paper.

This article is laid out as follows. First, the meaning and relationships between variables of interest, namely organizational trust, innovativeness, operational efficiency and the market position are analyzed in order to put forward hypotheses. Then, the methods and results of an empirical research are discussed. The paper ends with a discussion of results, limitations of the study and directions for future research.

Theoretical Background and Hypotheses Development

Organizational Trust and Innovativeness

There is no universally acknowledged standard on how to define organizational trust. However, some definitions are more frequently cited than other. The prominent authors in this area, Mayer, Davis and Schoorman, used the term "trust" to denote the willingness to be vulnerable to others and the intent to take risks related to trustworthiness perceptions. This willingness is derived from ability, integrity and benevolence assessments (Mayer, Davis & Schoorman,1995), which could refer to an organization (Li, Bai & Xi, 2011). Following the lead of Mayer and colleagues, trustworthiness should not be taken as a synonym of trust, as some authors tend to indicate, but rather as a strong predictor. Herein, the generic term "organizational trust" (Li, 2008) will be used with respect to intraorganizational trust, where an organization is a referent. Moreover, in terms of so understood organizational trust it should be noted that trust is a climate-based phenomenon expressed by a specific organization's culture (Shockley-Zalabak, Morreale & Hackman, 2010).

The plausible claim in the literature that trust stimulates a wide range of innovations encompassing the market, product, processes, and organizational dimensions (Wang & Ahmed, 2004; OECD/Eurostat, 2005; Kock, 2007; Salomo, Gemunden & Billing, 2007; Michalski et al, 2014), is rather widespread (Ruppel & Harrington, 2000; Ciancutti & Steding, 2001; Bibb & Kourdi, 2004; Covey & Merrill, 2006; Shockley-Zalabak et al, 2010; Li, 2012; Sankowska, 2013). The arguments for that assertion are well-reasoned. Trust builds culture for innovations within an organization as well as is believed to suspend negative judgments and mitigate the risk of being exploited by the other party. In high-uncertainty and high-vulnerability, trust is believed to play the leading role (Mollering, 2012). It produces the feeling of psychological safety (Edmondson, 1999) in face of uncertainty and ambiguity, which often characterizes innovative processes of unforeseeable potential outcomes. However, the assertion that trust allows to cope with uncertainty does not entail that uncertainty is entirely eliminated after all, as it is just psychologically overcome (Mollering, 2012). Thus, when there is trust climate inside an organization one is likely to encounter higher tolerance for errors and risk-taking (Colquitt, Scott & LePine, 2007), which are common when undertaking new things of partly or fully unpredictable nature. Moreover, people are more apt to openly discuss their points of view as they are not so frightened about losing their social face. On the other hand, there is more concern for other's differing points of views and interests, which may be an impetus for change, especially when it results in giving up one's irrelevant mental model and adopting a novel approach. It is strengthened by encouragement to try new things, which is legitimized by trust. Taken together trust encourages to generate and share new ideas, which is a prerequisite for innovation processes. By contrast, distrust hinders engagement with work and motivation to be innovative (Dirks, 1999; Černe et al., 2014).

In practical terms, it means that individuals spend their resources on protection at the cost of innovations. Although the recent literature on the topic has often emphasized the paramount importance of trust in innovations, only few studies accounted for this effect empirically, and their findings were often highly ambiguous. Supporting evidence for the positive impact of trust on innovations is provided by a sparse body of empirical research (Ruppel & Harrington, 2000; Krot & Lewicka, 2011), which points out that organizational innovation is rather positively associated with trust. For instance, in interorganizational setting, trust has been proven to be linked to innovation (Clegg et al, 2002; Micheels & Gow, 2011). With respect to institutional trust empirical findings have offered support for its link to innovativeness (Ellonen, Blomqvist & Puumalainen, 2008). By contrast, Herting has reported that trust only correlates significantly with administrative innovations (2002). Overall, it is expected that trust positively affect innovativeness. When there is trust people are more likely to engage in idea generation and knowledge creation. Otherwise, under the conditions of distrust or a lack of trust, members of an organization are more prone to avoid such activities.

Indirect evidence for a connection between trust and innovativeness could be drawn from studies relating trust with knowledge (Politis, 2003), intellectual capital (Nahapiet & Ghoshal, 1998; Tsai & Ghoshal, 1998) and creativity endorsement (Brattstrom, Lofsten & Richtnér, 2012; Li, 2012; Mollering, 2012). Notably, an overwhelming number of studies have argued that trust facilitates knowledge sharing (Davenport & Prusak, 1998; Abrams et al, 2003; Ford, 2003; Kim & Mauborgne, 2003; Levin, Cross & Abrams, 2003; Huotari & livonen, 2004; Bijlsma-Frankema et al., 2005; Chowdhury, 2005), which in turn can boost innovation processes (West & Anderson, 1996; Darroch, 2005; Salomo et al, 2007; Sankowska, 2013).

On the other hand, only few studies go beyond the mainstream debate linking trust with knowledge sharing and emphasizing that trust accelerates actual knowledge creation (Lee & Choi, 2003; Chung & Jackson, 2011), as when trust is present individuals are more likely to exchange knowledge and be creative. All this determinates knowledge creation and, consequently, innovations. Built on the same reasoning, the support for the positive effect of trust embedded in social capital on innovativeness can be found in Nahapiet and Ghoshal's theoretical framework, pointing out trust as a precondition to intellectual capital combination (which is of a paramount importance for a knowledge creation process according to Nonaka and Takeuchi, 1995) and its exchanges (Nahapiet & Ghoshal, 1998), both of which result in innovation afterwards. Moreover, the association postulated in their theoretical model has been well-documented in an empirical investigation (Tsai & Ghoshal, 1998).

One additional reason to expect the fostering role of trust in innovations is provided by the claims of Li's theory linking trust with creativity and play as all innovations are preceded with creative ideas. Accordingly, trust is maintained to be responsible for the mechanism of psychological relaxation (Li, 2012) complementary to psychological safety, through which individuals are highly prone to follow their curiosity and fascination, to use their imaginations, and to discover new things. These, in turn, are processes associated with play.

Play through positive emotions such as excitement, joy and curiosity, enables uncertainty, ambiguity and fear of the unknown, inherent to innovation, to be experienced as non-threatening (due to a tolerance mechanism) or even as a pleasant challenge (due to an appreciation mechanism). Higher creativity levels are achieved; hence these feelings stimulate imagination and the generation of novel solutions in a quest for self-actualisation. Viewed through Li's lens, trust ought to be particularly pronounced in contexts that require high creativity (Mollering, 2012). Indeed, trust has been documented to trigger creativity (Barczak, Lassk & Mulki, 2010; Brattstrom et al, 2012), which might lead to innovations.

The three abovementioned basic streams of literature linking trust with knowledge sharing, knowledge creation and creativity are the reasons for trust to be considered as a stimulant for innovation. Thus, it is expected the following:

Hypothesis 1: Organizational trust will be positively associated with innovativeness.

Organizational Trust and Operational Efficiency

There is a number of studies in which we can trace down a very general statement indicating that trust leads to better performance (Culbert & McDonough, 1986; Ciancutti & Steding, 2001; Dawson, 2002; Ward & Smith, 2003; Tschannen-Moran, 2004; Rus, 2005; Bell & Cohn, 2008). Operational performance understood in terms of quality, cost, flexibility, or speed (Slack, Chambers & Johnston, 1998; Gonzalez-Benito, 2005) - by some authors referred to as operational effectiveness (Mithas, Ramasubbu & Sambamurthy, 2011) - might be particularly affected by trust for a number of reasons. In order to clarify the distinction between effectiveness and efficiency the term "operational efficiency" is adopted throughout this paper.

