Using the MACBETH Method to improve the scenario analysis tool PESTEL in large civil construction projects

Usando el Método MACBETH para mejorar la herramienta de análisis de escenarios PESTEL en grandes proyectos de construcción civil

DOI:

https://doi.org/10.15446/dyna.v84n203.65359Palabras clave:

Decision-making, multicriteria, civil engineering projects (en)Toma de decisiones, multicriterios, proyectos de ingeniería civil (es)

Descargas

Recibido: 5 de mayo de 2017; Revisión recibida: 27 de octubre de 2017; Aceptado: 1 de noviembre de 2017

Abstract

The paper presents a methodological study performing a prioritization of the PESTEL analysis factors on the pre-construction and assembly environments of large civil engineering projects. The objective is to test if it is possible to use the decision making support methodology MACBETH to generate a hierarchy scale among criteria that might behave as a Pareto distribution. According to an expert choice, four of the ten alternatives represent 72.16% of the preference of the consulted expert. The answer does not represent a Pareto distribution, but does not invalidate the hypothesis. It is possible that the judgment of some specialist comes closer to such a phenomenon.

Keywords:

Decision-making, multicriteria, civil engineering projects..Resumen

El artículo presenta un estudio metodológico que realiza una priorización de los factores de análisis PESTEL en los entornos de pre-construcción y montaje de grandes proyectos de ingeniería civil. El objetivo es comprobar si es posible utilizar la metodología de apoyo a la toma de decisiones MACBETH para generar una escala de jerarquía entre los criterios que podrían comportarse como una distribución de Pareto. Según una elección de un experto, cuatro de las diez alternativas representan 72,16% de la preferencia del experto consultado. La respuesta no representa una distribución de Pareto, pero no invalida la hipótesis. Es posible que el juicio de algún especialista se acerque a tal fenómeno.

Palabras clave:

Toma de decisiones, multicriterios, proyectos de ingeniería civil..1. Introduction

The present paper has as its main feature being a methodological study aiming at, from the Macbeth method of decision making developed by [1], performing a prioritization of the PESTEL analysis factors on the pre-construction and assembly environments of large civil engineering projects. In this sense, the main hypothesis is that the Macbeth method must be able to generate a Pareto distribution [2] where there are "few, but of great importance" and "many, but of little importance" factors.

The instability revealed in a crisis situation in institutions always allows a reflection on the impacts of any actions on the most varied fronts. In the case of large civil engineering projects, this reflection must be elaborated collectively and with the greatest methodological severity, because of the volume required for their application, as well as their impacts.

Concerning such civil engineering projects, a literature review allows identifying that this area, throughout the years, has absorbed management concepts in order to improve the quality and rationalize the execution on the construction sites. However, depending on the magnitude of certain projects, more management elements may be required, mainly concerning planning and decision-making.

Projects which demand a long-term execution and which are indivisible such as the construction of refineries, hydropower and nuclear plants are normally finalized with external scenarios significantly different from those at the beginning. These infrastructure constructions are part of the agenda mainly on the BRICS countries, due to the necessity of growth and the opportunity emerged with the creation of the BRICS bank, which in its first resources release, in 2016, issued a total amount of US$ 811 million, for renewable energy projects in four of its member countries [3].

A research done by consultant Grant Thornton International revealed that the lack of investments in infrastructure in emerging countries such as the BRICS or in Latin American countries is the greatest challenge faced by entrepreneurs. According to the study, 45% of the companies in these countries mention the transport infrastructure as the greatest impairment to growth [4]. For instance, the construction of the Petrochemical Complex of Rio de Janeiro (Complexo Petroquímico do Estado do Rio de Janeiro - COMPERJ) is highlighted. The aforementioned construction started in March 2008 to be concluded in September 2012. After several schedule revisions, caused by externalities unpredicted in the initial project, it is estimated that the conclusion will occur in 2023 [5] - that is, if the current crisis in Brazil doesn't postpone this deadline once again.

