Colombian ADR´s: Why so few?

Palabras clave:

gobierno corporativo, AD R, desarrollo económico y financiero, conflicto interno. (es)colombianas han tenido una presencia limitada en el mercado de

los American Depositary Receipts (AD Rs). Explicaciones tradicionales sustentan

que una débil protección al inversionista y el grado de desarrollo

económico y financiero de los países incrementan el costo de entrar en el

mercado de AD R. Sin embargo, en el caso de Colombia estas explicaciones

no son suficientes porque su situación no difiere de manera significativa

con respecto a otros países latinoamericanos. Utilizando un modelo

teórico, en este artículo se afirma que factores como el narcotráfico y el

conflicto armado explican mejor por qué las empresas colombianas se han

apartado del mercado de AD R.

Maximiliano González*, Alexander Guzmán** & María Andrea Trujillo***

*Associate professor, School of Management, Universidad de los Andes, Bogotá, Colombia. E-mail: mgf@adm.uniandes.edu.co

** Titular professor, Colegio de Estudios Superiores de Administración - CESA, and is associate researcher, School of Management, Universidad de los Andes, Bogotá, Colombia. E-mail: ale-guzm@uniandes.edu.co

*** Titular professor, Colegio de Estudios Superiores de Administración - CESA, and is associate researcher, School of Management, Universidad de los Andes, Bogotá, Colombia. E-mail: ma.trujillo53@uniandes.edu.co

Submitted: June 2010 Accepted: September 2011

Abstract :

We address the question of why Colombian companies have had such a limited presence in the American Depositary Receipts (ADRs) market. Traditional explanations state that weak investor protection and the degree of economic and financial development in Colombia increase the cost of entry in the ADR market. However, in the case of Colombia these explanations do not suffice because in these respects Colombia is no different from other Latin American countries. Using a theoretical model, we show that additional factors such as drug trafficking and armed conflict better explain why Colombian firms have moved away from the ADRs market.

Keywords:

Corporate governance, ADRs, economic and financial development, internal conflict.

Resumen:

Los autores abordan el cuestionamiento de por qué las empresas colombianas han tenido una presencia limitada en el mercado de los American Depositary Receipts (ADRs). Explicaciones tradicionales sustentan que una débil protección al inversionista y el grado de desarrollo económico y financiero de los países incrementan el costo de entrar en el mercado de ADR. Sin embargo, en el caso de Colombia estas explicaciones no son suficientes porque su situación no difiere de manera significativa con respecto a otros países latinoamericanos. Utilizando un modelo teórico, en este artículo se afirma que factores como el narcotráfico y el conflicto armado explican mejor por qué las empresas colombianas se han apartado del mercado de ADR.

Palabras clave:

gobierno corporativo, ADR, desarrollo económico y financiero, conflicto interno.

Résumé:

Les auteurs se posent la question de la présence limitée des entreprises colombiennes sur le marché des American Depositary Receipts (ADRs). Il est traditionnellement expliqué qu'une faible protection de l'investisseur et le degré de développement économique et financier des pays augmentent le coût d'entrée sur le marché des ADRs. Cependant, ces explications se révèlent insuffisantes pour le cas de la Colombie qui, pour ces aspects, ne diffère pas de façon significative par rapport à d'autres pays latino-américains. Utilisant un modèle théorique, l'article affirme que certains facteurs additionnels tels que le trafic de stupéfiants et le conflit armé expliquent mieux les raisons pour lesquelles les entreprises colombiennes se sont écartées du marché des ADRs.

Mots-clefs :

gouvernement corporatif, ADRs, développement économique et financier, conflit interne.

Resumo:

Os autores abordam o questionamento de por que as empresas colombianas têm tido uma presença limitada no mercado dos American Depositary Receipts (ADRs). Explicações tradicionais sustentam que uma fraca proteção ao investidor e o grau de desenvolvimento econômico e financeiro dos países aumentam o custo de entrar no mercado de ADRs. Sem embargo, no caso da Colômbia, estas explicações não são suficientes porque, nestes aspectos, a Colômbia não difere de maneira significativa de outros países latino-americanos. Utilizando um modelo teórico, afirma-se, neste artigo, que fatores adicionais como o narcotráfico e o conflito armado explicam melhor o porquê das empresas colombianas terem se afastado do mercado de ADRs.

Palavras Chave:

governo corporativo; ADRs; desenvolvimento econômico e financeiro; conflito interno.

Over past fifteen years, many Latin American firms have cross-listed in the US through the American Depository Receipts (ADR) program. Although there are several theories that explain why firms issue ADRs[1], proposed by Coffee (1999) and Karolyi (2004, 2006), this movement is part of the "functional convergence"[2] toward a stronger corporate governance environment. In 1990, the only Latin American country with significant participation in the US ADR market was Mexico, holding the nineteenth place among the countries with ADRs. However, the situation changed completely a decade later. In 2003, Mexico and Brazil were the largest issuers in the US ADR market. In 2005, two of the twenty most successful ADRs were Latin American and the number was duplicated in 2006 (Chong and López de Silanes, 2007, pp. 41). Generally, for an average Latin American country around fifty percent of the most important stocks have a cross-listing in the US. The number has reached 80% for all the largest issuers in Mexico and Venezuela, with the number of Brazilian and Chilean firms also growing substantially. However, the situation in Colombia is not consistent with this trend. Currently only eight of the largest one hundred companies trading in the Colombian market have issued ADRs, four of them in the last two years. In this paper we ask why.

We argue that in addition to observable firm characteristics such as investment opportunities, size, and ownership structure; and country characteristics, such as economic and financial development, there are other factors that increase the costs of listing abroad. Problems related to "internal order" such as drug trafficking and armed conflict affect the incentives of local companies to adopt global financing mechanisms. Reviewing the case of Colombia provides a good opportunity to show how factors not usually found in the business literature affect firms' participation in the international financial markets.

It is generally agreed that there are more advantages than disadvantages when a firm lists its shares on a more developed stock exchange. According to La Porta et al. (2002), Sarkissian and Shill (2004), and Doidge et al. (2004), companies that commit themselves to adopting better corporate governance practices have better market valuation. This valuation is the result of, among other things, the confidence that foreign investors have that the controlling shareholders will limit the extraction of private benefits. Likewise, various authors have recognized the reduction of the firms' cost of capital as another important reason to issue ADRs (Hail and Leuz, 2009; Bekaert and Campbell, 2000; Errunza and Miller, 2000; Stulz, 1999).

Moreover, through the ADR market firms can improve their ability to finance growth opportunities to the extent that it increases and diversifies its investment base (Foerster and Karolyi, 1999). Chong and López-de-Silanes (2007) maintain that the high liquidity of the foreign market allows firms to avoid illiquidity during recessions in the local market. At the same time, Reese and Weisbach (2002) argue that foreign cross-listing is associated with lower agency costs due to better supervision. Similarly, Pagano et al. (2002) indicate that experience in foreign markets and a firm's reputation are other advantages when listed abroad.