Efficiency concerns to "doing things right" (Drucker, 1974). One of the reasons why trust might promote operational efficiency (Ellonen et al., 2008) can be found in a literature strand that identifies trust as a source of transaction cost reduction (Williamson, 1975, 1993; Blomqvist et al, 2002; Dyer & Chu, 2003; Sako, 2006; Schwenker & Botzel, 2007; Chow, 2008; Kohn, 2008). This reduction is driven by the decrease of monitoring as a form of control, the decline of enforcement and safeguards (Gulati, 1995), as well as of the time and resources required for transaction fulfillment. Trust shortens also the process of negotiating and contracting. In this stream of the discussion, it is worth to notice that Blomqvist et al. (2002) see the trust effect not only from the point of view of transaction cost decrease, but also from through the lens of transaction benefits such as lower production costs, higher productivity, improved quality and reduced time to market.

Another key point in the subject literature is that trust enhances operational efficiency not only by affecting contractual arrangements between parties, but also the way they are performed. This is in line with the argument by Blomqvist et al. (2002), about transaction benefits in a situation of trust between parties. The underlying mechanism for this benefit generation is that trust simplifies the content of agreements leaving parties with flexibility (Bibb & Kourdi, 2004) in the way how the desired goals are achieved in a course of changing circumstances. In addition, trust motivates people to do their best and allocate their resources such as attention and effort in the work and particular arrangements (De Jong & Elfring, 2010). These effects facilitate the commitment of resources to operational improvements and establishment of routines, practices and strategies to do things better and exploitation of the economies of scale (Blomqvist et al., 2002). On the other hand, trust constitutes a type of heuristic simplifying and serving the process of gathering and interpreting information as well as choosing relevant behaviors (McEvily, Perrone & Zaheer, 2003). Such process facilitates learning of current operations facilitated by experience (Levinthal & March, 1993).

Based on the research and theory reviewed above, it is expected that:

Hypothesis 2: Organizational trust will be positively associated with operational efficiency.

Organizational Trust, Innovativeness, Operational Efficiency and Market Position

There is some evidence (Davis et al., 2000) that employee trust in a general manager affects a widely used revenue based performance indicator of market position (Rubera & Kirca, 2012), namely sales (Rust et al, 2004) in case of restaurants. The existing body of literature, however, has not yet provided a tentative explanation of this impact. Moreover, in the case of restaurants, the impact of trust on sales might be more direct as, to a large extent, the staff's attitude shapes its behaviors towards clients. Generally, in a wider scope of contexts, it might be expected that the market position affects organizational trust for more complex reasons too. The reason is that the better market position of the company, the higher organizational trust climate in the organization. But this explanation is more tentative in light of research indicating that trust is a casual antecedent of organizational performance (Davis et al, 2000). Thus, in this paper it is advocated that organizational trust does have an effect on the market position measured with revenue-based indicators (such as market share, market grow), but an indirect one, through innovativeness and operational efficiency, which link with the organizational trust has been discussed previously.

The logic of the proposed paths is as follows. Organizational trust induces innovativeness, which according to the prior literature is of a fundamental interest to a firm's performance outcome such as profits (Sorescu & Spanjol, 2008). On the other hand, innovativeness is both connected with operational efficiency and the market position. Innovativeness enhances a company's position both directly and indirectly by the impact on operational efficiency. First of all, innovativeness increases the likelihood that a company will outperform its competitors with an offer more appealing to the existing customers, which will determine market success (Cho & Pucik, 2005; Bouncken, Koch & Thorsten, 2007; Kock, 2007). In extreme circumstances, innovations can substantially extend sales by creating new markets for new customers (Salomo et al, 2007). With highly innovative products and solutions a firm can attract more customers, both domestic and foreign, and thereby achieve market success. At the same time, innovative solutions implemented in the company's business nurture operational efficiency through the introduction of methods for doing the same things better. Put differently, due to innovations firms become more efficient in their operations as innovation can change not only a performance mean but also its variability. The support for this kind of thinking can be traced down in a qualitative study of Yeung, Lai and Yee (2007), suggesting that innovativeness leads to internal efficiency, which taken together are believed to shape customer satisfaction to a large extent.

Thus, based on the argumentation developed above, the following is proposed:

Hypothesis 3: Innovativeness affects positively operational efficiency.

As has been suggested before, both exploitation and exploration change performance by affecting the way we do the things and deciding which things to do (March, 1991; Levinthal & March, 1993). In particular, these enrich value for current and potential customers, thereby affecting firm's market position. Consistent with the above discussion, I propose also the following:

Hypothesis 4: Innovativeness affects positively market position.

Hypothesis 5: Operational efficiency affects positively the market position.

As organizational trust can contribute to operational efficiency due to process innovations, it is hypothesized the following:

Hypothesis 6: Innovativeness mediates the relationship between organizational trust and operational efficiency.

Furthermore, following the argument that due to operational efficiency facilitated by process innovations the customers receive products just in time and in a cost effective way, a firm's market position is likely to be enhanced. I therefore hypothesize:

Hypothesis 7: Operational efficiency mediates the relationship between innovativeness and market position.

Methodology

Method

Several methods were applied to test the proposed hypotheses. Firstly, the correlations between the variables of interest were searched. Then, in keeping with Baron and Kenny (1986), multiple regressions were used to test mediated relationships as indicated in Figure 1. In order to test further all links at the same time structural equation modeling was applied.

Data

The data used to test the hypotheses were gathered using CATI (Computer Assisted telephone interviewing). telephone interviewing assisted with a computer was conducted by a professional company, CEM Market and Public opinion Research institute, which follows professional and ethical standard of ESOMAR (European society for opinion and Marketing Research) based on a previously prepared close-ended questionnaire. The CATI technique standardizes a data collection procedure. The five pollsters who conducted the telephone interview were not familiar with the formulated hypotheses. The call center was located in Cracow in Poland. The sample consisted of 202 companies listed on the Warsaw Stock Exchange by 2010, which came from twenty three various sectors ranging from manufacturing to services. The average number of years for the companies in the data set from the first listing on the stock exchange was 10 years, while the median was 8 years. The average value of organizational slack was 4.28% and the median value 4.40%. The subjective judgments of managers as key informants were used in order to gather the required data, which were responses to the statements referring to constructs of interest in the study (Appendix A-B). items were assessed by respondents in regard to a company.

Measures

Organizational trust. Much research on organizational trust adopted the scale of trustworthiness proposed by Mayer and Davis (1999). However, as trustworthiness estimation, it is only a very good predictor of trust. Therefore, to measure organizational trust as a climate-based phenomenon, three items were used for the purpose of this study, since there is no existing measure that captures appropriately the concept at the level of organization. One item was adopted from Hacker and Willard (2002) - The organization operates on the assumption of trust even in new situations" - and one from Glińska-Neweś (2007) - "Within the organization there is a climate of trust". the third item, "The organization is trustworthy", was added to reflect trustworthiness as a base for trust assessment. All items capture the essence of trust, which is not only based on trustworthiness (a belief) but on willingness to trust (a predisposition to take risks). The items were measured on a 7-point scale ranging from "completely disagree" (1) to "completely agree" (7). The internal consistency estimate of Cronbach's alpha coefficient for the battery of three items displayed high reliability (a = 0.92), above the acceptable cut-off value of 0.70 (Nunnally, 1978). The word "trust" was used in two items, which classifies the scale as a direct measure. As noted by Colquit et al. (2011), direct measures of trust were proven to be reliable in prior research.