Despite that, the high complexity of the construction works which involve the mentioned infrastructure projects demands a corresponding effort concerning the planning and the decision making - that is, a wide data survey and information processing. [6], on a seminal text on the multi-criteria methodologies for supporting decision making enumerate three axioms about the creation of criteria for the decision making: (i) exhaustibility (ii) cohesion; (iii) non-redundancy. It is expected that the decision makers, as they try to achieve exhaustibility when searching a set of criteria, find out that several of those are redundant. Thus, there must be a balance effect when one observes the axioms (i) and (iii). On the other hand, it is precisely the characteristic of projects that the present paper proposes to discuss which worries the authors: in studies of such a magnitude (complex, expensive and with high risks) the commitment to perform a exhaustive planning may be translated into a significant amount of judgment criteria, ignoring the third axiom.

The objective of the present paper is to test if it is possible to use the decision making support methodology MACBETH [1] to generate a hierarchy scale among criteria that might behave as a Pareto distribution. To this end, we have chosen to perform this study only with the economic dimension of the PESTEL tool (described in the next section). The choice, even though arbitrary, may be justified due to the fact that the economic studies have been under academic and empirical debate since 1776, following the publication of the book "The Wealth of Nations" by Adam Smith. Besides, the literature concerning investments assessment - commonly used for studies of feasibility of such projects - is prominently economic, based on traditional tools such as: Internal Rate of Return, Net Present Value and Payback Period.

2. PESTEL analysis

Being careful with the corporate strategy and the efficacy of project planning has been the main idea for value generation in the economic activities. However, the precision to build efficient management mechanisms while capable of boosting the strategies in the long term must be highlighted. In face of such an obstacle, the need to ponder the environments where the companies are found inserted is revealed, as well as establishing strategies compatible to the prospection of scenarios for the activity. It is also vital to survey the environmental aspects based on performance indicators, highlighting that they must be in line with the proposed methodology in order to make the decision making effective.

Surveys on this topic point towards supporting the decision making related to the strategic planning through two fundamental tools: SWOT and PESTEL analyses. [7] assembles a panel where the models PESTEL and SWOT indicate the panorama for the company and the strategic positioning likely to be taken. This environment has the possibility of finding elements that allow the assessment of which actions should be taken and positioning the company for the decision making, aiming at inferring which strategies may be used in their planning.

According to [8] the PESTEL analysis arose from the necessity of seeing the external environment of the organizations, in order to exhibit the threats and opportunities surrounding them, involved in several perspectives. The analysis serves to demonstrate several macro environmental factors in order to make it possible to understand the company's market position and orientate it for future organizational strategies. [7] concluded that the companies in general are affected by six macro environmental forces related to exogenous factors; being them: (P)political, (E)economic, (S)social, (T)technological, (E)environmental and (L)legal. The fundamental feature of these forces is that they are not under control of the organizations. Aiming at performing a macro environmental and sectoral diagnosis for the prospection of engineering scenarios, a qualitative approach of exploratory and descriptive natures was used. The management tools used for such a prospection were: PESTEL analysis and the decision making aid method Macbeth.

Thus, it is inherently necessary to create conditions for the organization to become effective in its decision process in face of the opportunities and threats related to the organizational environment. This paper enhances the economic factor in the scenario of civil construction projects. But, we may also include and prioritize several sub-criteria, as demonstrated in Fig. 1. In this manner, the methodology becomes an ideal tool in project management and monitoring processes, which may be used together with Delphi methods that use the consensus of opinions of a set of specialists about future occurrences.

However, despite offering the basic elements for a strategic analysis of scenarios, the texts that deal with the PESTEL tool do not offer a consensus about the subdivisions of each one of the six macro environmental forces. In this case, it is up to the executor of the planning project to define which elements shall be included in each one of them.

