Publicado

Tendencias en inclusión financiera para la transformación social de los micronegocios: revisión sistemática de literatura

Trends in financial inclusion for the social transformation of micro-businesses: a systematic literature review

DOI:

https://doi.org/10.15446/dyna.v92n235.116564Palabras clave:

micronegocios, microfinanciación, pequeña empresa, PRISMA, progreso social, revisión sistemática de literatura (es)micro-business, microfinance, small business, PRISMA, social progress, systematic literature review (en)

Descargas

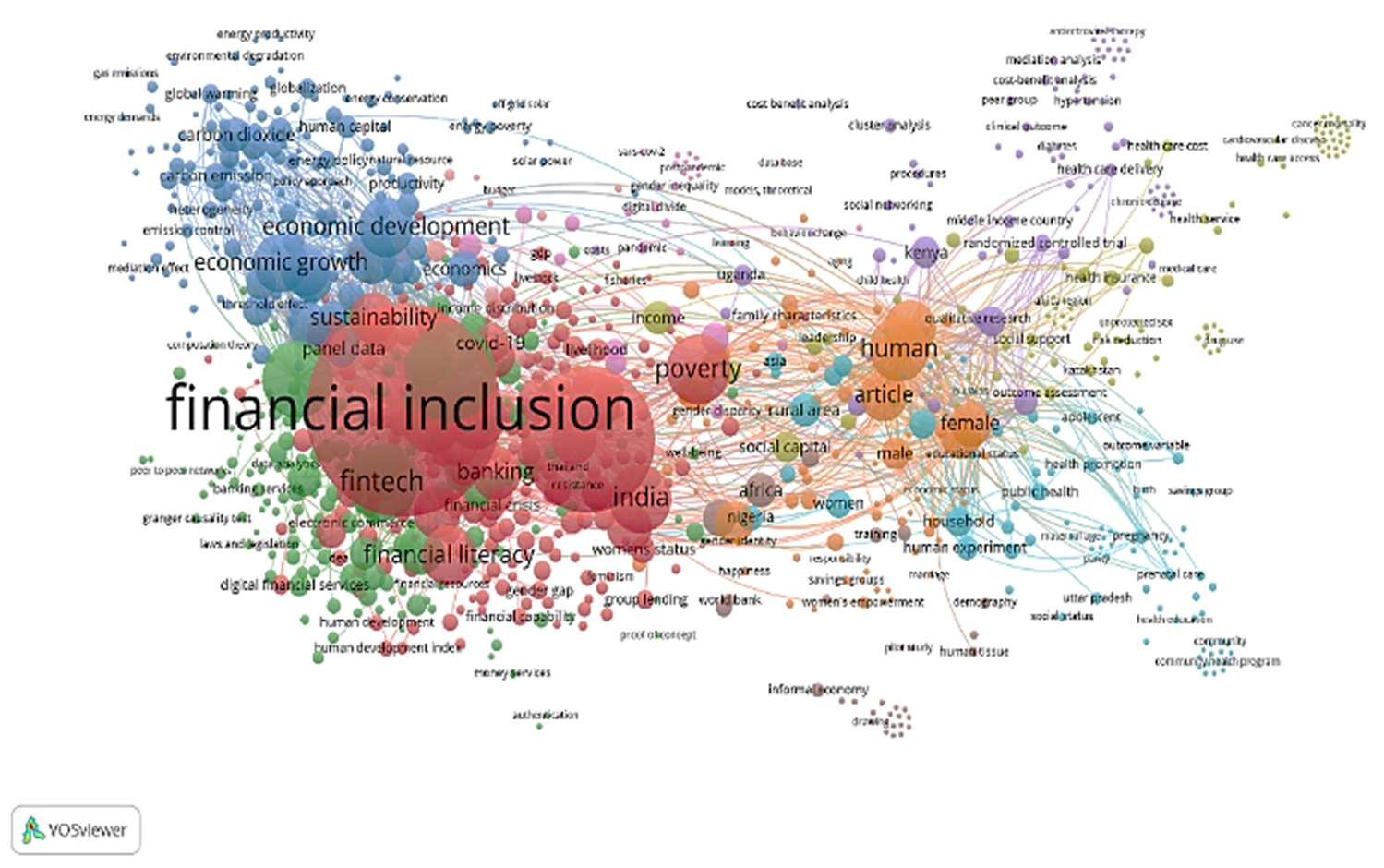

Las implicaciones financieras y de crédito para el bienestar de los hogares de las pequeñas empresas o micronegocios son cruciales para entender su transformación social y la ampliación de sus negocios. Por esto, este artículo tiene como objetivo examinar el panorama de las investigaciones de las microfinanzas, el microcrédito y la inclusión financiera y su impacto en el desarrollo empresarial de las pequeñas empresas o micronegocios, teniendo en cuenta las condiciones sociales, económicas y productivas. Para esto, se ejecuta un análisis bibliométrico y una revisión sistemática de literatura a partir de las revistas de la categoría Administración (Business) clasificadas de Q1 a Q4 por Scimago. Mediante la aplicación de PRISMA y de VOSviewer se realiza la construcción y mapeo de redes bibliométricas. Entre los principales hallazgos, se encuentran que los micronegocios principalmente ubicados en países emergentes tienen una relación significativa frente al empoderamiento de la mujer y la educación financiera.

The financial and credit implications for the household well-being of small businesses or micro-businesses are crucial to understanding their social transformation and business expansion. Therefore, this article aims to examine the research landscape of microfinance, microcredit and financial inclusion and their impact on the entrepreneurial development of small businesses or micro-businesses, considering social, economic and productive conditions. To this end, a