Innovativeness. Measuring innovativeness is very challenging, since it is hard to find a suitable measure of this notion for different sectors that would be available at hand and allow meaningful comparison. Seeing that the tradeoff is made in empirical research by employing subjective measures. It is believed that they are more appropriate for heterogeneous group of firms (Denison & Mishra, 1995) and provide robust results (Wall et al., 2004). Following the stream of research referring innovativeness not only to new product development, but also to other underlying dimensions (Wang & Ahmed, 2004; Sankowska, 2013), innova-tiveness was assessed by respondents through the lens of four items measuring innovativeness, that is products, processes, marketing and organizational practices. Items were rated on a 7-point scale where 1 corresponds to a "completely higher" and 7 to a "completely lower" level of innovativeness in comparison to a firm's main competitor. The measure displayed reliable results in terms of Cronbach's alpha (a = 0.90). Sample items were "Our product innovativeness concerning introduction of products/services, which are new or considerably new with respect to their features or intended application" and "Our process innovativeness as implementation of new or considerably new methods of production or supply".

Operational efficiency. In keeping with Gonzales-Benito's measure of relative operational performance perceptions, six items were applied to score a relative position of a company with regard to its competitors on the following dimensions: operational costs, time needed for designing and/or manufacturing products, pace of new products launching, product quality, flexibility to adapt product to different volumes of demand, capacity to meet customers' requirements in time (Gonzalez-Benito, 2005). Respondents were instructed to give responses on a 7-scale point ranging from "very inferior" (1) to "very superior" (7). The alpha coefficient was 0.89.

Market position. three items derived from Mazur, Rószkiewicz and Strzyżewska (2008) were used to measure the market position: capturing market share, sales growth, export growth compared to the main competitors. Firm's market position was evaluated on a 7-point scale ranging from "completely lower" (1) to "completely higher" (7), in comparison with a firm's main competitor. The alpha coefficient obtained a satisfactory value (α = 0.80).

Analysis and Results

Unidimensionality of constructs used in the study was assessed by exploratory factor analysis. Factor loadings are reported in Appendix A. The scales were examined by estimating measurement model (Appendix B). Estimates were based on the maximum likelihood technique using AMOS. A confirmatory factor analysis supported the four factors. The goodness-of-fit measures for the overall measurement model are acceptable (RMSEA = 0.005; CFI = 0.940; NFI = 0.898; TLI = 0.917).

Summated scales were employed for measurement as all Cronbach's alphas are at least 0.8, which should be considered as a very good result. table 1 reports the descriptive statistics and correlation matrix for the study variables. The highest correlation pertains to innovativeness and operational efficiency. All correlations are positive. Most of the correlation coefficients are modest in size and statistically significant. The bivariate correlation analyses provide support for five of the formulated hypotheses.

H1: Organizational trust is correlated with innovativeness (r = 0.063, p < 0.001).

H2: Organizational trust is significantly correlated with operational efficiency (r = 0.65, p < 0.001).

H3. Innovativeness is significantly correlated with operational efficiency (r = 0.74, p < 0.001).

H4. Innovativeness is significantly correlated with market position (r = 0.60, p < 0.001).

H5. Operational efficiency is significantly correlated with market position (r = 0.50, p < 0.001).

Generally, the initial findings provide support for the five formulated hypothesis.

tests of mediations hypothesis

In the conceptual model depicted in Figure 1 there are several pathways linking organizational trust to market position. to test some of those links (hypothesis 6 and 7) regression analyses were employed using organizational trust, innovativeness, operational efficiency and market position. Regression analyses were performed to test: (i) whether innovativeness mediates the connection between organizational trust and operational efficiency; and (ii) whether operational efficiency mediates the relationship between innovativeness and market position. Results are presented in Figure 2.

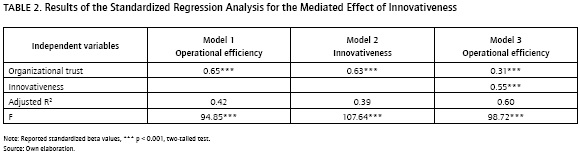

Firstly, it was examined whether innovativeness mediates the relationship between organizational trust and operational efficiency (table 2). Organizational trust and innovativeness are significantly associated (r = 0.63, p < 0.01), and both are significantly correlated to operational efficiency (accordingly r = 0.65, r = 0.74, both p < 0.01). Therefore, the preconditions suggested by Baron and Kenny (1986) required to establish a mediated relationship are satisfied. When organizational trust and innovativeness were simultaneously entered as predictors in the regression equation and operational efficiency as the outcome, the mediator innovativeness is still a significant predictor of operational efficiency (β = 0.55, p < 0.001), but the effect of independent variable of organizational trust on the dependent variable of operational efficiency is reduced (from β = 0.65 to β = 0.31). Accordingly, the last condition for mediation relationship is fulfilled. As the slope reduced, therefore, it is concluded that it is a partial mediation. The amount of mediation is 0.34. The last model explained more than half of the variance in operational efficiency (the coefficient of determination is 61%). these above results provide support for hypothesis 6 and 7.

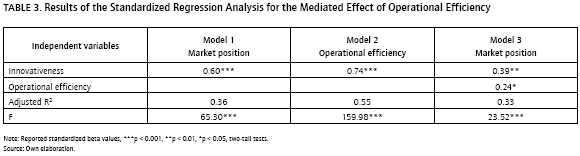

Secondly, the same previous analysis was used, but examining whether operational efficiency meditates the relationship between innovativeness and market position (table 3). Innovativeness and market position are significantly correlated (b = 0.60, p < 0.001), innovativeness alone is a significant predictor of operational efficiency (β = 0.74, p < 0.001), and operational efficiency is a significant predictor of market position (β = 0.50, p < 0.001). When both variables (innovativeness and operational efficiency) are included in the regression equation, the intervening operational efficiency is still a significant predictor of the outcome (β = 0.24, p < 0.05). However, the standardized slope coefficient for innovativeness is now equal to 0.39, p < 0.01. The slope has been reduced from 0.60 to 0.39; therefore, the amount of mediation is 0.21. The model with the partial mediator explained more than a quarter of the variance in market position (R2 = 0.34).

To further test the full model of the organizational trust impact on the market position structural equation modeling was employed with the estimation procedure of AMOS (Byrne, 2001). For this study a confirmatory analysis approach was used. Figure 3 reports the casual relationships between variables and results of the estimation. The structural model estimated with the maximum likelihood method reported following fit indices: chi-square = 0.014, df = 1, p = 0.906, RMSEA = 0.000, CFI = 1.00. RMSEA value less than 0.05 are interpreted as a close fit (Brownie & Cudeck, 1993). A comparative fit index CFI above the threshold of 0.90 indicates a good model fit (Kline, 2005).

Therefore, it was achieved an excellent fit of theoretical model with empirical data. Thus, the structural model lends further support for previous results.

Discussion

The findings of this research recognize complementary roles of trust for organizational performance. What is more, the paper gathers in one empirical study findings on the effects of trust that evolved on separate tracks. The empirical evidence has demonstrated that an organizational climate of trust, which is an intraorganizational phenomenon, has an impact on the market position; however, not as direct as the one we can observe, for example, in a particular case of clients' trust in a firm or/and its products. In case of overall organizational trust expressing the climate in an organization, the links are not so straightforward.

Organizational trust creates the advantage in terms of innovation and increased operational efficiency, which taken together lead to an improved market position. Firms with higher organizational trust levels seem to be better at innovativeness and operational efficiency. Moreover, the findings show that innovativeness and increased operational efficiency partially accounted for the effect of organizational trust on the market position; however, even more pronounced is the influence of trust on the market position through innovativeness. The plausible explanation is that trust is much more important for a creative part of work (exploration) than for systematic processes, which require more standardization (exploitation).