A large portion of the literature explores the benefits of cross-listing (see Iacobucci, 2004, and Doidge et al., 2010). However, there are also disadvantages. Trading in US increases the transparency and disclosure requirements, which produce an increase in the probability of losing control of the firm. Improvements required by corporate governance standards and the potential penalties imposed for violations represent threats to controlling shareholders. In addition, the costs associated with adoption of standards of information disclosure at the international level are part of the restrictions facing companies that choose to participate in the international market (Aggarwal et al., 2007).

Doidge et al. (2007) propose another perspective to analyze the process of listing in foreign markets. They point out that the adoption of corporate governance mechanisms depends on the cost of applying them. The authors state that these costs are largely determined by the country's economic and financial development, but also by the investor protection environment. If a country provides sufficiently high investor protection, the adoption of strong corporate governance mechanisms is not necessary. On the other hand, if the economic and financial development of a country is too low, the adoption of corporate governance mechanisms such as cross-listing carries transaction costs that are too high to compensate for their potential benefits.

Extending Doidge, Karolyi and Stulz's model (2007), we derived factors that explain the limited presence of Colombian firms in the US ADR market. We state that in addition to investor protection and the country's economic and financial development, factors related to internal order have an important impact on transaction costs when issuing ADRs and ultimately on the desire of firms to implement good governance practices. We stress that the economic and financial development of Colombia is similar to that of Argentina, Brazil, Chile, Mexico, and Venezuela. Moreover, for some investor protection measures and financial development ratios, Colombia scores better than the rest of the countries in the region. However, factors associated with internal order, such as drug trafficking and armed conflict, have an impact on the willingness of Colombian firms to issue ADRs.

In this paper, we contribute to the literature by considering other country-specific factors, beyond economic and financial development, which until now have been absent in the corporate governance literature, such as internal order problems. When companies issue ADRs to obtain funds, the foreign investor's perception of the internal order situation could affect his willingness to invest in turbulent environments. Since we are building our work through the analysis of the case of Colombia, it is important to highlight that in the case-study methodology in general, but in this paper in particular, we do not seek to provide "statistical proof" of anything. Here the goal is to validate our ideas conceptually using a single case. Further efforts will be necessary to go forwards from this conceptual validation (as in our paper) to a statistical validation[3].

In the following section we present our extension of Doidge, Karolyi and Stulz's model (2007), from which we obtain our principal predictions. Then, we analyze predictions of the model in the context of the Colombian case. Finally, we offer conclusions.

Our model follows closely Doidge, Karolyi and Stulz' model (2007), which in turn extends to Shleifer and Wolfenzon (2002). The model's general idea is that countries differ not only in how they protect investors, but also in the costs associated with market access and implementation of corporate governance mechanisms. Doidge, Karolyi and Stulz (2007) show that if the cost of implementing good corporate governance in countries with low economic and financial development is excessive, the benefits perceived by firms in implementing such a process are, if anything, marginal. Thus, firms located in countries with such characteristics tend to find unnecessary to implement good corporate governance mechanisms. In synthesis, the contribution these authors make is in recognizing the existence of economic and financial development, below which, convergence mechanisms in corporate governance are inaccessible due to the high transaction costs[4].

According to this analysis, we can define three levels at which firms can decide to implement or not external governance mechanisms: A low level, where firms operate in countries with very poor economic and financial development and weak investor protection, and therefore they cannot obtain any net benefit by issuing ADRs. A high level where firms enjoy a very high standard in terms of financial development and investor protection, and therefore there is no need to list abroad to improve their already good corporate governance. Finally, a medium level where firms can improve their corporate governance by taking actions such as issuing ADRs.

Our extension is based on a simple idea: Transaction costs are not solely affected by the country's economic and financial development, but also by problems of social order a country faces. This new factor changes the level at which the implementation of external corporate governance, such as issuing ADRs, is optimal.

Structure of the model

The model assumes that the proportion of private benefits, f, which the controlling shareholder can extract from minority shareholders, is influenced by the costs of good corporate governance mechanisms, as well as by the legal system and the country's economic situation. As the controlling shareholder's private benefits are not, by nature, observable, cross-listing could limit such extraction and create favorable expectations for minority shareholders. At the same time, the model explains that if transaction costs for issuing shares abroad exceed the benefits ex post, issuing ADRs may not be feasible.

Stage t = 0

As in Doidge et al. (2007), a controlling shareholder has an initial wealth equal to W and has to invest K to take advantage of an investment opportunity, where (K > W). The return on the investment is R = aKa, where 0 < a < 1 and a > 0. The controlling shareholder must issue (K - W) in shares to foreign investors. In this way, when the controlling shareholder secures the funds, investors develop expectations regarding the proportion of the company's cash flow that will be expropriated as private benefits, f, by the controlling shareholder.

Stage t = 1

Expropriation by the controlling shareholder is costly. This cost increases because minority shareholders are protected at the country level, p, and at the company level, q. Thus, the cost of extracting private benefits E(f) is

where 0.5bf2 is a cost factor associated with the proportion of private benefits, f, which the controlling shareholder could extract. K is the amount required to realize the investment opportunity; p and q are the level of investor protection by the country and by the firm respectively; and b, a and a are positive parameters. From equation (1) we can see that the expropriation costs increase with p and q and, ultimately, minority shareholders are better protected when p and q increase.

Given that the level of investor protection chosen by the firm, denoted by q, makes it costly to adopt good governance mechanisms, it is assumed that the marginal cost of corporate governance is increasing. This supports a functional form for the cost of corporate governance, given that C(q) = mq2, where m and q are both positive constants. The reasoning is that other measures to increase the quality of the firm's corporate governance could be available.

As in Doidge et al. (2007), there are transaction costs associated with raising capital from foreign investors, for example, by issuing ADRs. So an issue equal to (K - W) is associated with a cost of n(K - W), where n is the transaction costs of obtaining capital, which is influenced by the country's economic and financial development. The value of n is assumed as a constant between 0 and 1. We assumed a risk neutral world with a risk free rate normalized at zero. That is, minority shareholders buy shares as long as they can guarantee, through the payment of dividends, an amount equal to their initial investment. Ultimately, n represents non-financial transaction costs, such as investment in more efficient operating systems, specifying processes and costs incurred in complying with international standards, among others.