bibliometric analysis and a systematic literature review are carried out based on the Business category journals classified from Q1 to Q4 by Scimago. Through the application of PRISMA and VOSviewer, bibliometric networks are constructed and mapped. Among the main findings, it is that micro-businesses mainly located in emerging countries have a significant relationship with women's empowerment and financial education.

Referencias

[1] Estrada D., y Hernandez-Rubio, A., Situación actual e impacto del microcrédito en Colombia. Banco de la República & Asociación Colombiana de Instituciones Microfinancieras (Asomicrofinanzas), Bogotá, Colombia, [online]. 2019. Accessed: Oct. 26, 2023. Available at: https://repositorio.banrep.gov.co/bitstream/handle/20.500.12134/9723/LBR_2019-07.pdf?sequence=8

[2] Patiño, O.A., Microcrédito historia y experiencias exitosas de su implementación en América Latina, Revista Escuela de Administración de Negocios, 63, pp. 41–58, 2008. DOI: https://doi.org/10.21158/01208160.n63.2008.442.

[3] Internacional Finance Corporation (IFC), IFC’s Definitions of Targeted Sectors, MSME. [Online]. Accessed: Jul. 19, 2024. Available at: https://www.ifc.org/en/what-we-do/sector-expertise/financial-institutions/definitions-of-targeted-sectors#:~:text=MSME,relevant%20MSME%20loan%20size%20proxy.

[4] Garson, J., Microfinance and anti-poverty strategies: a donor perspective. UN Capital Development Fund, New York, USA, [Online]. 1997. Accessed: Aug. 14, 2023. Available at: https://digitallibrary.un.org/record/1486898

[5] Aagaard, P., The global institutionalization of microcredit, Regul Gov, 5(4), pp. 465–479, 2011. DOI: https://doi.org/10.1111/j.1748-5991.2011.01111.x.

[6] Morduch, J., The microfinance promise, J Econ Lit, 37(4), pp. 1569–1614, 1999. DOI: https://doi.org/10.1257/jel.37.4.1569.

[7] Lee, W., Character-based lending for micro business development: empirical insights into conceptualizing character, Journal of Small Business & Entrepreneurship, 34(6), pp. 645–660, 2019. DOI: https://doi.org/10.1080/08276331.2019.1701256.