Trust is more adequate for creativity and, in turn, innovations that are connected with highly ambiguous tasks. For operational efficiency, routines and rules are more crucial for improvements than the autonomy embodied in trust. Still, for organizational members to be effective in sustaining focus and following standards they must feel confident about their organization, which induces them to organizational commitment. Such aspect suggests that trust plays different roles in various types of learning, with the greatest influence at the exploration stage. In turn, the latter implies that organizational trust should have different importance for different types of companies, and further sectors. Those who rely on innovativeness as their main mode of achieving competiveness would be more trust sensitive than ones competing on a cost advantage solely. Thus, a less knowledge-intensive type of company attenuates the meaning of organizational trust for market performance.

Managers should be advised about this total impact of the organizational trust on the market position of a company. Importantly, it has been found that the impact of organizational trust on a firm market position through innovativeness is stronger than its impact through operational efficiency enhancement. This suggests that intraorganizational trust sustains a competitive advantage through bringing customers value, rather than lower costs. Secondly, the findings suggest that the combination of innovativeness and operational performance accelerates performance encapsulated in the market position to a greater extent. However, it has been discovered that gains in market position from innovativeness are much higher than the benefits from operational efficiency improvement, which is in line with research claiming that exploration outperforms exploitation in terms of return gains (Levinthal & March, 1993). Nevertheless, both exploitation and exploration need to be introduced within an organization to achieve market success. As such, these findings provide support for the claim that the path from organizational trust to market position through innovativeness is especially attractive for a firm in order to gain a competitive advantage. However, trust plays significantly different roles in various types of learning. This is in line with the assertion that trust enables organizations to amalgamate systematic processes and structure with creativity (Brattstrom et al, 2012), which boil down to exploitation and exploration accordingly.

The issue of generalizability of reported findings to different levels of analysis can be raised, particularly, whether conclusions hold true at the national level. Some prominent studies suggest that trust leads to better performance of countries (Fukuyama, 1995). Countries, where general trust is high, do better than low trust countries (Zack & Knack, 2001). It was demonstrated that on the average a 10 percentage point increase in trust results in the growth rate of GDP by 0.5 percentage point (Dincer & Uslaner, 2010). Taking into account that innovativeness and growth are associated, we could expect that trust is more important for innovativeness than efficiency even at the national level too. However, in order to validate this assertion new research endeavor should be undertaken.

Findings suggest that a road to a better market position is very complex and company's characteristics such as organizational climate of trust should be well-considered in organizations. Organizational trust should be of particular interest for those companies that strive to achieve better market positions by innovating. Those aiming at operational efficiency can still reach some satisfactory levels through control mechanisms.

Limitations and Further Research

Although the present study has yielded very interesting results, there are some limitations that are inherent in every empirical work. Thus, future research can be extended in several ways. With regard to a research design, the use of self-reported subjective data might be viewed as a limitation. However, constructing a sample of observations on the basis of objective indicators such as "a number of patents" or "a number of new products introduced" constitutes an empirical challenge and, importantly, puts a constraint on comparisons in case of heterogeneous samples of enterprises. It should also be noted that a telephone-administrated questionnaire basing on key informants may lead to some bias. Therefore, in future research an effort should be paid to collect data from multiple respondents.

A problematic aspect is that the data is cross-sectional, which does not allow for unquestioned causal interpretation. It is important to note that although the direction of causality between organizational trust and market position was assumed in the proposed model, it cannot be excluded the opposite direction of influence, namely that a strong market position builds trust inside an organization. This alternative interpretation, however, seems less plausible. This is consistent with evidence provided by Davis et al. (2000), where trust is a causal antecedent of organizational performance. In addition, the time dimension to data can also be further enriched in future studies.

Another issue arising from the current research, which attributes such a prominent role to organizational trust, is the suggestion that more research should be done in an attempt to account for factors determining a trust climate in organizations. A future agenda for researchers could be an study of the exact outcome of organizational trust in specific sectors together with an examination of its antecedents.

References

Abrams, L. C., Cross, R., Lesser, E., & Levin, Z. (2003). Nurturing interpersonal trust in knowledge sharing networks. Academy of Management Executive, 17(4), 64-77.

Argyris, C. (1964). Integrating the individual and the organization. New York, NY, USA: John Wiley.

Barczak, G., Lassk, F., & Mulki, J. (2010). Antecedents of Team Creativity: An Examination of team Emotional Intelligence, team trust and Collaborative Culture. Creativity and Innovation Management, 19(4), 332-345.

Barney, J., & Hansen, M. (1995). Trustworthiness as a source of competitive advantage. Strategic Management Journal, 15(Special Issue), 175-190.

Baron, R. M., & Kenny, D. A. (1986). The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

Bell, A. H., & Cohn, R. G. (2008). Winning with trust in business. Gretna, LA, USA: Pelican Publishing Company.

Bibb, S., & Kourdi, J. (2004). Trust Matters for Organizational and Personal Success. New York, NY, USA: Palgrave.

Bijlsma-Frankema, K., Rosendal, B. W., Woolthuis, R. K., & Cheltenham, E. E. (2005). Does trust breed head? Differential effects of trust on heed and performance in a network and a divisional form of organizing. In: Bijlsma-Frankema, K., & Rosendal, B. W. (Eds.). Trust under pressure. Empirical Investigation of Trust and Trust Building in Uncertain Circumstances. Northampton, MA, USA: Edward Elgar Publishing.

Blomqvist, K., Kylaheiko, K., & Virolainen, V. M. (2002). Filling a gap in traditional transaction cost economics: towards transaction benefits-based analysis. International Journal of Production Economics, 79(1), 1-14.

Bouncken, R. B., Koch, M., & Thorsten, T. (2007). Innovation Strategy Explored: Innovation Orientation's Strategy Precognitions and Market Performance Outcomes. In: Ernst, G., & Gemuden, H. S. Innovation orientation, innovativeness and innovation success. Bayreuth: Wiesbaden, Der Gabler Verlag.

Brattstrom, A., Lofsten, H., & Richtnér, A. (2012). Creativity, trust and systematic processes in product development. Research Policy, 41 (4), 743-755.

Brownie, M. W., & Cudeck, R. (1993). Alternative ways of assessing model fit. In: Bollen, K. A., & Long, J. S. Testing Structural Equation Models. Newbury Park, CA: Sage Publications.

Byrne, B. M. (2001). Structural equation modeling with Amos: basic concepts, applications, and programming. New Jersey, NJ, USA: Lawrence Erlbaum Associates.

Černe, M., Nerstad, C. G. L., Dysvik, A., & Skerlavaj, M. (2014). What goes around comes around: knowledge hiding, perceived motivational climate, and creativity. Academy of Management Journal, 57(1), 172-192.

Cao, M., & Zhang, Q. (2013). Supply Chain Collaboration: Roles of Interorganizational Systems, Trust, and Collaborative Culture. London: Springer-Verlag.

Cho, H. J., & Pucik, V. (2005). Relationship between innovative-ness, quality, growth, profitability, and market value. Strategic Management Journal, 26, 555-575.

Cho, Y. J., & Poister, T. H. (2014). Managerial practices, trust in leadership, and performance: case of the Georgia Department of transportation. Public Personnel Management, 43(2), 179-196.

Chow, I. H. S. (2008). How trust reduces transaction costs and enhances performance in China's Business. SAM Advanced Management Journal, 73(2), 25-34.

Chowdhury, S. (2005). The Role of Affect- and Cognition-based trust in Complex Knowledge Sharing. Journal of Managerial Issues, 17(3),310-326.

Chung, Y., & Jackson, S. E. (2011). Co-worker trust and knowledge creation: a multilevel analysis. Journal of Trust Research, 1(1), 65-83.