Figure 1: Objective function

3. PESTEL analysis

A great number of current decisions involve economic-financial matters, having as fundamental base strictly quantitative aspects, translated into monetary values, distributed in periodic cash flows properly discounted by arbitrary fees. However, the decision theory expects such choices to be based on other qualitative aspects, not less important than the previous ones and which translate the nebulous environment that, as a general rule, is not internalized in the analysis. Such a circumstance may come to constitute a determinant source of failure or of inconsistency of a project yet to be chosen based on strictly quantitative criteria, for instance, in the case of a hydropower plant which would demand the flooding of an indigenous land to be built; how to price the environmental losses caused?

It is necessary to develop methodologies that may comprise quantitative and qualitative criteria at the same time, that is, where the decision maker may insert aspects connected to the business environment and political and behavioral scenarios.

The sophistication of decision models occurred when operational research emerged. The so-called Multi-Criteria Decisions - MCDA originated from this science, and form a set of techniques which aim at investigating a number of alternatives, considering multiple conflicting criteria and objectives [9]. Authors [10] highlight also that they allow a more efficient and realistic solution for complex problems which comprise several scenarios, players and criteria (tangible and intangible).

In the early 1970's, a conference was held in the University of South Carolina (USA) about the topic which, according to [11], began to take shape and organize itself in a "scientific community, formerly disperse, interested on mastering multi-criteria". The meeting Euro Working Group on multi-criteria Aid for Decisions was organized in 1975 in Brussels alongside with a conference which later formed the “International Society on Multiple Criteria Decision Making”. These two meetings are the origin of the two schools: the perspective decision making of the American school of multi-attribute utility and the current "aide à la décision" of the French school. Authors [12] state that the "French school is based in prevalence relationships" where the ELECTRE and PROMETHEE family methods are enhanced and the American school "reduces the several criteria to a summary criterion through a weighted sum in most of the cases. They also highlight the following methods: MAH, TODIM, MACBETH and UTA for the American school.

The MACBETH method aims at finding the cardinal and ordinal relationships amongst the criteria which determine the target. Similar to the economic analysis, it is expected that the obtained results have a logical consistency, that is, keep rationality. The software used for treatment of the model (M-MACBETH) verifies automatically the consistency, suggesting adjustments when inconsistencies are identified. This verification grants the rationality of the model, therefore, when the method is validated, the scientific criterion is ensured [13].

The cardinal scales generated translate the interviewees’ opinions into distributions which may be transformed into percentages which indicate the order of preference among the alternatives, as well as the degree of such a preference, as highlights [14].

The next section intends to describe the methodological proposal as well as the Macbeth tool. Thus, it will be possible to demonstrate the cardinal scale generated through the submission of the responses of an energy specialist to the method.

4. Equations

The research was structured as follows:

-

Bibliographic review: The content base Web of Science was used for the bibliographic review stage. For such, reference terms about the PESTEL analysis and multi-criteria methodologies of decision making were searched aiming at finding, according to quotation indexes, seminal articles and/ or articles related to the theme to which the research was applied. Some of the selected references were used to write the literature revision.

-

As a second reference source, a survey was conducted in the Thesis and Dissertation Bank from COPPE - Alberto Luiz Coimbra Institute for Graduate Studies and Research in Engineering of the Federal University of Rio de Janeiro. Besides searching for recent academic studies on the theme, this second research aimed at identifying experts in the oil business to respond to inquiries from the present study, since the aforementioned institution congregates courses related to Oil Engineering, the Laboratory for the Analysis of Bio fuels and Oil Compounds from the Oil Chemical Program (Institute of Chemistry), besides the PETROBRAS Research Center.

-

Model and hypothesis design: after making an effort towards surveying alternative methodologies of decision making, the Macbeth method was established as the most suitable for the present methodological study.

-

Empirical study locus definition: among the several thesis and articles researched, the work by [8] was selected since it is a work that focuses the petrochemical industry, which needs infrastructure works with a complexity compatible to the present methodological proposal.