[8] Terberger, E., and Winkler, A., Microfinance and development: policy perspectives, in: Handbook of Development Policy, Zafarullah, H., and Huque, A.S., Eds., Edward Elgar Publishing, Cheltenham, UK, 2021, pp. 271–282. DOI: https://doi.org/10.4337/9781839100871.00031.

[9] Marban-Flores, R., Análisis comparativo entre los programas de microfinanzas desarrolladas e implantadas en el Grameen Bank (en Bangladesh) y la línea de microcrédito del Instituto de Crédito de Oficial (en España), in: IX Reunión de Economía Mundial, Madrid, [Online]. 2007. Accessed: Sep. 19, 2023. Available at: https://www.findevgateway.org/sites/default/files/publications/files/mfg-es-documento-analisis-comparativo-entre-los-programas-de-microfinanzas-desarrolladas-e-implantadas-en-grameen-bank-y-la-linea-de-microcredito-del-instituto-de-credito-oficial-4-2007.pdf

[10] Yunus, M., Dalsace, F., Menascé, D., and Faivre-Tavignot, B., Reaching the rich world’s poorest consumers, Harvard Business Review, [Online]. 2015. Accessed: Jan. 19, 2024. Available at: https://hbr.org/2015/03/reaching-the-rich-worlds-poorest-consumers

[11] Banco Mundial, Inclusión financiera, Overview. [Online]. Accessed: Jul. 24, 2024. Available at: https://www.bancomundial.org/es/topic/financialinclusion/overview

[12] Das, A., and Saha, A., Microfinance research in India during 2001–2021: a bibliometric analysis with its social impact using altmetrics, vision. The Journal of Business Perspective, 1(18), 2023. DOI: https://doi.org/10.1177/09722629231191308.

[13] Beg, K., Padmapriya, B., Shajar, S.N., Ahmad, Md.M., and Faiyyaz, A.G., The bibliometric analysis of previous twenty- five years’ literature: a microfinance review, Heliyon, 10(3), art. e24979, 2024. DOI: https://doi.org/10.1016/j.heliyon.2024.e24979.

[14] Gutiérrez-Nieto, B., and Serrano-Cinca, C., 20 years of research in microfinance: an information management approach. Int J Inf Manage, 47, pp. 183–197, 2019. DOI: https://doi.org/10.1016/j.ijinfomgt.2019.01.001.

[15] Britto, N., and Visano, B.S., Building community capacity: self-assessment performance metrics for Canadian microcredit programs, Canadian Journal of Program Evaluation, [Online]. 2017. Available at: https://ssrn.com/abstract=3087223

[16] Brau J.C., and G.M., Woller, microfinance: a comprehensive review of the existing literature. The Journal of Entrepreneurial Finance, 9(1), pp. 1–28, 2004. DOI: https://doi.org/10.57229/2373-1761.1074.

[17] Sauza-Ávila, B., Pérez-Castañeda, S.S., Cruz-Ramírez, D., Lechuga-Canto, C.B., González-Hernández, I.J., and Hernández-Bonilla, B.E., Revisión de la literatura de Educación Financiera en las PYMES, Ingenio y Conciencia Boletín Científico de la Escuela Superior Ciudad Sahagún, 9(18), pp. 30–35, 2022. DOI: https://doi.org/10.29057/escs.v9i18.8699.

[18] Duvendack, M., and Mader, P., Impact of financial inclusion in low- and middle-income countries: a systematic review of reviews, Campbell Systematic Reviews, 15(1–2), art. e1012, 2019. DOI: https://doi.org/10.4073/csr.2019.2.

[19] Niño, C., and Vásquez-Merchán, I.L., Seguridad ontológica en una nación ansiosa: un marco existencial de la seguridad colombiana, International and Multidisciplinary Journal of Social Sciences, 12(2), pp. 213–238, 2023. DOI: https://doi.org/10.17583/rimcis.12095.

[20] Carvajal-Villamizar, J.A., Mejía Azuero, J.C., and Bermúdez-Tapia, M., Geopolitics in a zone of influence due to the conflict between Russia and Ukraine, Novum Jus, 18(1), pp. 89–126, 2024. DOI: https://doi.org/10.14718/NovumJus.2024.18.1.4.