Ciancutti, A., & Steding, T. (2001). Built on trust. Gaining competitive Advantage in Any Organization. Lincolnwood: Contemporary Books.

Clegg, C., Unsworth, K., Epitropaki, O., & Parker, G. (2002). Implicating trust in the innovation process. Journal of Occupational & Organizational Psychology, 75(4), 409-422.

Colquitt, J. A., LePine, J. A., Zapata, C., & Wild, R. E. (2011). Trust in typical and high-reliability contexts: building and reacting to trust among firefighters. Academy of Management Journal, 54(5), 999-1015.

Colquitt, J. A., Scott, B. A., & LePine, J. A. (2007). Trust, Trustworthiness, and trust Propensity: A Meta-Analytic test of their Unique Relationships with Risk taking and Job Performance. Journal of Applied Psychology, 92(4), 909-927.

Costa, A. C. (2003). Understanding the nature and the antecedents of trust within work teams. In: Noteboom, B., & Six, F. The Trust Process in Organizations. Cheltenham, UK: Edward Elgar.

Covey, S. R., & Merrill, R. R. (2006). The speed of trust: the one thing that changes everything. New York, NY, USA: Free Press.

Culbert, S. A., & McDonough, J. J. (1986). The politics of trust and organization empowerment. Public Administration Quarterly, 10(2), 171-188.

Darroch, J. (2005). Knowledge management, innovation and firm performance. Journal of Knowledge Management, 9(3), 101-115.

Davenport, T., & Prusak, L. (1998). Working Knowledge: How Organizations Manage What They Know. Boston, MA, USA: Harvard Business School Press.

Davis, J. H., Schoorman, F. D., Mayer, R. C., & Tan, H. H. (2000). The trusted general manager and business unit performance: Empirical evidence of a competitive advantage. Strategic Management Journal, 21 (5), 563-576.

Dawson, E. J. (2002). Trust in business and other transactions: who and when. Bloomington: 1st Books Library.

De Jong, B. A., & Elfring, T. (2010). How does trust affect the performance of ongoing teams? Mediating role of reflexivity, monitoring, and effort. Academy of Management Journal, 53(3), 535-549.

Delbufalo, E. (2012). Outcomes of inter-organizational trust in supply chain relationships: a systematic literature review and meta-analysis of the empirical evidence. Supply Chain Management: An International Journal, 17(4), 377-402.

Denison, D. R., & Mishra, A. K. (1995). Toward a Theory of Organizational Culture and Effectiveness. Organization Science, 6(2), 204-223.

Dincer, O., & Uslaner, E. M. (2010). Trust and growth. Public Choice, 142(1-2), 59-67.

Dirks, K. I (1999). The effects of interpersonal trust on work group performance. Journal of Applied Psychology, 84(3), 445-455.

Driscoll, J. W. (1978). Trust and participation in organizational decision making as predictors of satisfaction. Academy of Management Journal, 12(1), 44-56.

Drucker, P. F. (1974). Management: Task, Responsibilities, Practice. New York, NY, USA: Harper and Row.

Dwivedi, R. S. (1983). Management by trust: a conceptual model. Group & Organization Management, 8(4), 375-405.

Dyer, J. H., & Chu, W. (2003). The Role of Trustworthiness in Reducing transaction Costs and Improving Performance: Empirical Evidence from the United States, Japan, and Korea. Organization Science, 14(1), 57-68.

Edmondson, A. (1999). Psychological Safety and Learning Behavior in Work Teams. Administrative Science Quarterly, 44(2), 350-383.

Ellonen, R., Blomqvist, K., & Puumalainen, K. (2008). The role of trust in organizational innovativeness. European Journal of Innovation Management, 11 (2), 160-181.

Ford, D. P. (2003). Trust and Knowledge Management: the seeds of success. In: Holsapple, C. W. Handbook on Knowledge Management. Berlin: Springer-Verlag.

Fukuyama, F. (1995). Trust: the Social Virtues and the Creation of Propensity. New York, NY, USA: Free Press.

Gambetta, D. (1988). Can we trust trust? In: Gambetta, D. Trust: making and breaking cooperative relationships. Oxford, UK: Basil Blackwell.

Glińska-Neweś, A. (2007). Kulturowe uwarunkowania zarzqdzania wiedzqw przedsiçbiorstwie. Toruń: Wydawnictwo "Dom Organizatora".

Gonzalez-Benito, J. (2005). A study of the effect of manufacturing proactivity on business performance. International Journal of Operations & Production Management, 25(3), 222-241.

Gulati, R. (1995). Does familiarity breed trust? the implications of repeated ties for contractual choice in alliance. Academy of Management Journal, 38(1), 85-112.

Hacker, S. K., & Willard, M. L. (2002). The Trust Impetrative: Performance Improvement through Productive Relationships. Milwaukee, WI, USA: ASQ Quality Press.

Herting, S. (2002). Trust correlated with innovation adoption in hospital organizations. Phoenix, AZ, USA: American Society for Public Administration.

Huotari, M. L., & Iivonen, M. (2004). Managing Knowledge-Based Organizations Through Trust. In: Huotari, M. L., & Iivonen, M. Trust in Knowledge Management Systems in Organizations. Hershey: Idea Group Publishing.

Kim, W. C., & Mauborgne, R. (2003). Fair Process: Managing in the Knowledge Economy. Harvard Business Review, 81(1), 127-136.

Kline, R. B. (2005). Principles and practice of structural equation modeling. New York, NY, USA: The Guilford Press.

Kock, A. (2007). Innovativeness and innovation success - a meta-analysis. In: Ernst, H., & Gemunden, H. G. Innovation orientation, innovativeness and innovation success. Wiesbaden: Der Gabler Verlag.

Kohn, M. (2008). Trust. Self-Interest and the Common Good. Oxford: Oxford University Press.

Kramer, R. M., & Cook, K. S. (2004). Trust and distrust: Dilemmas and Approaches. In: Kramer, R. M., & Cook, K. S. Trust and distrust in organizations. Dilemmas and Approaches. New York, NY, USA: Russell Sage Foundation.

Krot, K., & Lewicka, D. (2011). Innovation and organisational trust: study of firms in Poland. International Journal of Innovation and Learning, 10(1), 43-59.

Lee, H., & Choi, B. (2003). Knowledge Management Enablers, Processes, and Organizational Performance: An Integrative View and Empirical Examination. Journal of Management Information Systems, 20(1), 179-228.

Levin, D. Z., Cross, R., & Abrams, L. C. (2003). Why should I trust you? Predictors of Interpersonal Trust in Knowledge Transfer Context. Working paper. Denver.

Levinthal, D. A., & March, J. G. (1993). The myopia of learning. Strategic Management Journal, 14 (S2), 95-112.

Li, P. P. (2008). Toward a geocentric framework of trust: an application to organizational trust. Management and Organization Review, 4(3), 413-439.

Li, P. P. (2012). Exploring the unique roles of trust and play in private creativity: From the complexity-ambiguity-metaphor link to the trust-play-creativity link. Journal of Trust Research, 2(1), 71-97.

Li, P. P., Bai, Y., & Xi, Y. (2011). The contextual antecedents of organizational trust: a multidimensional cross-level analysis. Management and Organization Review, 8(2), 371-396.

Likert, R. (1967). The human organization: its management and value. New York, NY, USA: McGraw-Hill.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71-87.

Mayer, R. C., & Davis, J. H. (1999). The effect of the performance appraisal system on trust for management: A field quasi-experiment. Journal of Applied Psychology, 84(1), 123-136.

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Journal, 20(3), 709-734.