We assume that n is influenced by two basic factors: The country's economic and financial development, d, and the internal order problems that increase the transaction costs of obtaining foreign capital, s. As stated above, the foreign investor's perception of the internal order situation could affect his or her willingness to invest. In addition, companies may adopt practices that protect them from such situations but also distance them from international standards; or compliance with international standards may be costly. Therefore, the capital needed to invest in the project is associated with a cost of n(K - W) = n(d + s)(K - W), 0 ≤ d + s ≤ 1.

Stage t = 2

The controlling shareholder extracts an optimal proportion of private benefits f* that maximize the ex post value of his payments. He seeks to maximize his share of a company's benefit, S, that is the firm's total cash flow after subtracting the transaction costs associated with issuing foreign capital n(K - W), the cost of the corporate governance mechanisms C(q), the cost of extracting private benefits E(f), and the dividend payment to minority shareholders U,

which, after substituting, is equal to

subject to S ≥ 0 and f*.

In the maximization problem in (2), the controlling shareholder chooses K, q and f. It is important to point out that K could be considered as a variable to the extent that there are various amounts associated with different investments opportunities. However, once the controlling shareholder has chosen an investment opportunity, the amount K becomes fixed. The maximization problem is subject to two restrictions. The first refers to the controlling shareholder only investing if S ≥ 0 (participation constraints). The second restriction refers to the amount of private benefits to extract, f, which must be such that it maximizes the controlling shareholder's benefit (incentives compatibility constraints).

The selection of K, q and f is not simultaneous. f is determined once the shares have been sold to foreign investors. Therefore, after the controlling investor has chosen q and K (level of protection for the investor and the amount required to realize the respective investment opportunity), minority investors purchase shares for an amount equal to (K - W). Subsequent to the sale of shares, to the controlling shareholder is given a proportion, v, of the firm's total cash flow, which in turn is determined by the quantity of private benefits he extracts, f.

In a scenario without expropriation, v is determined by the firm's total cash flow, CF, which in turn is the return on investment, that is, CF = R = aKα. However, when there is expropriation by the controlling shareholder, the firm's total cash flow is reduced in proportion to private benefits expropriated, CF = (1 - f*)aKα. Therefore, and given that the amount of cash flow the minority shareholder receives is equal to its reserve profit, U = (K - W), the proportion of the firm's total cash flow that he or she receives under the expropriation scenario is given by.

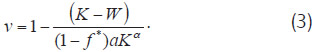

Ultimately, the proportion of cash flows appropriated by the controlling shareholder, v, is:

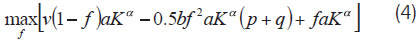

Therefore, after securing funds the controlling shareholder chooses the proportion to be expropriated, f, where 0 ≤ f < 1, such that it maximizes

where v(1-f*)aKα is the liquidated dividends that the controlling shareholder receives, 0.5bf2 aKα (p + q) is the costs of extracting private benefits, and faKa is the total of private benefits extracted by the controlling shareholder. Taking first order conditions yields:

The above solution indicates that the amount of cash flow expropriated decreases as (p + q) increases. Likewise, v is decreasing, that is, to the extent that the controlling shareholder has greater participation in the firm's cash flows, he or she will have less incentive to expropriate. Replacing (3) in (5) it holds that

The previous result shows that f depends on K and q, which are variables of the controlling shareholder's decision. Therefore, f could be seen as f(K, q). So, f depends on the firm's level of protection, q, and the expropriation costs C(q) = mq2. If m is low, the company could cheaply improve investor protection in the country, by improving protection at the company level. In the extreme case, if m = 0, investor protection at the country level becomes irrelevant and the controlling shareholder chooses a level q sufficiently high (q → ∞) so that f = 0. However, if the amount of foreign capital secured by the firm, for example through issuing ADRs, is very small, there are no incentives for the firm to improve the level of q, if the associated transaction costs, n, do not compensate the perceived benefits of adopting good governance mechanisms. Thus, following Doidge et al. (2007), we state:

Proposition 1: If parameter m, which is the inductor of cost of governance at the firm level, is equal to zero, all the firms that secure funds abroad choose a value of investment protection at the firm level, q, that is sufficiently high so that the fraction of cash flow expropriated, f, will equal zero and investor protection by the State is irrelevant.

Proof: See appendix.

Proposition 2: To the extent that m increases, q decreases and investor protection depends almost exclusively on protection guaranteed by the State, p.

Proof: See appendix.

Proposition 3: To the extent that p increases and m is greater than zero, q decreases because governance mechanisms at the firm level are redundant and costly.

Proof: See appendix.

Proposition 4: Finally, for firms whose inductor parameter of the costs of securing foreign capital, n, is sufficiently elevated, q equals zero because the firm does not expect to secure foreign capital.

Proof: See appendix.

These propositions show that the company's choice of governance mechanisms (for example, issuing ADRs) depends on the cost of applying these mechanisms and the transaction costs of issuing shares. These costs are determined not only by investor protection at the country level and by the country's economic and financial development, but also, as we propose in this paper, by problems related to social order, such as illegal armed groups, illegal traffic in arms and drugs, asset laundering and the presence of illicit money in the economy. All of which affects the willingness of companies located in a given country to adopt mechanisms such as issuing ADRs.

Stage t = 3

Payments made by the controlling shareholder to the minority shareholders after the expropriation, are the following: Payment for the controlling shareholder, pc, is determined by the dividends corresponding to his participation in the firm's cash flow after expropriation, v(1-f)aKα, the expropriation costs 0.5bf2 aKα (p + q), and the benefits obtained by it faKα:

The payment to the minority shareholder, πM, is determined by the dividends corresponding to participation (1 - v) in the firm's cash flows after the expropriation, which will equal the reservation profits:

Predictions of the model

The model developed up to this point offers the following predictions. In the hypothetical unrealistic scenario in which the implementation of good governance practices at the firm level does not have cost, all companies would develop business practices that would make state protection unnecessary. In countries with high investor protection, additional efforts by companies to implement good corporate governance practices beyond those required by the regulatory framework are costly and redundant. In countries with low economic and financial development it is possible that the costs of implementing good corporate governance mechanisms exceed the perceived benefits. Finally, the transaction costs assumed by the companies could be affected, not just by the country's economic and financial development, but also by factors associated with internal order, such as the armed conflict and drug trafficking.

In the following section, we address the Colombian case, not with a view to empirically validating the model, which is clearly not possible from just one observation, but to highlight some of the model's main theoretical arguments.

Corporate governance literature shows a substantial heterogeneity in the behavior of firms in emerging markets. Chong and López-de-Silanes (2007) maintain that for the case of Latin America, even under distorting conditions such as insufficient legal protection and weak rule of law, improvement could be made if firms begin to adopt better corporate governance practices. Following Coffee (1999), one of the alternatives available to firms to reach high corporate governance standards is functional convergence, which refers to changes at the firm level that somehow bypass the local investor protection environment. In this sense, functional convergence does not require legal reforms per se, but firms could attract more investors under the rubric of self-imposed protection for shareholders. The existence of cross-listing programs in the US is a good mechanism to promote the improvement of corporate governance at the firm level regardless of the local legal environment.