[21] Rojas-Mora, J.E., Pinto-Quijano, Á.C., Vásquez-Merchán, I.L., y Morales-Sánchez, C.F., Medición y evaluación de gobernanzas criminales y su relación con el narcotráfico en Colombia. Revista Científica General José María Córdova, 21(44), pp. 817–840, 2023. DOI: https://doi.org/10.21830/19006586.1176.

[22] Navas-Camargo, F.J., Bermúdez-Guerrero, J.A., y Garay-Acevedo, C.P., Puntos de acción desde la migración en el marco de la seguridad y defensa nacional, Novum Jus, 17(3), pp. 237–265, 2023. DOI: https://doi.org/10.14718/NovumJus.2023.17.3.9.

[23] López-Rodríguez, C.E., and López-Ordoñez, D.A., Financial education in Colombia: challenges from the perception of its population with socioeconomic vulnerability, Economics & Sociology, 15(1), pp. 193–204, 2022. DOI: https://doi.org/10.14254/2071-789X.2022/15-1/12.

[24] Sang, N.M., Analyzing publication trend on microcredit research using bibliometrics approach, International Journal of Advanced and Applied Sciences, 9(2), pp. 1–8, 2022. DOI: https://doi.org/10.21833/ijaas.2022.02.001.

[25] Akter, S., Uddin, M.H., and Tajuddin, A.H., Knowledge mapping of microfinance performance research: a bibliometric analysis. Int J Soc Econ, 48(3), pp. 399–418, 2021. DOI: https://doi.org/10.1108/IJSE-08-2020-0545.

[26] Zaby, S., Science mapping of the global knowledge base on microfinance: influential authors and documents, 1989–2019. Sustainability, 11(14), art. 3883, 2019. DOI: https://doi.org/10.3390/su11143883.

[27] Bhatt, A., Joshipura, M., and Joshipura, N., Decoding the trinity of fintech, digitalization and financial services: an integrated bibliometric analysis and thematic literature review approach, Cogent Economics & Finance, 10(1), art. 2114160, 2022. DOI: https://doi.org/10.1080/23322039.2022.2114160.

[28] Chhatoi, B.P., Sahoo, S.P., and Nayak, D.P., Assessing the academic journey of ‘Financial Inclusion’ from 2000 to 2020 through bibliometric analysis. Journal of Scientometric Research, 10(2), pp. 148–159, 2021. DOI: https://doi.org/10.5530/jscires.10.2.29.

[29] Gálvez-Sánchez, F.J., Lara-Rubio, J., Verdú-Jóver, A.J., and Meseguer-Sánchez, V., Research advances on financial inclusion: a bibliometric analysis, Sustainability, 13(6), 2021. DOI: https://doi.org/10.3390/su13063156.

[30] Woolcott-Oyague, O., y Ramírez-Gómez, E.R., La asimetría informativa y el caso del consumidor financiero, Novum Jus, 18(1), pp. 17–41, 2024. DOI: https://doi.org/10.14718/NovumJus.2024.18.1.1.

[31] Paul, J., and Criado, A.R., The art of writing literature review: What do we know and what do we need to know?, International Business Review, 29(4), art. 101717, 2020. DOI: https://doi.org/10.1016/j.ibusrev.2020.101717.

[32] Coughlan, M., Cronin, P., and Ryan, F., Doing a literature review in nursing, health and social care. Sage Publications, Londres, UK, 2013.

[33] Urrútia, G., y Bonfill, X., Declaración PRISMA: una propuesta para mejorar la publicación de revisiones sistemáticas y metaanálisis, Med Clin (Barc), 135(11), pp. 507–511, 2010. DOI: https://doi.org/10.1016/j.medcli.2010.01.015.

[34] Page et al., M.J., The PRISMA 2020 statement: an updated guideline for reporting systematic reviews, BMJ, 372(71), art. 2021. DOI: https://doi.org/10.1136/bmj.n71

[35] Ramírez-Montoya, M.-S., and García-Peñalvo, F.-J., Co-creation and open innovation: systematic literature review, Comunicar, 26(54), pp. 09–18, 2018. DOI: https://doi.org/10.3916/C54-2018-01.