Mazur, J., Rószkiewicz, M., & Strzyżewska, M. (2008). Orientacja na wiedzę a wyniki ekonomiczne przedsię- biorstwa. Wyniki bada ń średnich przedsiçbiorstw funkcjonujqcych w Polsce. Oficyna Wydawnicza SGH, Warszawa.

McEvily, B., Perrone, V., & Zaheer, A. (2003). Trust as an Organizing Principle. Organization Science, 14(1), 91-103.

McGregor, D. (1960). The Human Side of Enterprise. New York, NY, USA: McGraw-Hill.

Michalski, M., Yorov, K. M., & Botella, J. M. (2014). Trust and IT innovation in asymmetric environments of the supply chain management process. Journal of Computer Information Systems, 54(3), 10-24.

Micheels, E. T., & Gow, H. R. (2011). The moderating effects of trust and commitment on market orientation, value discipline clarity, and firm performance. Agribusiness, 27(3), 360-378.

Mithas, S., Ramasubbu, N., & Sambamurthy, V. (2011). How information management capability influences firm performance. MIS Quarterly, 35(1), 237-256.

Mollering, G. (2012). Trusting in art: Calling for empirical trust research in highly creative contexts. Journal of Trust Research, 2(2), 203-210.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital, and the organizational advantage. Academy of Management Review, 23(2), 242-266.

Nonaka, I., & Takeuchi, H. (1995). The knowledge-creating company: How Japanese companies create the dynamics of innovation. New York, NY, USA: Oxford University Press.

Nunnally, J. C. (1978). Psychometric Theory. New York, NY, USA: McGraw-Hill.

OECD/Eurostat (2005). Oslo Manual-Guidelines for collecting and interpreting innovation data. 3rd edition. Oslo: OECD Publishing & Eurostat.

Politis, J. D. (2003). The connection between trust and knowledge management: What are its implications for team performance. Journal of Knowledge Management, 7(5), 55-66.

Rispens, S., Greer, L., & Jehn, K. A. (2007). It could be worse. A study on the alleviating roles of trust and connectedness in intragroup conflicts. International Journal of Conflict Management, 18(4), 325-344.

Rubera, G., & Kirca, A. H. (2012). Firm Innovativeness and Its Performance Outcomes: A meta-analytic review and theoretical integration. Journal of Marketing, 76, 130-147.

Ruppel, C. P., & Harrington, S. J. (2000). The relationship of communication, ethical work climate, and trust to commitment and innovation. Journal of Business Ethics, 25(4), 313-328.

Rus, A. (2005). Trust and performance: institutional, interpersonal and network trust. In: Bijlsma-Frankema, K, & Woolthuis, R. K. Trust under pressure. Cheltenham: Edward Elgar.

Rust, R. T., Ambler, T., Kumar, V., & Srivastava, R. K. (2004). Measuring Marketing Productivity: Current Knowledge and Future Directions. Journal of Marketing, 68, 76-89.

Sako, M. (2006). Does Trust Improve Business Performance? Organizational Trust. Oxford: Oxford University Press.

Salomo, S., Gemunden, H. G., & Billing, F. (2007). Facilitating information flow across organizational interfaces for successful innovation projects - the impact of product innovativeness. ZfB, 67(2), 97-120.

Sankowska, A. (2013). Further understanding of links between inter-organizational trust and enterprise innovativeness - from a perspective of an enterprise. International Journal of Innovation and Learning, 13(3), 308-321.

Schwenker, B., & Botzel, S. (2007). Making Growth Work. New York, NY, USA: Springer.

Shockley-Zalabak, P., Morreale, S., & Hackman, M. (2010). Building the high-trust organization. Strategies for supporting key dimensions of trust. San Francisco: Jossey-Bass.

Slack, N., Chambers, S., & Johnston, R. (1998). Operations Management. London: Pitman Publishing.

Sorescu, A. B., & Spanjol, J. (2008). Innovation's effect on firm value and risk: insight from consumer packaged goods. Journal of Marketing, 72(2), 114-132.

Tsai, W., & Ghoshal, S. (1998). Social capital and value creation: the role of intrafirm networks. The Academy of Management Journal, 41 (4), 464-476.

Tschannen-Moran, M. (2004). Trust matters. Leadership for Successful Schools. San Francisco: Jossey-Bass.

Wall, C. L., Michie, J., Patterson, M., & Wood, S. J. (2004). On the validity of subjective measures of company performance. Personnel Psychology, 57(1), 95-118.

Wang, C. L., & Ahmed, P. K. (2004). The development and validation of the organisational innovativeness construct using confirmatory factor analysis. European Journal of Innovation Management, 7(3), 303-313.

Ward, A., & Smith, J. (2003). Trust and mistrust: radical risk strategies in business relationships. San Francisco: Wiley.

West, M. A., & Anderson, N. R. (1996). Innovation in top management teams. Journal of Applied Psychology, 81 (6), 680-694.

Whipple, J. M., Griffis, S. E., & Daugherty, P. J. (2014). Conceptualization of trust: can we trust them? Journal of Business Logistics, 34(2), 117-130.

Williamson, O. (1975). Market and hierarchies: Analysis and antitrust implications. New York, NY, USA: Free Press.

Williamson, O. (1993). Calculativeness, trust, and economic organization. Journal of Law and Economics, 36(1), 453-487.

Yeung, A. C. L., Lai, K. H., & Yee, R. W. Y. (2007). Organizational learning, innovativeness, and organizational performance: a qualitative investigation. International Journal of Production Research, 45(11),2459-2477.

Zak, P. J., & Knack, S. (2001). Trust and growth. Economic Journal, 111(470), 295-321.

Zand, D. (1972). Trust and managerial problem solving. Administrative Science Quarterly, 17(2), 229-239.

Referencias

Abrams, L. C., Cross, R., Lesser, E., & Levin, Z. (2003). Nurturing interpersonal trust in knowledge sharing networks. Academy of Management Executive, 17(4), 64-77.

Argyris, C. (1964). Integrating the individual and the organization. New York, NY, USA: John Wiley.

Barczak, G., Lassk, F., & Mulki, J. (2010). Antecedents of Team Creativity: An Examination of team Emotional Intelligence, team trust and Collaborative Culture. Creativity and Innovation Management, 19(4), 332-345.

Barney, J., & Hansen, M. (1995). Trustworthiness as a source of competitive advantage. Strategic Management Journal, 15(Special Issue), 175-190.

Baron, R. M., & Kenny, D. A. (1986). The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

Bell, A. H., & Cohn, R. G. (2008). Winning with trust in business. Gretna, LA, USA: Pelican Publishing Company.

Bibb, S., & Kourdi, J. (2004). Trust Matters for Organizational and Personal Success. New York, NY, USA: Palgrave.

Bijlsma-Frankema, K., Rosendal, B. W., Woolthuis, R. K., & Cheltenham, E. E. (2005). Does trust breed head? Differential effects of trust on heed and performance in a network and a divisional form of organizing. In: Bijlsma-Frankema, K., & Rosendal, B. W. (Eds.). Trust under pressure. Empirical Investigation of Trust and Trust Building in Uncertain Circumstances. Northampton, MA, USA: Edward Elgar Publishing.

Blomqvist, K., Kylaheiko, K., & Virolainen, V. M. (2002). Filling a gap in traditional transaction cost economics: towards transaction benefits-based analysis. International Journal of Production Economics, 79(1), 1-14.

Bouncken, R. B., Koch, M., & Thorsten, T. (2007). Innovation Strategy Explored: Innovation Orientation's Strategy Precognitions and Market Performance Outcomes. In: Ernst, G., & Gemuden, H. S. Innovation orientation, innovativeness and innovation success. Bayreuth: Wiesbaden, Der Gabler Verlag.