-

Identification of an expert and submission of his convictions to the method, as it will be shown next.

-

Returning to the objective of the present article, it comprises the generation of a new objective function from MACBETH whose results of the judged prioritizations shall be a cardinal scale of the sub-factors (subdivisions) of the PESTEL tool that works as an efficient Pareto distribution [2], or a similar curve. In this sense, the planning force would be concentrated only on the elements which represent the greatest degree of importance for each of the ten factors.

As demonstrated in item 2, the PESTEL tool does not offer predetermined subdivisions. In this case, in order to validate the method, we found support on the Doctoral Thesis by [8] which, validating criteria inherent to the oil industry supply chain, used the following sub-factors (subdivisions) PESTEL, Fig. 1.

It is important to point out that the effort in the thesis by [8] in expanding the most the PESTEL factors may generate redundancies among the items to be assessed. Another crucial problem concerns the concept of limited rationality described by [15]. In this case, the marginal gain obtained by the increase of an item of analysis may not justify the increase on the cost of judgment.

Thus, following the accessibility criteria, a structured interview was conducted with an oil expert from the Federal University of Rio de Janeiro to obtain criteria to order the actions, following the MACBETH method. The interviewee has over 15 years of experience in fundraising, management and follow-up of basic and executive engineering projects. The experience is necessary to ensure that the professional knows how to value the multidisciplinary approach, considering the entire chain of the business and the different demands from stakeholders, with an ability to minimize risks and continuously improve productivity.

To validate the methodological proposal, only the process of prioritization of the economic sub-factors used by [8] will be detailed. For that matter, the authors are able to detail more thoroughly the methodological proposal.

It has been suggested that the collaborator should generate an ordinal prioritization of every PESTEL sub-criteria as a way of generating a result to be used as a control for the result of the prioritization generated by Macbeth.

After being submitted to such a process, the collaborator ended up with the following framework (Fig. 2):

Figure 2: Economic Sub-factors

The ordinal scale offers a sight of the importance of the sub-factors, but it does not present solutions of mathematical treatments that may be used as a Pareto distribution [2].

MACBETH is based on the establishment of matched-pair comparisons among criteria/attributes considering the objective and subjective features, according to an absolute scale of values. In order to compare the alternatives, the decision maker must judge, in the light of each specific criterion, which is the best alternative and how much better it is according to the following options: indifferent alternatives, very weak difference, weak, moderate, strong, very strong or extreme.

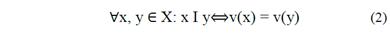

In practical terms, in order to make it possible to ordinarily measure the attractiveness of options x of a finite set X, it is necessary to associate to each x a real number v(x) which satisfies the conditions: of strict preference (eq. 1) and of indifference (eq. 2).

In order to avoid possible inconsistencies, typical of aggregation of ordinations done separately of each criterion (Arrow's Theorem [16]), it is possible to obtain cardinal information from the decision maker, in such a way that it also meets the additional condition (eq. 3).

with x more attractive than y and w more attractive than z: so the ratio (v(x)-v(y))/(v(w)-v(z)) measures the difference in attractiveness between x and y when the difference in attractiveness between w and z is the measurement unit.

Taking into consideration such conditions, a numerical scale of intervals is established (v: X → R: x → v(x)). In MACBETH, the transition from ordinal information to cardinal information is done comparing the options to the pairs in a qualitative way [17].

On the software which implements the model (M-MACBETH), as the assessments are inserted in the judgment matrix, the consistency is automatically verified, and when there is some inconsistency, possible solutions are indicated.

From the judgment matrix, MACBETH proposes a score for each option which composes the numerical scale of the method. Be the difference the categories which differ the attractiveness (Ck) with k =0, ..., 6, which corresponds to “null” (Co), “very weak” (C1), “weak” (C2), “moderate” (C3), “strong” (C4), “very strong” (C5) and “extreme” (C6). Furthermore, Andrade, Andrade and Mello [18] highlight that, if v(a+) and v(a-) are, respectively, the greater and lesser scores among the options, the base MACBETH scale may be found resolving the following linear programming problem:

The chart presents an "alternative" represented in light blue entitled “tudo inf.” - “everything inferior”. In some judgments, MACBETH also generates other alternative called “tudo sup.” - “everything superior” (Fig. 3). It is worth pointing out that such maneuvers are, actually, representative alternatives (the reason for the quotation marks) and must not suffer direct comparisons with the criteria or alternatives considered. In this case, it has been chosen not to do any judgments, only indicating that the alternatives of the present study were all superior to this representative alternative (as observed in the mentioned column).

Figure 3: The decision matrix of the collaborator

5. Final considerations

Considering the objective of the present study, that is, to perform from Macbeth model a prioritization of the factors in the PESTEL analysis of the pre-construction and assembly environments of large civil engineering projects, we may consider that it has been achieved in section 4 of the present paper.

According to the results, it is also possible to verify the main hypothesis that the Macbeth model should be able to generate a Pareto distribution (Rule 80/20), in which there are "few, but of great importance" and "many, but of little importance" factors. The application of the methodology demonstrated that four of the ten alternatives represent 72.16% of the preference of the consulted expert. The answer does not represent a Pareto distribution, but does not invalidate the hypothesis. It is possible that the judgment of some specialist comes closer to such a phenomenon.

Concerning the present paper, the distribution obtained behaves as a descending branch of a parable. This demonstrates the superiority of the first four alternatives in relation to the others.

It can be thus verified that, in face of the researches performed, the use of Macbeth may be an admirable instrument to aid the decision making in the process of complex scenarios assessment, where the manager tends to search the mitigation of the risk on the development of a comprising model, thus creating as many alternatives or criteria as possible. This matter finds a wide debate on the discussions of the multi-criteria models of decision making, as clarified in Roy's axioms of exhaustibility, cohesion and non-redundancy [19].

The purpose of the present study was to demonstrate that the complex scenario of civil engineering constructions, mainly those connected to great projects such as those employed in the oil industry, requires from the manager a more demanding level of analysis, which can nonetheless be simplified. This is derived from the incorporation of management concepts, particularly related to decision making that the civil engineering field has experienced over the last years.

Thus, countries which still lack this kind of projects, such as BRICS, may benefit greatly from tools which collaborate to maximize the efforts with no compromise of the risks.

As a way of fomenting new studies, it is proposed the generation of final matrices from a group of specialists involved in large construction projects and use the results as a panel in a wide debate aiming at creating some kind of "key factors" or "crucial weighting" for this type of project. In this case, of course, it will be necessary to develop sample selection methods thorough enough, as well as relativize the results obtained for the site where the study shall take place, as well as for a specific time period.

Finally, it is convenient to highlight that a reassessment of methodologies and criteria/alternatives must be done along time, for the relative importance of the factors may be altered. For example, the drop on the real interest rate of 6% per year to 2% per year as claimed by the current Brazilian government may turn it into something a lot less important than it is today.

References

Referencias

Bana e Costa, C.A. e Vansnick, J.C., Uma nova abordagem ao problema de construção de uma função de valor cardinal: MACBETH. Investigação operacional, 15, pp. 15-35, 1995.

Houthakker, H.S., The Pareto distribution and the Cobb-Douglas production function in activity analysis. The Review of Economic Studies, 23(1), pp. 27-31, 1955. DOI: 10.2307/2296148

Ians. India to get $250 million for renewables from BRICS New Development Bank. The New Indian Press, Business. April 15th 2016.

Campos, A. e Rodrigues, M., Infraestrutura é maior desafio no Bric, mostra pesquisa. Estado de São Paulo, Caderno de Economia e Negócios. April 26th 2013.