[36] Kitchenham, B., Procedures for performing systematic reviews, Keele, Staffs, [Online]. 2004. Accessed: Jun. 06, 2023. Available at: https://www.inf.ufsc.br/~aldo.vw/kitchenham.pdf

[37] Higgins, J.P., and Green, S., Cochrane Handbook for systematic reviews of interventions. Cochrane Book Series. Wiley, 2008. DOI: https://doi.org/10.1002/9780470712184.

[38] Centre for Reviews and Dissemination, Systematic Reviews. CRD’s guidance for undertaking reviews in health care, 3rd ed., Centre for Reviews and Dissemination, University of York, York, UK, 2009.

[39] Hiebl, M.R.W., Sample selection in systematic literature reviews of management research, Organ Res Methods, 26(2), pp. 229–261, 2021. DOI: https://doi.org/10.1177/1094428120986851.

[40] Hirsch, J.E., Does the h index have predictive power?, Proceedings of the National Academy of Sciences, 104(49), pp. 19193–19198, 2007. DOI: https://doi.org/10.1073/pnas.0707962104.

[41] Luciano-Alipio, R.A., Sotomayor-Chahuaylla, J.A., García-Juárez, H.D., and Peláez-Camacho, H.Y., Business management in the development of MYPES in mining areas of Peru, Revista Venezolana de Gerencia, 28(103), pp. 1174–1189, 2023. DOI: https://doi.org/10.52080/rvgluz.28.103.16.

[42] Urueña-Mejía, J.C., Gutierrez, L.H., and Rodríguez-Lesmes, P., Financial inclusion and business practices of microbusiness in Colombia, Eurasian Business Review, 13(2), pp. 465–494, 2023. DOI: https://doi.org/10.1007/s40821-022-00231-2.

[43] Tia, J., Kuunibe, N., and Nkegbe, P.K., Drivers of financial inclusion in Ghana: evidence from microentrepreneurs in the Wa Municipality of the Upper West Region, Cogent Economics & Finance, 11(2), art. 2267854, 2023. DOI: https://doi.org/10.1080/23322039.2023.2267854.

[44] Ramli, A., and Zain, R.M., Does microcredit benefit microbusinesses? Lessons from microcredit agencies in Malaysia, WSEAS Transactions on Business and Economics, 20, pp. 236–248, 2023. DOI: https://doi.org/10.37394/23207.2023.20.23.

[45] Bharti, N., and Kumari, S., Regional Rural Banks (RRBs) contribution to agriculture finance: a critical analysis of the performance of RRBs in India using DEA and structure equation modeling, Australasian Business, Accounting and Finance Journal, 16(5), pp. 154–169, 2022. DOI: https://doi.org/10.14453/aabfj.v16i5.10.

[46] Malik, K., Meki, M., Morduch, J., Ogden, T., Quinn, S., and Said, F., COVID-19 and the future of microfinance: evidence and insights from Pakistan, Oxf Rev Econ Policy, 36(Supplement_1), pp. S138–S168, 2020. DOI: https://doi.org/10.1093/oxrep/graa014.

[47] Atmadja, A.S., Sharma, P., and Su, J.J., Microfinance and microenterprise performance in Indonesia: an extended and updated survey, Int J Soc Econ, 45(6), pp. 957–972, 2018. DOI: https://doi.org/10.1108/IJSE-02-2017-0031.

[48] Mishra, M., and Karunanithi, G., The Roma response to development strategies: a replicate model for collective action and inclusive development in a Hungarian village, Society and Economy Soc Ec, 39(1), pp. 65–84, 2017. DOI: https://doi.org/10.1556/204.2016.003.

[49] Karlan, D., Osman, A., and Zinman, J., Follow the money not the cash: comparing methods for identifying consumption and investment responses to a liquidity shock, J Dev Econ, 121, pp. 11–23, 2016. DOI: https://doi.org/10.1016/j.jdeveco.2015.10.009.