Brattstrom, A., Lofsten, H., & Richtnér, A. (2012). Creativity, trust and systematic processes in product development. Research Policy, 41 (4), 743-755.

Brownie, M. W., & Cudeck, R. (1993). Alternative ways of assessing model fit. In: Bollen, K. A., & Long, J. S. Testing Structural Equation Models. Newbury Park, CA: Sage Publications.

Byrne, B. M. (2001). Structural equation modeling with Amos: basic concepts, applications, and programming. New Jersey, NJ, USA: Lawrence Erlbaum Associates.

Černe, M., Nerstad, C. G. L., Dysvik, A., & Skerlavaj, M. (2014). What goes around comes around: knowledge hiding, perceived motivational climate, and creativity. Academy of Management Journal, 57(1), 172-192.

Cao, M., & Zhang, Q. (2013). Supply Chain Collaboration: Roles of Interorganizational Systems, Trust, and Collaborative Culture. London: Springer-Verlag.

Cho, H. J., & Pucik, V. (2005). Relationship between innovative-ness, quality, growth, profitability, and market value. Strategic Management Journal, 26, 555-575.

Cho, Y. J., & Poister, T. H. (2014). Managerial practices, trust in leadership, and performance: case of the Georgia Department of transportation. Public Personnel Management, 43(2), 179-196.

Chow, I. H. S. (2008). How trust reduces transaction costs and enhances performance in China's Business. SAM Advanced Management Journal, 73(2), 25-34.

Chowdhury, S. (2005). The Role of Affect- and Cognition-based trust in Complex Knowledge Sharing. Journal of Managerial Issues, 17(3),310-326.

Chung, Y., & Jackson, S. E. (2011). Co-worker trust and knowledge creation: a multilevel analysis. Journal of Trust Research, 1(1), 65-83.

Ciancutti, A., & Steding, T. (2001). Built on trust. Gaining competitive Advantage in Any Organization. Lincolnwood: Contemporary Books.

Clegg, C., Unsworth, K., Epitropaki, O., & Parker, G. (2002). Implicating trust in the innovation process. Journal of Occupational & Organizational Psychology, 75(4), 409-422.

Colquitt, J. A., LePine, J. A., Zapata, C., & Wild, R. E. (2011). Trust in typical and high-reliability contexts: building and reacting to trust among firefighters. Academy of Management Journal, 54(5), 999-1015.

Colquitt, J. A., Scott, B. A., & LePine, J. A. (2007). Trust, Trustworthiness, and trust Propensity: A Meta-Analytic test of their Unique Relationships with Risk taking and Job Performance. Journal of Applied Psychology, 92(4), 909-927.

Costa, A. C. (2003). Understanding the nature and the antecedents of trust within work teams. In: Noteboom, B., & Six, F. The Trust Process in Organizations. Cheltenham, UK: Edward Elgar.

Covey, S. R., & Merrill, R. R. (2006). The speed of trust: the one thing that changes everything. New York, NY, USA: Free Press.

Culbert, S. A., & McDonough, J. J. (1986). The politics of trust and organization empowerment. Public Administration Quarterly, 10(2), 171-188.

Darroch, J. (2005). Knowledge management, innovation and firm performance. Journal of Knowledge Management, 9(3), 101-115.

Davenport, T., & Prusak, L. (1998). Working Knowledge: How Organizations Manage What They Know. Boston, MA, USA: Harvard Business School Press.

Davis, J. H., Schoorman, F. D., Mayer, R. C., & Tan, H. H. (2000). The trusted general manager and business unit performance: Empirical evidence of a competitive advantage. Strategic Management Journal, 21 (5), 563-576.

Dawson, E. J. (2002). Trust in business and other transactions: who and when. Bloomington: 1st Books Library.

De Jong, B. A., & Elfring, T. (2010). How does trust affect the performance of ongoing teams? Mediating role of reflexivity, monitoring, and effort. Academy of Management Journal, 53(3), 535-549.

Delbufalo, E. (2012). Outcomes of inter-organizational trust in supply chain relationships: a systematic literature review and meta-analysis of the empirical evidence. Supply Chain Management: An International Journal, 17(4), 377-402.

Denison, D. R., & Mishra, A. K. (1995). Toward a Theory of Organizational Culture and Effectiveness. Organization Science, 6(2), 204-223.

Dincer, O., & Uslaner, E. M. (2010). Trust and growth. Public Choice, 142(1-2), 59-67.

Dirks, K. I (1999). The effects of interpersonal trust on work group performance. Journal of Applied Psychology, 84(3), 445-455.

Driscoll, J. W. (1978). Trust and participation in organizational decision making as predictors of satisfaction. Academy of Management Journal, 12(1), 44-56.

Drucker, P. F. (1974). Management: Task, Responsibilities, Practice. New York, NY, USA: Harper and Row.

Dwivedi, R. S. (1983). Management by trust: a conceptual model. Group & Organization Management, 8(4), 375-405.

Dyer, J. H., & Chu, W. (2003). The Role of Trustworthiness in Reducing transaction Costs and Improving Performance: Empirical Evidence from the United States, Japan, and Korea. Organization Science, 14(1), 57-68.

Edmondson, A. (1999). Psychological Safety and Learning Behavior in Work Teams. Administrative Science Quarterly, 44(2), 350-383.

Ellonen, R., Blomqvist, K., & Puumalainen, K. (2008). The role of trust in organizational innovativeness. European Journal of Innovation Management, 11 (2), 160-181.

Ford, D. P. (2003). Trust and Knowledge Management: the seeds of success. In: Holsapple, C. W. Handbook on Knowledge Management. Berlin: Springer-Verlag.

Fukuyama, F. (1995). Trust: the Social Virtues and the Creation of Propensity. New York, NY, USA: Free Press.

Gambetta, D. (1988). Can we trust trust? In: Gambetta, D. Trust: making and breaking cooperative relationships. Oxford, UK: Basil Blackwell.

Glińska-Neweś, A. (2007). Kulturowe uwarunkowania zarzqdzania wiedzqw przedsiçbiorstwie. Toruń: Wydawnictwo "Dom Organizatora".

Gonzalez-Benito, J. (2005). A study of the effect of manufacturing proactivity on business performance. International Journal of Operations & Production Management, 25(3), 222-241.

Gulati, R. (1995). Does familiarity breed trust? the implications of repeated ties for contractual choice in alliance. Academy of Management Journal, 38(1), 85-112.

Hacker, S. K., & Willard, M. L. (2002). The Trust Impetrative: Performance Improvement through Productive Relationships. Milwaukee, WI, USA: ASQ Quality Press.

Herting, S. (2002). Trust correlated with innovation adoption in hospital organizations. Phoenix, AZ, USA: American Society for Public Administration.

Huotari, M. L., & Iivonen, M. (2004). Managing Knowledge-Based Organizations Through Trust. In: Huotari, M. L., & Iivonen, M. Trust in Knowledge Management Systems in Organizations. Hershey: Idea Group Publishing.

Kim, W. C., & Mauborgne, R. (2003). Fair Process: Managing in the Knowledge Economy. Harvard Business Review, 81(1), 127-136.

Kline, R. B. (2005). Principles and practice of structural equation modeling. New York, NY, USA: The Guilford Press.

Kock, A. (2007). Innovativeness and innovation success - a meta-analysis. In: Ernst, H., & Gemunden, H. G. Innovation orientation, innovativeness and innovation success. Wiesbaden: Der Gabler Verlag.

Kohn, M. (2008). Trust. Self-Interest and the Common Good. Oxford: Oxford University Press.

Kramer, R. M., & Cook, K. S. (2004). Trust and distrust: Dilemmas and Approaches. In: Kramer, R. M., & Cook, K. S. Trust and distrust in organizations. Dilemmas and Approaches. New York, NY, USA: Russell Sage Foundation.