Development of ADR programs in Latin America

In the past fifteen years, there has been a great movement toward cross-listing by Latin American firms. Latin American ADRs programs represent about 13% of the total programs available throughout the world. In the period 2005-2006, Latin American companies had five of the largest fifteen ADR programs in the world and five of the twenty most actively traded ADRs in the United States (Chong y López de Silanes, 2007, p. 41). Some cases are worth mentioning. For example, Venezuelan firms showed a great dynamism in the nineties with nine new firms in the ADRs program, while in this decade only two companies decided to issue this type of instrument. The second interesting case is Brazil, which in 2007 increased the number of firms with ADRs programs by nearly 50%. Finally, the special case of Colombia stands out from the rest, with poor participation by the country's firms in the issuing of ADRs, although this situation has been changing over the past decade.

Figure 1 shows the percentage of issuers from each country in the ADR program of the New York Stock Exchange. Mexico and Argentina are the countries in which more national firms have adopted these corporate governance mechanisms. Venezuela and Brazil show very similar percentages despite the difference in their market size. While in Venezuela 10 firms of the 65 issuers have ADRs, in Brazil 88 of the 573 issuers have ADRs. Chilean companies have participated moderately in implementing these governance mechanisms, possibly due to the liquidity of the market in which these firms operate. It is evident that Colombian firms are the least active in the region in issuing ADRs. Fewer than 7% of the firms listed on the exchange have ADRs. Karolyi (2004) states that for the average Latin American country, around 50 percent of the most active stocks have cross-listed their shares in the US market. In the case of Mexico and Venezuela, in 2000 this percentage has approached 80 percent. The number of Chilean and Brazilian firms has likewise shown a substantial increase.

Generally, the growth in the number of Latin American firms that issue ADRs is evident. This would support the idea that, in countries with weak investor protection, firms implement functional convergence mechanisms. However, this intuition does not apply for Colombia. The first Colombian firm to issue ADRs was Bancolombia, a financial sector company, in July 1995. The second did not take place until December 2002, by the Corporación Financiera Colombiana, which belonged to the same sector. In 2004 the third issuer was Interconexión Eléctrica S. A., a company from the electricity sector. Almacenes Éxito, a firm in the "big box" store sector, was to issue ADRs in 2007. Finally, since 2008 Ecopetrol (the Colombian petroleum company) (2008), Cementos Argos (2008), Grupo de Inversiones Suramericana (2008), Grupo Nutresa S. A. (2009), and Interbolsa (2010), these latter four being private companies, have issued ADRs challenging the low participation in international markets by Colombian firms in recent years.

We revised the SEC's requirements to identify if they represent potentials obstacles for Colombian firms to decide to issue ADRs. Table 1 shows the types and characteristics of the ADRs programs. As seen in this table, the program type of depositary receipts determines the requirements that the issuer has to accomplish. Five of the Colombian firms with ADRs programs are Level 1 (Cementos Argos, Interconexión Eléctrica S. A., Interbolsa, Grupo de Inversiones Suramericana, and Grupo Nutresa S. A.), two are Level 2 (Ecopetrol and Corporación Financiera Colombiana), and two are Level 3 (Bancolombia and Almacenes Éxito). If we take into account the requirements of the lowest level, all firms with high and medium marketability in the Colombian Stock Exchange are eligible (38 firms) to cross list in the U.S market. In percentage terms, approximately 24 percent of the eligible firms are ADRs issuers in the foreign market. This percentage was only the 3% in 2000 and 8% in 2005.

This situation shows the backwardness of the nineties and the slow movement of Colombian companies toward North American markets. It is worth asking: Why have only few Colombian firms issued ADRs, despite the potential advantages inherent in this type of mechanism?

The country's economic and financial development and transaction costs

Arguments put forth by Doidge et al. (2007) call attention to the importance of the country's characteristics for the implementation of good corporate governance systems; these characteristics influence the cost-benefit ratio incurred by firms when committing themselves to good corporate governance practices. In this way, the decision that firms make to adopt mechanisms that guarantee high quality corporate governance depends largely on the country in which the firm is located. However, this commitment could be prohibitively costly in countries with weak investor protection and low economic and financial development. Along these lines, it is conceivable that firms in countries with low economic and financial development will find it optimal to invest less in corporate governance, and minority shareholders' rights will be determined mainly at the country level rather than at the firm level.

Therefore, it becomes important to analyze Colombia's economic and financial development in recent decades, and to compare it with other Latin American countries and see if this explains the limited presence of this country in the ADRs market. We use 2008 as year of comparison because up until that year, Colombia had only four companies issuing ADRs and, if theoretical predictions of Doidge et al. (2007) apply to this country, we would find Colombia to be the country showing the worst economic and financial development in Latin America.

Countries in this region have shown capacity to grow at relatively high rates over an extended period of time (Cardoso and Fishlow, 1992). However, with regard to the economic performance as well as the perception of foreign investors, Colombia has performed in many cases better than the rest of the countries in the region.

Using data from UNESCO (2000) and CEPAL (2007) regarding Gross Domestic Product (GDP) in Latin American countries between 1990 and 2008 (estimated), the following facts emerge: The aggregate average growth of the GDP for Latin American countries over the past 19 years is 80.64%, which equals a 3.16% average annual increase. Growth for Colombia has been about average (95.82% aggregate and 3.6% annual average). This growth is greater than Brazil (61.1% aggregate and 2.54% annual average), Venezuela (86.75% aggregate and 3.34% annual average) and Mexico (79.7% aggregate and 3.13% annual average). The only countries in this study that exceed Colombia's growth rate are Argentina (104.94% aggregate and 3.85% annual average) and Chile (158.17% aggregate and 5.12% annual average). This provides evidence that Colombia's economic performance in terms of GDP has been better than the countries that are most active in issuing ADRs, such as Brazil and Mexico. Figure 2 shows the aggregate percent variation in GDP for Chile, the country with the highest economic growth in the region, for Colombia, and the average for Latin America.

Figure 3 shows comparative data for the five countries analyzed in this article and the average for Latin America, in relation to aggregate percentage growth in the Gross Domestic Product between 1990 and 2008. Note how the countries with the greatest economic growth in the sample are Chile, Argentina and Colombia.

Now we review the published country risk classifications (see Figure 4). The scores granted by Fitch Ratings and Moody's put only Chile and Mexico in the "investment grade" category. On the other hand, Colombia and Brazil earned a similar classification, while Venezuela and Argentina display the lowest scores in the group of countries we studied. Given the importance that investors assign to these risk classifications, this could indicate that for firms located in Argentina and Venezuela access to ADRs programs would be more limited than for Colombia. One can expect that Colombia would have the same level of participation as Brazil and similar to Mexico. However, this is not the case, as is seen in Figure 1[5].