[50] Atmadja, A.S., Su, J.J., and Sharma, P., Examining the impact of microfinance on microenterprise performance (implications for women-owned microenterprises in Indonesia), Int J Soc Econ, 43(10), pp. 962–981, 2016. DOI: https://doi.org/10.1108/IJSE-08-2014-0158.

[51] Hassan, S., Alam, M.M., and Rahman, R.A., An estimation of market size for microfinance: study on the urban microentrepreneurs in Selangor, Malaysia, Asian Soc Sci, 11(27), pp. 269–274, 2015. DOI: https://doi.org/10.5539/ass.v11n27p269.

[52] Alam, M.M., Hassan, S., and Said, J., Performance of Islamic microcredit in perspective of Maqasid Al-Shariah: a case study on Amanah Ikhtiar Malaysia, Humanomics, 31(4), pp. 374–384, 2015. DOI: https://doi.org/10.1108/H-12-2014-0072.

[53] Mokhtar, S.H., and Ashhari, Z.M., Issues and challenges of microcredit programmes in Malaysia, Asian Soc Sci, 11(26), pp. 191–195, 2015. DOI: https://doi.org/10.5539/ass.v11n26p191.

[54] Alam, M.M., and Molla, R.I., The limitations of microcredit for promoting microenterprises in Bangladesh, Economic Annals, 57(192), pp. 41–53, 2012. DOI: https://doi.org/10.2298/EKA1292041A.

[55] Al-Mamun, A., Adaikalam, J., and Mazumder, M.N.H., Examining the effect of amanah ikhtiar Malaysia’s microcredit program on microenterprise assets in rural Malaysia, Asian Soc Sci, 8(4), pp. 272–280, 2012. DOI: https://doi.org/10.5539/ass.v8n4p272.

[56] Banco Mundial, Financiacion de pequeñas y medianas empresas (Pyme), SME Finance. [Online]. Accessed: Aug. 26, 2024. Available at: https://www.worldbank.org/en/topic/smefinance

[57] Foro Económico Mundial, Tecnología Financiera (Fintech), Videos. [Online]. Accessed: Jun. 26, 2024. Available at: https://www.weforum.org/videos/fintech-growing/

[58] Kandie, D., and Islam, K.J., A new era of microfinance: the digital microcredit and its impact on poverty, J Int Dev, 34(3), pp. 469–492, 2022. DOI: https://doi.org/10.1002/jid.3607.

[59] Fundación Española para la Ciencia y la Tecnología (FECYT), Scopus, Research Intelligence. [Online]. Accessed: Aug. 26, 2023. Available at: https://www.recursoscientificos.fecyt.es/sites/default/files/scopus_octubre_2022.pdf

[60] Sjöberg-Tapia, Ó., Oyarzún Lillo, F., Ganga, F., and Cadamuro Inostroza, I.O.R., Justicia organizacional y resultados empresariales. Estudio comparativo en pequeñas y medianas empresas de Chile y Perú, Novum Jus, 16(3), pp. 315–337, 2022. DOI: https://doi.org/10.14718/NovumJus.2022.16.3.12.

Cómo citar

IEEE

ACM

ACS

APA

ABNT

Chicago

Harvard

MLA

Turabian

Vancouver

Descargar cita

Licencia

Derechos de autor 2025 DYNA

Esta obra está bajo una licencia internacional Creative Commons Atribución-NoComercial-SinDerivadas 4.0.

El autor o autores de un artículo aceptado para publicación en cualquiera de las revistas editadas por la facultad de Minas cederán la totalidad de los derechos patrimoniales a la Universidad Nacional de Colombia de manera gratuita, dentro de los cuáles se incluyen: el derecho a editar, publicar, reproducir y distribuir tanto en medios impresos como digitales, además de incluir en artículo en índices internacionales y/o bases de datos, de igual manera, se faculta a la editorial para utilizar las imágenes, tablas y/o cualquier material gráfico presentado en el artículo para el diseño de carátulas o posters de la misma revista.