Krot, K., & Lewicka, D. (2011). Innovation and organisational trust: study of firms in Poland. International Journal of Innovation and Learning, 10(1), 43-59.

Lee, H., & Choi, B. (2003). Knowledge Management Enablers, Processes, and Organizational Performance: An Integrative View and Empirical Examination. Journal of Management Information Systems, 20(1), 179-228.

Levin, D. Z., Cross, R., & Abrams, L. C. (2003). Why should I trust you? Predictors of Interpersonal Trust in Knowledge Transfer Context. Working paper. Denver.

Levinthal, D. A., & March, J. G. (1993). The myopia of learning. Strategic Management Journal, 14 (S2), 95-112.

Li, P. P. (2008). Toward a geocentric framework of trust: an application to organizational trust. Management and Organization Review, 4(3), 413-439.

Li, P. P. (2012). Exploring the unique roles of trust and play in private creativity: From the complexity-ambiguity-metaphor link to the trust-play-creativity link. Journal of Trust Research, 2(1), 71-97.

Li, P. P., Bai, Y., & Xi, Y. (2011). The contextual antecedents of organizational trust: a multidimensional cross-level analysis. Management and Organization Review, 8(2), 371-396.

Likert, R. (1967). The human organization: its management and value. New York, NY, USA: McGraw-Hill.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71-87.

Mayer, R. C., & Davis, J. H. (1999). The effect of the performance appraisal system on trust for management: A field quasi-experiment. Journal of Applied Psychology, 84(1), 123-136.

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Journal, 20(3), 709-734.

Mazur, J., Rószkiewicz, M., & Strzyżewska, M. (2008). Orientacja na wiedzę a wyniki ekonomiczne przedsię- biorstwa. Wyniki bada ń średnich przedsiçbiorstw funkcjonujqcych w Polsce. Oficyna Wydawnicza SGH, Warszawa.

McEvily, B., Perrone, V., & Zaheer, A. (2003). Trust as an Organizing Principle. Organization Science, 14(1), 91-103.

McGregor, D. (1960). The Human Side of Enterprise. New York, NY, USA: McGraw-Hill.

Michalski, M., Yorov, K. M., & Botella, J. M. (2014). Trust and IT innovation in asymmetric environments of the supply chain management process. Journal of Computer Information Systems, 54(3), 10-24.

Micheels, E. T., & Gow, H. R. (2011). The moderating effects of trust and commitment on market orientation, value discipline clarity, and firm performance. Agribusiness, 27(3), 360-378.

Mithas, S., Ramasubbu, N., & Sambamurthy, V. (2011). How information management capability influences firm performance. MIS Quarterly, 35(1), 237-256.

Mollering, G. (2012). Trusting in art: Calling for empirical trust research in highly creative contexts. Journal of Trust Research, 2(2), 203-210.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital, and the organizational advantage. Academy of Management Review, 23(2), 242-266.

Nonaka, I., & Takeuchi, H. (1995). The knowledge-creating company: How Japanese companies create the dynamics of innovation. New York, NY, USA: Oxford University Press.

Nunnally, J. C. (1978). Psychometric Theory. New York, NY, USA: McGraw-Hill.

OECD/Eurostat (2005). Oslo Manual-Guidelines for collecting and interpreting innovation data. 3rd edition. Oslo: OECD Publishing & Eurostat.

Politis, J. D. (2003). The connection between trust and knowledge management: What are its implications for team performance. Journal of Knowledge Management, 7(5), 55-66.

Rispens, S., Greer, L., & Jehn, K. A. (2007). It could be worse. A study on the alleviating roles of trust and connectedness in intragroup conflicts. International Journal of Conflict Management, 18(4), 325-344.

Rubera, G., & Kirca, A. H. (2012). Firm Innovativeness and Its Performance Outcomes: A meta-analytic review and theoretical integration. Journal of Marketing, 76, 130-147.

Ruppel, C. P., & Harrington, S. J. (2000). The relationship of communication, ethical work climate, and trust to commitment and innovation. Journal of Business Ethics, 25(4), 313-328.

Rus, A. (2005). Trust and performance: institutional, interpersonal and network trust. In: Bijlsma-Frankema, K, & Woolthuis, R. K. Trust under pressure. Cheltenham: Edward Elgar.

Rust, R. T., Ambler, T., Kumar, V., & Srivastava, R. K. (2004). Measuring Marketing Productivity: Current Knowledge and Future Directions. Journal of Marketing, 68, 76-89.

Sako, M. (2006). Does Trust Improve Business Performance? Organizational Trust. Oxford: Oxford University Press.

Salomo, S., Gemunden, H. G., & Billing, F. (2007). Facilitating information flow across organizational interfaces for successful innovation projects - the impact of product innovativeness. ZfB, 67(2), 97-120.

Sankowska, A. (2013). Further understanding of links between inter-organizational trust and enterprise innovativeness - from a perspective of an enterprise. International Journal of Innovation and Learning, 13(3), 308-321.

Schwenker, B., & Botzel, S. (2007). Making Growth Work. New York, NY, USA: Springer.

Shockley-Zalabak, P., Morreale, S., & Hackman, M. (2010). Building the high-trust organization. Strategies for supporting key dimensions of trust. San Francisco: Jossey-Bass.

Slack, N., Chambers, S., & Johnston, R. (1998). Operations Management. London: Pitman Publishing.

Sorescu, A. B., & Spanjol, J. (2008). Innovation's effect on firm value and risk: insight from consumer packaged goods. Journal of Marketing, 72(2), 114-132.

Tsai, W., & Ghoshal, S. (1998). Social capital and value creation: the role of intrafirm networks. The Academy of Management Journal, 41 (4), 464-476.

Tschannen-Moran, M. (2004). Trust matters. Leadership for Successful Schools. San Francisco: Jossey-Bass.

Wall, C. L., Michie, J., Patterson, M., & Wood, S. J. (2004). On the validity of subjective measures of company performance. Personnel Psychology, 57(1), 95-118.

Wang, C. L., & Ahmed, P. K. (2004). The development and validation of the organisational innovativeness construct using confirmatory factor analysis. European Journal of Innovation Management, 7(3), 303-313.

Ward, A., & Smith, J. (2003). Trust and mistrust: radical risk strategies in business relationships. San Francisco: Wiley.

West, M. A., & Anderson, N. R. (1996). Innovation in top management teams. Journal of Applied Psychology, 81 (6), 680-694.

Whipple, J. M., Griffis, S. E., & Daugherty, P. J. (2014). Conceptualization of trust: can we trust them? Journal of Business Logistics, 34(2), 117-130.

Williamson, O. (1975). Market and hierarchies: Analysis and antitrust implications. New York, NY, USA: Free Press.

Williamson, O. (1993). Calculativeness, trust, and economic organization. Journal of Law and Economics, 36(1), 453-487.

Yeung, A. C. L., Lai, K. H., & Yee, R. W. Y. (2007). Organizational learning, innovativeness, and organizational performance: a qualitative investigation. International Journal of Production Research, 45(11),2459-2477.

Zak, P. J., & Knack, S. (2001). Trust and growth. Economic Journal, 111(470), 295-321.

Zand, D. (1972). Trust and managerial problem solving. Administrative Science Quarterly, 17(2), 229-239.

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

CrossRef Cited-by

1. Muhammad Sualeh Khattak, Syed Zulfiqar Ali Shah. (2021). Entrepreneurial orientation and the efficiency of SMEs: The role of government financial incentives in an emerging industry. Journal of Public Affairs, 21(3) https://doi.org/10.1002/pa.2242.