The Emerging Markets Bond Index (EMBI), calculated by JP Morgan, shows the spread between the yields of sovereign bonds from a given country with respect to the yield of US sovereign bonds. This difference is attributable to a default risk premium on the sovereign debt market. EMBI makes it possible to predict the costs of capital for firms in a given country. In 2008, Mexico and Chile were the countries that offer the lower premium to foreign investors. After these two countries came Colombia. This performance is attributable to the tradition of payment that has sustained the country throughout its history. For Brazil, Argentina, and Venezuela, securing funds in foreign capital markets were more costly, so one can assume that Colombian firms must have shown a greater propensity to enter the foreign capital markets. Despite a deficient risk classification, firms located in Brazil, Argentina and Venezuela have been more active in the ADRs market.

Finally, in relation to economic policies it is pertinent to analyze currency devaluation in Latin American countries. To the extent that a country shows greater devaluation, abroad financing is more costly. Ultimately, high devaluation could be a factor that affects the propensity of firms to enter foreign capital markets. To show the performance of devaluation we took data from the official rate of exchange from December 2002 to 2008. The most stable countries in terms of exchange rate have been Chile and Colombia, followed by Argentina, Mexico and Venezuela. Brazil shows devaluation without a point of comparison in the period analyzed, approximately three hundred times greater than Chile's devaluation in percentage terms. This implies that firms located in Chile and Colombia that seek outside debt get on average the lowest costs in cumulative terms, due to losses on the exchange rate. Figure 5 shows the aggregate variation in currency devaluation for the countries studied, except Brazil due to its atypical performance, for the period 1992-2008.

In addition to taking into account economic development, it is also necessary to analyze financial development as well. Chong and López-de-Silanes (2007) show that Colombian stock market capitalization as a fraction of GDP equals 14.27%, which puts Colombia behind Chile, Argentina, Mexico and Brazil, but ahead of Venezuela, which has stock market capitalization of 5.5% of its GDP for 2006.

With respect to market depth, measured in terms of ownership concentration, Colombia and Mexico are the countries with the greatest ownership concentration with 64% and 65%, respectively. Various authors have argued that these high levels of shareholder ownership could affect the propensity to issue ADRs. For example, Doidge et al. (2009) found that the rights of controlling shareholders are negatively related to the existence of cross-listing in the US. Even though these arguments would partially explain what we see in the Colombian case, they do not correspond to the case of Mexico. Ultimately, ownership concentration does not offer a satisfactory explanation for the lack of utilization of ADRs by Colombian companies.

In addition, Chong and López-de-Silanes (2007) argue that Latin American capital markets are poorly developed. In fact, the size of the capital market on average in Latin American countries is less than half of the world mean. This is supported by the ratio of the number of firms relative to the population being approximately a quarter of the world mean (5.29% compared to 27.73%), and that number of IPOs with respect to the population is almost 10 times smaller than the global mean (0.23% compared to 2.97%).

Given these conditions, the intuition offered by Doidge et al. (2007) is insufficient to explain why Colombian firms have such a limited presence in the ADR market. As shown, economic and financial development of Mexico, Argentina, Brazil, Chile and Venezuela are relatively similar to that of Colombia and so the transaction costs that Colombian companies incur in implementing ADRs would be similar to those assumed by companies located in other countries in the region. We will show below how internal order problems offer a complementary explanation of the particularities of the Colombian case.

Firm level characteristics

Some authors recognize the importance of the firm's characteristics for implementation of good governance mechanisms, such as the issuing of ADRs. Coffee (2002) maintains that firms with high ownership concentration tend to behave differently from those with dispersed ownership, with the first seeking to maximize private control benefits and the latter tending to maximize share price. As a result, they have different attitudes toward accessing foreign financial markets and imposing more stringent legal rules on themselves. Ultimately, firms that issue ADRs limit their expropriation ability (Coffee, 1999; Reese and Weisbach, 2002; Doidge et al., 2004; Dyck and Zingales, 2004).

However, Latin American firms' ownership concentration levels have always been high relatively to other developed nations. Chong and López-de-Silanes (2007) show that average ownership concentration worldwide is 47%, while the average for Latin America is 58%. Chile is the country with the lowest shareholder concentration (45%), while the countries that are the most active in ADRs, such as Mexico and Brazil, display high shareholder concentration (64% and 57%, respectively). This indicator for Colombia, Argentina and Venezuela is equally high (63%, 53%, and 51%). Despite the dispersion in concentration levels, the differences are not representative and do not explain why Colombian firms have issued so few ADRs.

On the other hand, Durnev and Kim (2005) found that the quality of governance practices is positively related to the firms' growth opportunities. From this, one can assume that the companies that have issued ADRs in Colombia are those with the highest growth ratios. However, our analysis of the 530 largest companies in Colombia for the period 1996-2006 reveals that growth ratios (percentage of increase in sales) do not explain the firm's decision of issue ADRs after controlling for firm size, age and industry. To do this, we collected information from the National Equity-Issuer Registry Forms (Registro Nacional de Valores e Intermediarios, RNVI) filed by Colombia's Financial Superintendence (SFIN) and the Colombia's Superintendence for Commercial Societies (SSO C), mainly. Thus, the working sample consists of an unbalanced panel of 530 firms for the period 1996-2006 (5,150 firm-year observations). Of those, 477 belong to one of the 30 largest business groups in the country. This sample includes nine Colombian firms that have issued ADRs.

Table 2 shows a preliminary descriptive statistic (Panel A) and a panel probit random effects regression (Panel B) studying the relationship between growth opportunities and the decision of issue ADRs. In an univariate analysis (Panel A), preliminary statistic shows a higher level of growth opportunities for firms with ADRs when comparing with those firms that do not issue that kind of instruments. This difference is statistically significant in a test of differences in means. However, these results change in a multivariate analysis. To perform this analysis (Panel B) we use as endogenous variable a dummy that takes the value of 1 if the firm has issued ADRs, and zero otherwise. Our explanatory variables are growth opportunities (as the percentage growth in sales), firm size (as the natural log of the book value of total assets), firm age (as the number of years since the firm's inception), and the industrial sector of the firm (we break down the data by major industry sector, ISIC-two digits). The regression specification tests reject the null hypothesis of no individual effects. Thus, we perform a panel data regression. In addition, we choose the random effects specification due to the industrial sector variables are time invariant dummies. The results show that the growth opportunities do not have an impact on the decision of firms in regards to the issuance of ADRs in the Colombian case.