Natario, G., Grupo reivindica retomada imediata das obras no COMPERJ. ALERJ – Assembléia Legislativa do Estado do Rio de Janeiro, [online]. Noticias. June 07th 2016. Available at: http://www.alerj.rj.gov.br/Visualizar/Noticia/38550?AspxAutoDetectCookieSupport=1

Roy, B. and Boyssou, D., Mèthodologie Multicritèred’ Aide à la Dècision. Economica, Paris, 1985.

Porter, M.E., Competitive strategy, Free Press, New York, 1980.

Fontanillas, C.N., Uma análise da cadeia produtiva do petróleo a partir da aplicação do método AHP/FUZZY ao modelo PESTAL sob a ótica dos experts do petróleo, PhD. Thesis, Department of Production Engineering (COPPE-UFRJ), Rio de Janeiro, Brazil, 2016.

Gomes, E.G., Integração entre sistemas de informação geográfica e métodos multicritério no apoio à decisões parciais, M.S. Dissertation, Department of Production Engineering (COPPE-UFRJ), Rio de Janeiro, Brazil, 1999.

Cruz, E.P., Barreto, C.R. e Fontanillas, C.N., O processo decisório nas organizações, Intersaberes, Curitiba, Brasil, 2014.

Bana e Costa, C.A., Três convicções fundamentais na prática do apoio à decisão, Revista Pesquisa Operacional, 13(1), pp. 9-20, 1993.

Gomes, E.G., Lins, M.P.E. e Mello, J.C.C.B.S., de. Seleção do melhor município: Integração SIG-Multicritério, Revista Investigação Operacional, 22(1), pp. 59-85, 2002.

Cova, C.J.G., Execução orçamentária pública: Uma proposta de metodologia de tomada de decisão e avaliação de resultados, PhD. Thesis, Department of Production Engineering (COPPE-UFRJ), Rio de Janeiro, Brazil, 2000.

Cruz, E.P., Modelo multicritério e multidecisor para priorização de ações em Ciência, Tecnologia e Inovação: Um estudo no Fórum de Competitividade da Cadeia Produtiva da Indústria Farmacêutica, PhD. Thesis, Department of Chemical Engineering (UFRJ), Rio de Janeiro, Brazil, 2007.

Simon, H.A., Administrative behavior, New York: Free Press, 1965.

Arrow, K.J., Social Choice and individual values, New York, Wiley, 1951.

Bana e Costa, C.A., Angulo-Meza, L. e Oliveira, M.D., O método Macbeth e aplicação no Brasil, Engevista, 15(1), pp. 3-27, 2013.

Andrade, G.N. et al., Evaluation of power plants technologies using multi-criteria methodology Macbeth, IEEE Latin America Transactions, 14(1), pp. 188-198, 2016. DOI: 10.1109/TLA.2016.7430079

Roy, B., The outranking approach and the foundations of Electre methods, Theory and decision, 31(1), pp. 49-73, 1991. DOI: 10.1007/BF00134132

Cómo citar

IEEE

ACM

ACS

APA

ABNT

Chicago

Harvard

MLA

Turabian

Vancouver

Descargar cita

Licencia

Derechos de autor 2017 DYNA

Esta obra está bajo una licencia internacional Creative Commons Atribución-NoComercial-SinDerivadas 4.0.

El autor o autores de un artículo aceptado para publicación en cualquiera de las revistas editadas por la facultad de Minas cederán la totalidad de los derechos patrimoniales a la Universidad Nacional de Colombia de manera gratuita, dentro de los cuáles se incluyen: el derecho a editar, publicar, reproducir y distribuir tanto en medios impresos como digitales, además de incluir en artículo en índices internacionales y/o bases de datos, de igual manera, se faculta a la editorial para utilizar las imágenes, tablas y/o cualquier material gráfico presentado en el artículo para el diseño de carátulas o posters de la misma revista.