This result in regards to the relation between growth opportunities and the issuance of ADRs suggests that Colombian firms have been satisfying their funding necessities in the internal market. This supports the predictions of our theoretical model because it seems that the benefits of issue ADRs for Colombian firms are lower than the costs associated to this kind of instrument. During the 1990s the interest rate in Colombia was extremely high, reaching levels of 45% for the Colombian sovereign debt, and levels of 75% for consumption loans. In despite of this high level of cost for local loans and in despite of growth opportunities, firms did not use ADRs as a mechanism to get funding abroad.

As with the country's economic and financial development, some firm's characteristics do not appear to be a strong enough factor to explain the behavior of Colombian companies with respect to cross-listing their shares in the US market.

It is important to stress that we decided to control by industry in the regression reported in Table 2 because the decision of issue ADRs could be affected by this variable. Revising the Colombian case, we have four firms in financial services industry and one bank as issuers of ADRs. This fact is in accordance with the pattern that we find in Latin America. Table 3 shows the number of firms that issue ADRs classified by industries for Argentina, Brazil, Chile, Colombia, Mexico and Venezuela. The most active industries issuing ADRs are electricity, real estate investment and services, banks, financial services, food producers, and construct and materials. The nine Colombian firms that issue ADRs belong to five of these six sectors.

Internal order problems and transaction costs

The North American Congress on Latin America (NACLA, 1997) characterized the drug trafficking kings in Colombia, Pablo Escobar (from the city of Medellín), and the Rodriguez Orejuela brothers (from the city of Calí), in a contradictory manner. While the first was associated with acts of violence, the latter were considered businessmen. Gilberto Orejuela created his first pharmaceutical company at the age of 25 and by the time he was 50 it had become the biggest diversified group in the Colombian pharmaceutical sector. In a 1991 interview, Gilberto Orejuela stated that in the city of Calí, his companies generated employment for more than 4,000 people (Quinn, 1991). According to anti-drug intelligence services, the Rodriguez brothers used their legal economic activities to launder money, obtain supplies and gather the intelligence information necessary to keep their illicit operations hidden. Many Colombian drug traffickers used these tactics: To penetrate established businesses or to start their own to hide their illegal activities.

On the other hand, legitimate firms felt threatened by the possibility of being captured by the drug business and responded with even more concentrated ownership. Following the analysis of Gutiérrez et al. (2008), the idea behind the consolidation of the Grupo Empresarial Antioqueño (GEA - Antioquian Business Group), one of the principal economic groups in Colombia, arose because of a defensive strategy against the drug cartels. The GEA is formed in part by highly liquid listed companies, four of which are among the nine that have issued ADRs in Colombia: Bancolombia, Almacenes Éxito, Grupo de Inversiones Suramericana, and Grupo Nutresa. The first has succeeded in its expansion plans and the second was recently sold to the Casino de Francia group.

This is just an example to illustrate the influence of drug trafficking in Colombia and the defensive business practices adopted by some legitimate firms. Many firms and individuals have, in fact, been involved with illicit operations. Some of them were listed in the Foreign Assets Control Office (OFAC) report called the Specialty Designated Nationals List (SDN List). This list includes the names of individuals and organizations with which permanent residents and citizens of the US are prohibited from doing business with. Inspecting the list (informally called the Clinton List) it is evident that Colombia has been the country with the greatest number of names on that list. In 2008 alone, Colombia has 9,309 references, Mexico has 2,645, Brazil has 98, Venezuela has 80, Argentina has 56, and Chile has 31. As stated previously, trading in US markets increases the demand for transparency and information disclosure, requirements that persons or companies who have or have had relationships with illicit organizations could not accept.

However, it is important to highlight that since 1995 the Colombian government has improved the legal requirements about disclosure and corporate governance to public and private firms in Colombia. In addition, since 2007 the Colombian government has asked firms to implement the SARLAFT (System of Administration of the Risk of Money Laundering and Terrorism Financing) to make more difficult the money laundering and the financing of terrorism activities in the country. These efforts could, in part, explain the increase of ADR's issuers that grow from only one firm in 2000 to nine in 2010.

Drug trafficking is not the only problem of internal order in Colombia. Probably the most important is the armed conflict with the left-wing guerrillas, the most important of these being the FARC, Fuerzas Armadas Revolucionarias de Colombia (Armed Revolutionary Forces of Colombia), and with the right-wing paramilitary forces that fight with the guerrillas but also fight with the state. All subversive groups are active in the "kidnapping business", as shown in Figure 6, where the growth of kidnapping cases has increased since the eighties, reaching more than three thousand in 2001.

Subversive groups in Colombia have always justified the armed conflict from an ideological point of view. Violence associated with guerrillas is recent, dating back only to the late 1940s, when Liberal peasants organized self-defense associations in response to Conservative attacks during La Violencia (Boudon, 1996). However, the presence of drug trafficking and use of resources from it to finance their activities de-legitimized this justification (Pizarro-Leongómez, 2004). According to Duncan (2005, 2007), FARC as well as the self-defense forces are armies and therefore can provide protective services to drug trafficking organizations. Both illegal actors dominate the drugs trade (Duncan, 2006). Drug trafficking consumes key resources; armed conflict and crime in Colombia are at high levels compared to other countries (Echeverry, 2004). Besides, according to Avilés (2006), the elite civilian politicians who dominated the Colombian state promoted formal institutional changes, but tolerated paramilitary repression in order to counteract a strengthening guerrilla insurgency. In summary, drug trafficking introduced an element of business reasoning into the Colombian armed conflict, which brought other effects of the conflict into the political and economic sphere.

This particular context is a key factor for doing business and investment initiatives in Colombia because it affects perceptions about the Colombian environment. The problems derived from drug trafficking and organized crime, supported by illegal groups in Colombia, increase the security risks for business people and foreign investors. It is evident that criminal bands use kidnapping, extortion, and robbery of businesspersons and civilians as financing mechanisms. Guerrillas and paramilitary groups carried out around 75% of the kidnappings in recent years, a percentage that has dramatically dropped thanks to the current government's military offensive. These situations limit the willingness of foreign investors to buy shares of Colombian companies issued abroad because of the impact of the internal conflict problems on the operation of the firm, and in consequences, on the stock prices. This potentially limits the amount of funds that can be raised in foreign markets through the issuing of ADRs.

The Colombian case is not unique in the world. Countries such as Italy have lived similar situations. According to a Nuevo Diario (2004) report, the Neapolitan Mafia agreed with the Italian groups Parmalat and Cirio to impose their products on the southern Italian peninsula. In exchange for an "honorarium", the mafia employed its traditional methods to intimidate small business owners.

All this demonstrates there is, in fact, an understudied relationship between organized crime and business where information disclosure and legitimacy plays a key role. First, "legal" businesses react to avoid infiltration by illegal groups, in part, by increasing ownership concentration levels through complicated business arrangements that reduce the firm's transparency which in turn make it harder for an international investor to be willing to invest capital in such a firm. Second, the drug trafficking business (money laundering) was so widespread in the eighties and nineties that it touched many companies and individuals directly or indirectly, with or without their knowledge, and they faced restrictions on their participation in the international market. And third, the evolution of the armed conflict in Colombia and the use of criminal practices such as kidnapping and systematic attacks on corporate infrastructure substantially deteriorate the image of the country as a good place to invest. At the same time, this kind of illegal practices affects the willingness of the managers and owners of Colombian firms to implement high levels of disclosure. To reveal information would also make managers and owners targets. This is one of the reasons behind the low level of information about ownership structures and shareholders of private firms in Colombia. The governmental organisms collect this information but keep it in the strictest confidence. This situation would lead to less cross-listing.

From our theoretical model, the internal order problems, d, in Colombia are so high that it separates itself from other countries with similar economic and financial development levels in the ADRs market. This affects the use of ADRs as a viable governance mechanism. As we said before, the Colombian case analyzed here allows us to give conceptual support for our model; however, the theory we developed could also be validated empirically in order to additionally gain statistical support.

We posited the question of why only few Colombian firms have issued ADRs, despite the potential advantages of participating in the international financial market. We showed that in addition to the firms' and country's observable characteristics there are other factors, not usually taken into account in the literature, that affect the transaction costs of listing on the foreign market. Problems of social order such as illegal armed groups and illegal drug trafficking significantly reduce foreigners' willingness to invest. Confronted with this situation, Colombian firms have excluded themselves from the ADRs markets, and the possibility of using it as a signaling mechanism of good corporate governance. Our theoretical proposal highlights the relevance of the security and institutional strengthening at country level for businesses in general and for good governance practices in particular.

[1] For a review of these theories, see Reese and Weisbach (2002), Karolyi (2004), Karolyi (2006), Doidge et al. (2004, 2007, 2009, 2010), among others.

[2] Functional convergence is an alternative path to reach higher standards of investor protection, based on more decentralized, market-based, and firm level changes. Functional convergence does not require legal reform per se but still brings more firms and assets under the umbrella of effective legal protection for investors (Chong and Lopez-de-Silanes, 2007).

[3] Yin (2003) put it in this way: "A second common concern about case studies is that they provide little basis for scientific generalization. How can you generalize from a single case? Is a frequently heard question [...] The short answer is that case studies, like experiments, are generalizable to theoretical proposition and not to populations or universes. In this sense, the case study, like the experiment, does not represent a 'sample' and in doing a case study, your goal will be to expand and generalize theories (analytic generalization) and not to enumerate frequencies (statistical generalization)" (Yin, 2003, p. 10).

[4] Bergman and Nicolaievsky (2007) present another model studying additional factors affecting the mechanisms adopted by firms to provide better protection to their investors. These authors assume that each country regime is characterized by the set of contracts that it can enforce; hence, legal regimes differ in their ability to enforce some kind of contracts. This assumption allows them to present a model in which the insiders choose offer protection contracts inside a country according to their motivations and the legal regime.

[5] In March 2011, Standard & Poor's raised Colombia's rating to investment grade. However, for twelve years, Colombia had had a speculative- grade rating while similar countries as Chile and Mexico have investment-grade rating. An alternative explanation for a higher level of country risk classification of Colombia in comparison to Venezuela and Argentina during the 2000s in despite of the Colombian internal order problems, it is its excellent payment history. Colombia has never missed a payment.

Consider the following sequence of events (figure 1A).

The model has four periods. In t = 0, the controlling shareholder has an initial level of risk and an investment opportunity, which could be carried out through the securing of funds in outside markets. In t = 1, the controlling shareholder sells to outside investors a share participation necessary to advance the project. Prior to the sale, the controlling shareholder chooses the level of investor protection. In t = 2, the controlling shareholder retains a fraction of cash flows in order to later define the level of expropriation. En t = 3, payments are made to the controlling and minority shareholders. The controlling shareholder has an initial level of risk and an investment opportunity, which could be carried out through the securing of funds in foreign markets. The controlling shareholder sells outside investors share participation necessary to advance the project. Prior to the sale, the controlling shareholder chooses the level of investor protection. The controlling shareholder retains a fraction of cash flows in order to define the level of expropriation later. Payments are made to the controlling and minority shareholders.

Proofs

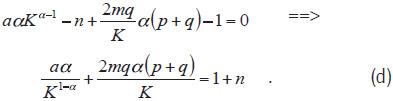

Taking the problem of maximization proposed in equation (2).

First order conditions set out

From (b) it holds that

Replacing (c) in (a)

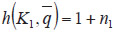

Starting from equation (d), denote, from which it holds that h(K,q) = 1 + n (e), with hK < 0 y hq > 0, which implies an inverse relation between K and q.

Starting with the preceding, we proceed to demonstrate each of the propositions.

i. Proposition 1

If m = 0 equation (c) holds that -0.5bf2aKα-1 = 0. From which, for constant values of b, a and K, necessarily f = 0. In addition, it is known about equation (6) that

Therefore, so that f = 0, (q → ∞)

ii) Proposition 2

From equation (e) it holds that h(K, q) = 1 + n, because of which it is known that

So, to maintain equality, to the extent that m increases q must be reduced.

iii) Proposition 3

From equation (e) it holds that h(K, q) = 1 + n, because of which it is known that

So, to maintain equality, to the extent that p increases, q must decrease.

iv) Proposition 4

Starting from equation (e), h(K, q) = 1 + n, and taking as a starting point a specific level of n, in this case n0, a specific level of K, in this case K0, and assuming a constant q, then. To the extent that n1 is present, such that n1 > n0, the following situation is generated:

Given that hK < 0, to maintain equality in the equation (e) then,

in which K1 < K0. Therefore, there is an inverse relation between n and K.

Aggarwal, R., Erel, I., Stulz, R. M. & Williamson, R. (2007). Differences in governance practices between U.S. and foreign firms: Measurement, causes, and consequences. NBER Working papers series, 14, 1-53.

Avilés, W. (2006). Paramilitarism and Colombia's low-intensity democracy. Journal of Latin American Studies, 38(2), 379-408.

Bekaert, G. & Campbell, R. H. (2000). Foreign speculators and emerging equity markets. Journal of Finance, 55(2), 565-613.

Bergman, N. & Nicolaievsky, D. (2007). Investor protection and the Coasian view. Journal of Financial Economics, 84(3), 738-771.

Boudon, L. (1996). Guerrillas and the state: The role of the state in the Colombian peace process. Journal of Latin American Studies, 28(2), 279-297.

Cardoso, E. & Fishlow, A. (1992). Latin American economic development: 1950-1980. Quincentenary Supplement: The Colonial and Post Colonial Experience. Five Centuries of Spanish and Portuguese America, Journal of Latin American Studies, 24, 197-218.

CEPAL (2007). Anuario estadístico de América Latina y el Caribe 2007 (Annual statistical survey of Latin America and the Caribbean 2007). Comisión Económica para América Latina y el Caribe (Economic Commission for Latin America and the Caribbean - CEPAL).

Chong, A. & López de Silanes, F. (2007). Gobierno corporativo en América Latina (Corporate governance in Latin America), Inter-American Development Bank, Working paper 59, University of Amsterdam.

Coffee, J. (1999). The future as history: The prospects for global convergence in corporate governance and its implications. Northwestern Law Review, 93, 631-707.

Coffee, J. (2002). Racing towards the top?: The impact of cross-listings and stock market competition on international corporate governance. Columbia Law Review, 102(7), 1757-1831.

Doidge, C., Karolyi, A. & Stulz, R. (2004). Why are foreign firms listed in the U.S. worth more? Journal of Financial Economics, 71, 205-238.

Doidge, C., Karolyi, A. & Stulz, R. (2007). Why do countries matter so much for corporate governance? Journal of Financial Economics, 86, 1-39.

Doidge, C., Karolyi, A. & Stulz, R. (2010). Why do foreign firms leave U.S. equity markets? Journal of Finance, 65(4), 1507-1554.

Doidge, C., Karolyi, A., Lins, K., Miller, D. & Stulz, R. (2009). Private benefits of control, ownership, and the cross-listing decision. Journal of Finance, 64(1), 425-466.

Duncan, G. (2005). Del campo a la ciudad: la infiltración urbana de los señores de la guerra. Documento (From country to city: the urban infiltration of guerrillas). CEDE 2005-2. Bogotá: Universidad de los Andes.

Duncan, G. (2006). Los señores de la guerra. Bogotá: Planeta.

Duncan, G. (2007). Historia de una subordinación. ¿Cómo los guerreros sometieron a los narcotraficantes? Zorro, C. (comp). El desarrollo: perspectivas y dimensiones. Aportes interdisciplinarios (433-452). Bogotá: Universidad de los Andes, Cider.

Durnev, A. & Kim, H. (2005). To steal or not to steal: Firm attributes, legal environment, and valuation. Journal of Finance, 60, 1461-1493.

Dyck, A. & Zingales, L. (2004). Private benefits of control: An international comparison. Journal of Finance, 59(2), 537-600.

Echeverry, J. (2004). Colombia and the war on drugs, how short is the short run? Bogotá: Uniandes. Documento CEDE 2004/13.

Errunza, V. R. & Miller, D. P. (2000). Market segmentation and the cost of capital in international equity markets. The Journal of Financial and Quantitative Analysis, 35, 577-600.

Fitch Ratings. (2008). Consulted April 30, 2008, http://www.fitchratings.com/

Foerster, S. R. & Karolyi, G. A. (1999). The effects of market segmentation and investor recognition on asset prices: Evidence from foreign stocks listing in the United States. Journal of Finance, 54(3), 981-1013.

Gutiérrez, L., Pombo, C. & Taborda, R. (2008). Ownership and control in Colombian corporations. The Quarterly Review of Economics and Finance, 48(1), 22-47.

Hail, L. & Leuz, C. (2009). Cost of capital effects and changes in growth expectations around U.S. cross-listings. Journal of Financial Economics, 93(3), 428-454.

Iacobucci, E. (2004). Toward a signaling explanation of the private choice of corporate law. American Law & Economics Review, 6, 319-344.

Karolyi, G. A. (2004). The role of ADRs in the development of emerging equity markets. Review of Economics and Statistics, 86(3), 670-90.

Karolyi, G. A. (2006). The world of cross-listings and cross-listings of the world: Challenging conventional wisdom. Review of Finance, 10(1), 3-115.

La Porta, R., López-de-Silanes, F. & Shleifer, A. (2002). Investor protection and corporate valuation. Journal of Finance, 57, 1147-1170.

Moody's Investors Service. (2008). Consulted on April 30, 2008, http://www.moodys.com/

NACLA. (1997). The rise and fall of the "gentlemen from Cali". NACLA Report on the Americas, North American Congress on Latin America, May/Jun97, 30(6).

Nuevo Diario. (March 3, 2004). "Camorra" napolitana "protegía" a Parmalat. Nuevo Diario, Nicaragua.

Pagano, M., Röell, A. A. & Zechner, J. (2002). The geography of equity listing: Why do companies list abroad? Journal of Finance, 57(6), 2651-2694.

Pizarro-Leongómez, E. (2004). Una democracia asediada: balance y perspectiva del conflicto armado en Colombia. Bogotá: Norma.

Quinn, T. (June 30, 1991). Passion-fruit mousse with the king of cocaine. The Sunday Telegraph, p. 16.

Reese, W. & Weisbach, M. (2002). Protection of minority shareholder interests, cross-listings in the United States, and subsequent equity offerings. Journal of Financial Economics, 66, 65-104.

Sarkissian, S. & Schill, M. (2004). The overseas listing decision: New evidence of proximity preference. Review of Financial Studies, 17(3), 769-809.

Shleifer, A. & Wolfenzon, D. (2002). Investor protection and equity markets. Journal of Financial Economics, 66, 3-27.

Stulz, R. M. (1999). Globalization, corporate finance, and the cost of capital. Journal of Applied Corporate Finance, 12(3), 8-25.

The Economist Intelligence Unit Limited. (2007). Security risks in Colombia. Country Profile Colombia, 13-14.

UNESCO, Organización de las Naciones Unidas para la Educación, la Ciencia y la Cultura. (2000). Análisis de prospectivas de la educación en la región de América Latina y el Caribe.

Yin, R. (2003). Case study research: Design and methods, 3rd edition. London: Sage Publications Ltd.

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

Visitas a la página del resumen del artículo

Descargas

Licencia

Derechos de autor 2011 Innovar

Esta obra está bajo una licencia internacional Creative Commons Reconocimiento-NoComercial-CompartirIgual 3.0.

Todos los artículos publicados por Innovar se encuentran disponibles globalmente con acceso abierto y licenciados bajo los términos de Creative Commons Atribución-No_Comercial-Sin_Derivadas 4.0 Internacional (CC BY-NC-ND 4.0).

Una vez seleccionados los artículos para un número, y antes de iniciar la etapa de cuidado y producción editorial, los autores deben firmar una cesión de derechos patrimoniales de su obra. Innovar se ciñe a las normas colombianas en materia de derechos de autor.

El material de esta revista puede ser reproducido o citado con carácter académico, citando la fuente.

Esta obra está bajo una Licencia Creative Commons: