Does family ownership affect innovation activity? A focus on the biotechnological industry

¿Se ve afectada la innovación por la propiedad familiar? Una aproximación a la industria de la biotecnología

A INOVACÂO É AFETADA PELA PROPRIEDADE FAMILIAR? UMA APROXI-MACÂO À INDÚSTRIA DA BIOTECNOLOGIA

DOI:

https://doi.org/10.15446/innovar.v27n65.64886Palabras clave:

Family firms, innovative activity, Resource-based View, cluster analysis. (en)empresas familiares, actividad innovadora, enfoque basado en recursos, análisis de clusters (es)

abordagem baseada em recursos, análise de clusters, atividade inovadora, empresas familiares (pt)

Descargas

This paper investigates if family ownership affects the firm’s innovation activity. It characterizes familiar and innovative firms using the Resource-based View of the firm and the relevant factors to innovate and gain competitive advantages. In particular, the purpose is identifying the profile of innovative firms and analyzing if family ownership is a characteristic related to their innovative activity. To achieve this objective, we have applied a cluster analysis methodology in a sample of companies of the Spanish biotechnological industry in which innovation is core. The results show the relevance of the family characteristics on the characterization of those innovative firms, contributing to clarify the existing inconclusive literature between family and innovation, and helping stakeholders and policy-makers to make decisions about inversion or transference of knowledge which would help to improve competitiveness and promote socio-economic changes.

Este artículo analiza si la propiedad familiar de una firma influye en su actividad de innovación. Para tales efectos, se caracterizaron empresas familiares e innovadoras que operan bajo el enfoque basado en recursos, así como los factores relevantes en sus procesos de innovación y de generación de ventajas competitivas. Específicamente, el objetivo de este trabajo es identificar el perfil de las empresas innovadoras y analizar si la propiedad familiar es una característica relacionada con sus iniciativas de innovación. Para lograr este objetivo, se aplicó una metodología de análisis de clústeres en una muestra de empresas de la industria biotecnológica española, dentro de la cual la innovación es un factor clave. Los resultados muestran la importancia de las características de las familias en la consolidación de empresas innovadoras, contribuyendo a precisar aportes no concluyentes en la literatura acerca de la relación familia-innovación. Así mismo, los resultados pretenden ayudar a los stakeholders y a los responsables de las políticas organizacionales en sus procesos de toma de decisiones frente a asuntos relacionados con la inversión o transferencia de conocimiento, en procura de mejorar factores de la competitividad y promover cambios socioeconómicos.

Recibido: de enero de 2015; Aceptado: de abril de 2016

ABSTRACT

This paper investigates if family ownership affects the firm's innovation activity. It characterizes familiar and innovative firms using the Resource-based View of the firm and the relevant factors to innovate and gain competitive advantages. In particular, the purpose is identifying the profile of innovative firms and analyzing if family ownership is a characteristic related to their innovative activity. To achieve this objective, we have applied a cluster analysis methodology in a sample of companies of the Spanish biotechnological industry in which innovation is core. The results show the relevance of the family characteristics on the characterization of those innovative firms, contributing to clarify the existing inconclusive literature between family and innovation, and helping stakeholders and policy-makers to make decisions about inversion or transference of knowledge which would help to improve competitiveness and promote socio-economic changes.

KEYWORDS:

Family firms, innovative activity, Resource-based View, cluster analysis.RESUMEN

Este artículo analiza si la propiedad familiar de una firma influye en su actividad de innovación. Para tales efectos, se caracterizaron empresas familiares e innovadoras que operan bajo el enfoque basado en recursos, así como los factores relevantes en sus procesos de innovación y de generación de ventajas competitivas. Específicamente, el objetivo de este trabajo es identificar el perfil de las empresas innovadoras y analizar si la propiedad familiar es una característica relacionada con sus iniciativas de innovación. Para lograr este objetivo, se aplicó una metodología de análisis de clústeres en una muestra de empresas de la industria biotecnológica española, dentro de la cual la innovación es un factor clave. Los resultados muestran la importancia de las características de las familias en la consolidación de empresas innovadoras, contribuyendo a precisar aportes no concluyentes en la literatura acerca de la relación familia-innovación. Así mismo, los resultados pretenden ayudar a los stakeholders y a los responsables de las políticas organizacionales en sus procesos de toma de decisiones frente a asuntos relacionados con la inversión o transferencia de conocimiento, en procura de mejorar factores de la competitividad y promover cambios socioeconómicos.

PALABRAS CLAVE:

empresas familiares, actividad innovadora, enfoque basado en recursos, análisis de clusters.RESUMO

Este artigo analisa se a propriedade familiar de uma empresa influencia em sua atividade de inovaçào. Para isso, caracterizaram-se empresas familiares e inovadoras que operam sob a abordagem baseada em recursos, bem como os fatores relevantes em seus processos de inovaçào e geraçào de vantagens competitivas. Em específico, o objetivo deste tra-balho é identificar o perfil das empresas inovadoras e analisar se a pro-priedade familiar é uma característica relacionada com suas iniciativas de inovaçào. Para atingir esse objetivo, foi aplicada uma metodologia de aná-lise de clusters numa amostra de empresas da indústria biotecnológica es-panhola, dentro da qual a inovaçào é um fator fundamental. Os resultados mostram a importancia das características das famílias na consolidaçào de empresas inovadoras, o que coopera para a precisào de contribuiçôes nào conclusivas na literatura sobre a relaçào família-inovaçào. Além disso, os resultados pretendem ajudar os stakeholders e os responsáveis pelas políticas organizacionais em seus processos de tomada de decisóes diante de assuntos relacionados com o investimento ou a transferencia de conhe-cimento, à procura de melhorar fatores da competitividade e promover mudanças socioeconómicas.

PALAVRAS-CHAVE:

abordagem baseada em recursos, análise de clusters, atividade inovadora, empresas familiares.RÉSUMÉ

Cet article analyse si la propriété familiale d'une entreprise influe sur son activité d'innovation. À cet effet, on a caractérisé des entreprises innovantes et familiales qui opèrent sous une approche fondée sur les ressources ainsi que les facteurs pertinents dans leurs processus d'innovation et de génération d'avantages concurrentiels. Plus précisément, le but de cet article est d'identifier le profil des entreprises innovantes et d'analyser si la propriété familiale est une caractéristique liée à leurs initiatives d'innovation. Pour atteindre cet objectif, on a appliqué une méthode d'analyse de clusters sur un échantillon d'entreprises espagnoles dans l'industrie de la biotechnologie, dans lesquelles l'innovation est un facteur clé. Les résultats montrent l'importance des caractéristiques des familles dans la consolidation des entreprises innovantes, contribuant ainsi à préciser des contributions non concluantes dans la littérature sur la relation famille-innovation. De même, les résultats visent à aider les parties prenantes et les responsables des politiques d'organisation dans leurs processus de prise de décisions par rapport aux questions liées à l'investissement ou le transfert de connaissances, en cherchant à améliorer les facteurs de compétitivité et promouvoir les changements socio-économiques.

MOTS-CLÉ:

entreprises familiales, activité d'innovation, approche fondée sur les ressources, analyse de clusters.Introduction

A key element for a family entrepreneur who wishes to develop value-adding activities is the innovative nature of the business and the close relationship of innovation with knowledge generation and transfer. On the one hand, literature about family firms notes the importance of family business to a vibrant economy and, on the other hand, the role of innovation as one of the motors of economic growth (Schumpeter, 1939), recognizing the significance of knowledge as a key resource and the importance of its transference to obtain innovation and, as a result of the innovation, competitiveness and economic growth (Drucker, 1993, 2001; Harris, 2001; Hagedoorn & Wang, 2012; Hoogenboom, Trommel & Bannink, 2008; Nonaka, 1994; Spender, 1996). Therefore, innovation is recognized as one of the keys to restore economic growth in the global recession that began around the end of the first decade of the 21st century, whose end is being debated at present, and which has been affecting Europe and Spain (Cabrales et al., 2009; Krugman, 2012).

From the framework of the Resource-based View (rbv), successful innovation allows a firm to get something unique that its competitors lack in order to build a competitive advantage (Andriopoulus & Lewis, 2010; Barney, 1991; Hill & Jones, 2008; Mayer, Somaya & Williamson, 2012; Sawang & Unsworth, 2011; Teece, 2010). This context led us to study and identify those factors of a firm which are relevant for innovating and thus gaining a competitive advantage. Among these factors we wonder if the ownership of innovative firms, in particular family ownership, could be a characteristic linked to their innovative activity. But not only the competitive advantage and the economic growth led us to study this relationship. Also, literature about family firms points out the relevance and prevalence of this type of ownership structure, suggesting that most firms in the world are controlled by their founders and heirs, who are directly involved in creating employment, generating innovation technology and improving life quality (Astrachan, Zahra & Sharma, 2003; Colli, Fernandez-Perez & Rose, 2003; Schulze et al., 2001). A report by the European Commission (2009) concludes that more than 60% of all European companies are family-owned and their contribution to the cdp is around 50%. The number of this kind of firms will increase in the future because a great number of unemployed will set up their own businesses as the only way to obtain income during the global recession (Cabrales et al., 2009; Krugman, 2012). These firms will then become family businesses.

However, when analyzing innovation in family firms, the empirical evidence and the preceding literature do not provide conclusive results in this regard (Carnes & Ireland, 2013; Penney & Combs, 2013). The impact of the firms' ownership on innovative activities is a research area pending an in-depth analysis: some authors suggest that innovation and entrepreneurial activities are stimulated among family firms (Chen, Tsao & Chen, 2013; Craig & Di-brell, 2006; Craig & Moores, 2006; Lodh, Nandy & Chen, 2014), while others say these firms are not as innovative as non-family firms (Classen et al., 2014) since they avoid entrepreneurial activities and risk in their decision-making process (Carney, 2005; Naldi et al., 2007). Therefore, in the family firm research area scholars have theorized different points of view about the relationship between innovative activity and family ownership. Besides, previous research has not focused on characterizing innovative firms to study the link between ownership and the innovative activity.

At this point, it is relevant to consider Damanpour (1991) about the importance of distinguishing among the types of organizations in innovation research, considering that in family firm research empirical studies have generally analyzed the role of innovation in public non-family and family firms, without focusing on a specific industry (Craig & Dibrell, 2006; Craig & Moores, 2006; Kellermanns et al., 2008; Lodh, Nandy & Chen, 2014; Zahra et al., 2004). That is the reason we conduct our empirical study on a specific industry in which innovation is decisive and core, in order to study the variables 'innovative activity' and 'family ownership' as main characteristics or factors to develop high importance resources and capabilities that result difficult to implement and imitate. Thus, we analyze the Spanish biotechnological industry focusing on firms for which innovation is a core element, as in the case of biotech business (Gottweis, 1998), since their potential in the innovation process has been recognized in the industrialized countries, where governments have supported the transference of the technical and scientific knowledge from the labs to the firms. In this area there is a major research context where we analyze innovative activity and family ownership and make a description and a characterization of the firms.

Consequently, in this paper, we will pay special attention to family firms and their links with innovation in order to find new ways to foster economic growth and society welfare. In particular, the aim of this paper is to identify the profile of innovative firms and analyze if ownership, family ownership specifically, is a characteristic related to their innovative activity. Several reasons motivated this study: the relevance of family businesses for a vibrant economy (Astrachan et al., 2003; Colli et al., 2003); the significance of innovation for firms and the growth of economies (Barney, 1991; Hill & Jones, 2008; Schumpeter, 1939); the different points of view posed about the relationship between innovative activity and family ownership (Carnes & Ireland, 2013; Penney & Combs, 2013); the relevance of establishing a typology and a characterization of r&d systems (Berchicci, 2013; Buesa et al., 2006); and different considerations around the importance of distinguishing types of organizations in innovation research (Damanpour, 1991).

To achieve this objective, we have used a cluster analysis following the approach proposed by Hair et al. (1999) in using the advantages of both continuous and categorical variables (Hair et al, 1999; Uriel & Aldas, 2005).

The contribution of our analysis is both theoretical and practical. It is theoretical because our proposal links three relevant elements in family business and organizational literature that have rarely been empirically researched together: family firms, innovative activity and biotechnolog-ical industry. Moreover, we have analyzed the questioned link between family ownership and innovation activity from the rbv approach, as a framework which allowed us to integrate innovative activity and ownership, focusing our attention on firms where innovation is core and looking for those relevant variables of the family firms which lead them to develop key resources and capabilities for innovation, and thus for the generation of a competitive advantage. Besides, we have adopted a quantitative methodology rarely used in the preceding literature to study the relation between family ownership and innovative activity, as it is the case of cluster analysis methodology, which is appropriate to empirically characterize cases of a sample.

Additionally, from a practical point of view, family firms, bio-technological firms' stakeholders and policy-makers would benefit from understanding the profiles of innovative firms, the factors that contribute to strengthen resources and capabilities, to develop competitive advantages and to make decisions accordingly, in such a way these firms grow correctly and create a biotechnological industry that promotes socio-economic growth. Besides the former contributions, it is important to state that this paper is the first empirical study in analyzing and clarifying family firms and innovation phenomenon on a sample of biotechnological Spanish firms. Moreover, in family firms' literature there is a lack of studies about this industry, despite the fact that the potential of biotechnology innovation process has been recognized in industrialized countries as a way to develop a knowledge-based economy and overcome the global recession.

The paper is organized as follows: first, in section two we review the theoretical foundations on the specific links between innovation activity and family ownership, and it also focuses on identifying the variables of the study; then, in section three we describe the sample used to develop the empirical analysis, the research objective of the paper and additionally we present the quantitative analysis; section four introduces the results of the study; and section five presents the main conclusions and limitations of this research exercise.

Innovative Activities in Family Firms

Existing literature on family firms has studied the impact of firms' ownership on innovation activities following different theoretical drivers such as Stewardship Theory (Craig & Dibrell, 2006), Agency Theory (Lodh, Nandy & Chen, 2014; Zahra, 2005), the socioemotional wealth (Gomez-Mejia et al, 2007) or the rbv (Carnes & Ireland, 2013; Zahra et al, 2004). However, innovation in family firms is a research area pending an in-depth analysis, since literature does not provide conclusive results (Carnes & Ireland, 2013; Penney & Combs, 2013).

From the rbv, we examine the conflictive link between family firm ownership and innovation activity, which was described above in order to integrate and extend both research areas. This idea is supported by the fact that in family firm research areas empirical studies have mainly analyzed the role of innovation in public family and non-family firms without a particular focus on a specific industry (Craig & Dibrell, 2006; Craig & Moores, 2006; Kellermanns et al, 2008; Lodh, Nandy & Chen, 2014; Zahra et al, 2004). Given that this idea may partially support the mixed empirical results about the link between family ownership and their innovation activity, we propose to conduct our empirical study on a specific industry in which innovation is decisive and core.

Therefore, the rbv allows us to study and identify relevant factors or variables in family firms which lead them to innovate and thus gain a competitive advantage and higher incomes. Moreover, thinking of innovation as a key element for firms' success leads us to rbv, which points out that we must research those factors or variables that better explain firms' final results.

Variables

In order to study and identify variables in family firms where innovation is core, we have made a literature review looking for variables and measures commonly used to study the link between family ownership and innovation activity, both in family firm research area and/or in rbv approach. In general, in literature about family firms, empirical studies use 'innovative activity' as a dependent variable and 'family ownership' as an independent one. Therefore, we have used these two variables to characterize the innovative firms of the sample. However, the following variables are also regularly used as control variables according to literature: firm size, age, past financial performance and liquidity. Consequently, we have decided to include them in the analysis to test whether they are significant in characterizing the firms.

Additionally, we have decided to introduce the variable 'entrepreneurial risk taking' for the following reasons: innovations, along with the role of the entrepreneur, are some of the most important factors to build competitive advantages (Barney, 1991; Hill & Jones, 2008); the role of the entrepreneur is important since is the person developing the innovative activity of a firm and, therefore, making decisions to take the entrepreneurial risk of innovation (Craig & Dibrell, 2006); and because in family firm research area some papers suggest to study the linkages between innovation and entrepreneurial risk-taking (Zahra et al, 2004). These reasons let us think there could be a linkage between ownership, the innovative activity and entrepreneurial risk-taking, being this variable also relevant to characterize the firms in the sample.

Accordingly, we have identified the following variables and measures:

Innovative activity: Firms' innovative activity is measured by the r&d expenditure/sales ratio, which is proportional to a firm innovation commitment. This ratio is a common measure of a firm's input to innovation process and allows comparison between firms (David, Hitt & Gimeno, 2001; Hitt et al, 1996; Kim, Kim & Lee, 2008; Renko, Carsrud & Bránnback, 2009).

Entrepreneurial risk-taking: Entrepreneurial risk-taking is usually measured by the debt/equity ratio since this measures financial risk. When a firm has an important debt it is said it has a high financial risk. Comparing companies that have taken risk investing in capital, the debt/equity ratio is greater in capital-intensive industries than in noncapital intensive industries (Zahra, 2005). In general, the suitable data for this index should consider a function of the profitability of the company, as well as the index of the industry.

Family ownership: A business is considered a family firm if both of the following conditions are met: first, two or more directors have a family relationship and, second, family members must hold a substantial proportion of equity (Gomez-Mejia, Makri & Larraza, 2010; Jones, Makri & Gomez-Mejia, 2008). In our study the 'family ownership' variable is a dummy variable (1/0) measured by the percentage of firm's stock held by the owner family. We have imposed a 10 per cent ownership threshold to ensure that the owner family held a substantial percentage of the firm's equity and at least two members of the board were family (Muñoz-Bullón & Sanchez-Bueno, 2011; Zahra, 2005).

Firm size: Sathe (2003) states that larger firms might resist change and innovation because these companies subject ideas for radical innovation to iterative reviews that stifle entrepreneurial ventures. Zahra asserts that "larger family firms have well-established connections within and outside their industries, making it possible for them to join strategic alliances and intensify entrepreneurial activities" (2005, p. 32). Therefore, firm size might have an effect on innovative activity and entrepreneurial risk-taking. To measure firm size, we use firm's total assets (Baysinger et al., 1991; Zahra et al, 2004).

Firm's age: Following Cairncross (1992), in the mature stage of life firms have the resources to exploit opportunities and introduce new products and services. Therefore, firm's age also has an effect on innovative activity and entrepreneurial risk-taking. To measure firms' age, this study uses the number of years the firm has been in existence (Zahra, 2005; Zahra et al., 2007).

Past financial performance: A successful past performance may affect innovative activity and entrepreneurial risk-taking because managers could reduce their wish to face entrepreneurship. If the firm is doing well managers could have no incentives to disrupt the status quo. Nevertheless, a successful past performance also provides resources that could encourage managers to carry out entrepreneurial activities. To measure firms' past performance, we use the firm's average return on assets (roa) over the preceding three-year period (Kim, Kim & Lee, 2008; Zahra, 2005).

Liquidity: Previous research has found that levels of liquidity could influence the amount of funds the firm has available in the current period for developing innovative activity and entrepreneurial risk-taking. A common measure of liquidity is the ratio: current assets/current liabilities (Baysinger & Hoskisson, 1989; Hitt et al. 1996).

Empirical Analysis, Sample and Methodology Sample

As it was noted, we propose as the objective of this paper to look for a profile of innovative firms and analyze if ownership, concretely family ownership, is a characteristic related to their innovative activity. To reach this, we have used a sample drawn from sabi database owned by Bureau van Dijk. This database contains comprehensive information about Spanish and Portuguese companies, such as financial statements, financial strength indicators, directors and contacts, original filings/images, detailed corporate structures, audit report, etc. We selected Spanish firms who are classified in cnae code 7211. cnae is the National Classification of Economic Activities compiled according to the conditions set out in the nace Regulation (statistical classifications of economic activities developed since 1970 in the European Union). The code 7211 groups the firms whose activity is the experimental r&d in biotechnology.

Our data comprise financial data up to December 31st 2013. As result we obtained 243 firms. In order to discard those cases that could invalidate the results of the empirical analysis (e.g., cases with too much missing data) we followed the methodology proposed by Lehmann, Gupta and Steckel (1998), and Santesmases (2009). In addition, we eliminated outliers.

Methodology

We used a cluster analysis following the approach proposed by Hair et al. (1999), which consists of using a combination of methods for continuous and categorical variables, taking the advantages of both proposals (Hair et al., 1999; Uriel & Aldas, 2005), and employing spss software. In this paper, the analysis is conducted with the aim of formulating a taxonomy or empirical classification for the biotechnology firms of the sample and for analyzing if ownership is a characteristic related to their innovative activity.

In our research the variables are measured on different scales; to avoid inconsistencies in the analysis we have standardized them (Uriel & Aldas, 2005). In the first step, we have used the hierarchical method of Ward in order to define the number of clusters. Then, in the second step, to determine the final composition of the groups we have employed the two-step cluster analysis method, which is suitable for the joint use of continuous and categorical variables.

Previously, theoretical considerations allow us to identify seven relevant variables that would characterize the biotech firms: innovative activity, entrepreneurial risk taking, family ownership, firm size, firm age, past financial performance and liquidity, measured as previously discussed.

Hierarchical Cluster Analysis

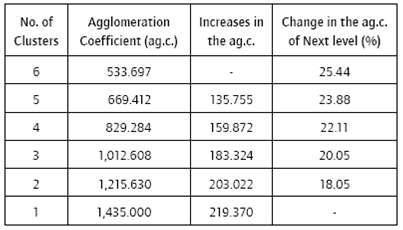

To apply the hierarchical method we have chosen Ward's proposal, using the Euclidean distance squared as a measure (Hair et al., 1999). As a point of reference to choose the most appropriate number of clusters we have used the agglomeration coefficient. When two very different clusters are joined it produces a very large coefficient or a high percentage of change in the coefficient. We look for large increases in the coefficient in order to stop the fusion of groups. We can see in table 1 considerable increases in passing from one number of clusters to the next number.

Source: Own elaboration.Table 1:

Agglomeration coefficient analysis for the Ward's method.

As seen in table 1, the higher agglomeration coefficients are for 3, 2 and 1 clusters. These coefficients show significant increases when going from 3 to 2 clusters (1,215.630 -1,012.608 = 203.022) and from 2 to 1(1,435.000 - 1,215.630 = 219.37). Therefore, if clusters 3 and 2 join we would be mixing very different groups, which would be detrimental to their internal homogeneity. The same would be applied if clusters 2 and 1 join. Besides, in order to identify agglomeration coefficients with large increases, in the same table we also calculated the percentage changes when going from 6 to 2 clusters. As we can see, the increase in the percentage of change when going from 2 clusters to 1 is large (18.05% = {(1,435 - 1,215.63)/1,215.63)}x100) and the change that occurred when going from 3 to 2 clusters (20.05%) is also remarkable.

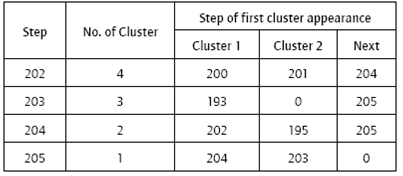

Then, we identified those atypical individuals in the solutions of 2 and 3 clusters obtained by Ward's method. Table 2 shows the scheme agglomeration for the last 4 steps (from step 198 to 199) of the analysis. This information is useful in identifying unique individuals which were joined to the grouping process late (e.g. potential outliers).

Source: Own elaboration.Table 2:

Agglomeration scheme from step 198 by Ward's method.

Table 2 shows in the last three columns the steps in which each one of the clusters is formed. Thus, a company that never has joined to a group has the 0 level. As can be seen, in step 203 (3 clusters) a new cluster is derived from merging a cluster with a unique firm and one cluster that had arisen as others join in step 193. In sum, the selection of 3 or less clusters eliminates the problem of the firm which had not previously joined any group.

Two-step Cluster Analysis

In this second phase of cluster analysis, the two-step method has been used because it allows segmenting a sample simultaneously using categorical and continuous variables. To proceed with this method, the variables are standardized since they are measured in different scales. Log-likelihood is chosen as measure of distance because there are continuous and categorical variables. This measure assumes that continuous variables follow a normal distribution while a multinomial distribution is adopted by the categorical variables, and that both are independent. However, the procedure works reasonably well although these assumptions are not met.

Furthermore, with this method, a fixed number of clusters in which it is desired to segment the sample of individuals may or not be specified. In this case, we first perform the analysis using the statistical program in order to determine the number of clusters automatically, and subsequently, we proceed with a specific number of three clusters. The optimal number of groups obtained automatically with the Schwarz Bayesian criterion has been 2, while using the Akaike information criterion has resulted in 4. Therefore, the recommended number of clusters is between 2 and 4, which supports the decision of segmentation in 3 clusters taken from the previous analysis following Ward's method.

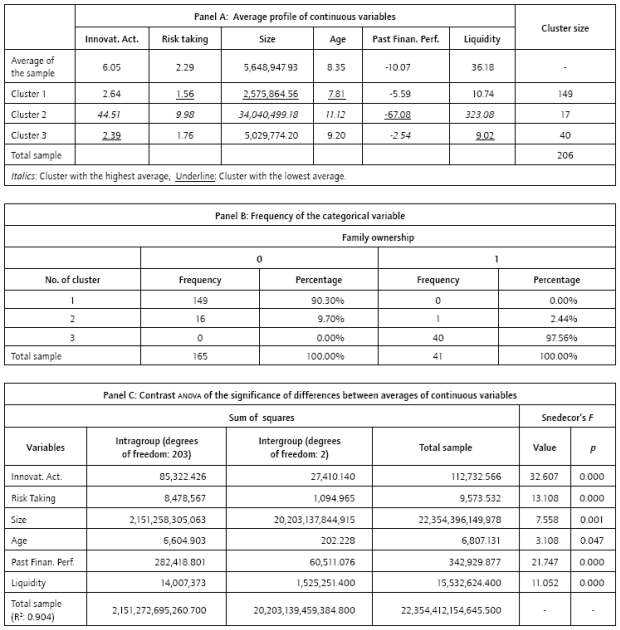

Table 3 shows the profile of the variables used for segmentation in three clusters. The last column exhibits the distribution of clusters: the largest cluster is the number 1 with 149 companies, followed by number 3 with 40 and number 2 with 17.

The previous profile analysis reveals the following sequence. Cluster 1 (149 companies) shows lower values than the glo bal average of the sample for all continuous variables, except past financial performance. The 149 companies comprising such value are 'non-family' firms. Cluster 2 (17 companies) shows higher values than the global average of the sample on continuous variables: innovative activity, entrepreneurial risk-taking, size, age, and liquidity, as well as a lesser value in the past financial performance variable; moreover, of the 17 companies that form this group, 16 are 'non-family' firms and 1 is family owned. Finally, cluster 3 (40 companies) shows higher values than the global average of the sample for age and past financial performance. The size variable approaches the average despite being lower. Additionally, the 40 companies that compound the cluster are all family owned.

Source: Own elaboration.Table 3:

Profiles of the averages of the variables used in obtaining the solutions of three clusters (two-step method).

The anova contrast is also developed in table 3, showing the significance of the difference between the averages of continuous variables with respect to the sample average (Snedecor's F). As shown in the table, the difference is significant for the 0.05 level. Therefore, the null hypothesis of the anova analysis of no difference between the averages observed for these variables is rejected. Finally, the percentage of the total variance of the sample explained by the segmentation in two clusters (R2) is 90.4%.

Results

Characterization and Typology of Spanish Biotech Firms

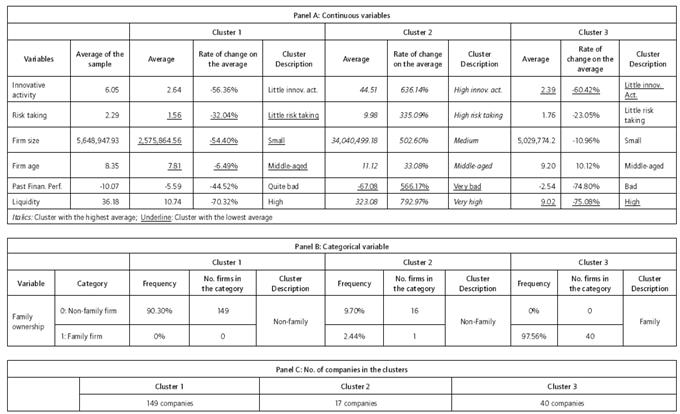

As we have mentioned above, table 3 shows three clusters with different profiles considering the variables selected to develop the method of two-step analysis. Following, table 4 illustrates averages or categories for each variable. Additionally, the average or frequency of each variable, the rate of change on the average of the sample, the number of companies in each category and an interpretation of these results or cluster description are displayed for the three groups. These data allow to get a general profile of the Spanish biotech companies regarding the main variables which characterize them.

Firms in the First Cluster

The 149 Spanish biotech firms that shape the first cluster are characterized by the following factors:

-

They are less innovative compared to the average of the sample (6.05). That is because their rate of innovation (2.64 on average), measured as R&D in 2010 divided by sales in 2010 (variable 'innovative activity'), has a rate of change of -56.36% compared to the global average.

-

They assume little risk compared to the average of the sample (2.29). This is because their risk-taking index (1.56), measured by the debt in 2010 divided by equity ratio in 2010 (variable 'entrepreneurial risk taking'), shows a variation rate of -32.04% with respect to the average of the sample. As already mentioned in section 3, in general, the suitable data for this index, which measures the financial risk of a firm, should be a function of the profitability of the company and of the referencing index of the industry.

-

They are small business (the smallest of the three clusters) following the classification made by the European Commission in its recommendation C (2003) 1422 about the amount of assets. The average amount of assets of the firms that make up this group (2,575,864.46 € in 2010) exceeds 2M. € but does not reach 10M. €.

-

They are middle-aged companies (7.81 years of media from their foundations until 2010), although they are the youngest in the sample, following the classification made by Berger and Udell (1998). According to this classification, firms with ages between 5 and 24 years are middle-aged.

-

Their past financial performance measured as the average return on assets (net income/total assets) for 2008, 2009 and 2010 can be considered quite bad (-5.59). This is due to the fact that while it is negative, as for the average of the sample (-10.7), is a 44.52% not as bad.

-

Joint liquidity of Spanish biotech firms in the first cluster, measured as current assets divided by current liabilities for the year 2010, is high. The reason is that this variable shows an average of 10.74 when good values are generally accepted between 1.5 and 2. This could mean that firms have excessive liquidity resources which would reduce their profitability. The index average for the sample also shows an excessive value (36.18); however, the average of the companies within this cluster is better, since it is 70.32% lower than the total average.

-

Firms in this group are non-family businesses because, as previously shown in table 4, all companies in cluster 1 (149) belong to this category.

Source: Own elaborationTable 4: Description of the clusters obtained by two-step cluster analysis procedure.

Firms in the Second Cluster

Regarding the 17 biotech firms grouped in cluster 2, with data for 2010, they are characterized by the following features:

-

They are highly innovative businesses compared to the average of the sample (6.05) because their rate of innovation (44.51 on average) is the highest of the industry. They have a change rate of 636.14% compared to the global average.

-

They assume high risk when comparing them with the average of the sample (2.29), given that their entrepreneurial risk-taking index (9.98) shows a variation rate of 335.09% with respect to the average of the sample.

-

They are medium size firms (the largest of the three clusters) because the average amount of assets (34,040,499.18 € in 2010) exceeds 10M. € but does not reach 43M. €.

-

They are middle-aged companies (11.12 years average) because they are between 5 and 24 years.

-

Their past financial performance, measured as the average return on assets for 2008, 2009 and 2010, is very bad (-67.05). It is the worst of the three clusters due to the fact that while it is negative, as the average of the sample (-10.7), it is 566.17% worse than the average.

-

The liquidity of the firms grouped in the second cluster is very high (323.08), the highest of the industry. As aforementioned, good values are generally accepted between 1.5 and 2. The average of the sample shows an excessive value (36.18); however, the average for firms in this cluster is 792.97% higher than the total average. Therefore, this could mean these firms are accumulating resources, which would reduce the profitability.

-

They are non-family firms due to the fact that 16 of the 17 group companies are classified in this category.

Firms in the Third Cluster

In addition, the 40 Spanish biotech firms in cluster 3, with data for 2010, are characterized as follows:

-

They are less innovative compared to the average of the sample (6.05); specifically, they are the least innovative of the industry. Table 4 shows the average of innovative activity index for this group is 2.39, the lowest of the three clusters, and also less than the average of the sample in 60.42%.

-

They assume little risk compared to the average of the sample (2.29). Their risk-taking index (1.76) shows a variation rate of -23.05% with regard to the average of the sample.

-

They are small firms since their average amount of assets (5,029,774.20 € in 2010) exceeds 2M. € but does not reach 10M. €.

-

They are middle-aged firms (9.20 years average) since they are between 5 and 24 years old.

-

The joint past financial performance of the firms in the third cluster is bad (-2.54), although this index is the least "bad" of the three clusters. The cluster shows a negative index but as the average of the sample is -10.7, the average of this cluster is 74.80%.

-

The liquidity of firms of the third cluster is high (9.02) because this index exceeds the values generally accepted as "good" (between 1.5 and 2). The average of the index of the sample is also excessive (36.18); however, the average of the index of this cluster is 75.08% lower. To sum up, as in the other two clusters, in this group there could be firms accumulating resources, thus reducing their profitability.

-

They are family firms due to the fact that all the companies of cluster 3 (40) belong to this category.

Relation between Family Ownership and Innovative Activity

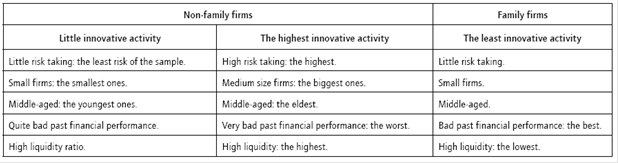

A summary of relevant information is outlined in table 5, which presents the typology of Spanish biotech firms. The cluster analysis shows the relation between family ownership and innovative activity as follows:

-

Most of the Spanish biotech companies (149 firms) are non-family firms that develop little innovation activity. In addition, they take the least risk of the sample and are the smallest and youngest firms of the industry, although they are middle-aged, they also have a quite irregular past financial performance and high liquidity (cluster 1).

-

The most innovative firms (17 firms) are non-family firms. They take the highest level of risks within the industry and are medium-sized. They are also the biggest and oldest firms and report the worst past financial performance and the highest liquidity ratio (cluster 2).

-

The least innovative firms (40 firms) are family firms. Apart from taking few risks they are small and middle-aged firms, reporting a bad past financial performance and high liquidity; however, these two variables are the least negative of the industry (cluster 3).

It seems that innovative Spanish biotech businesses are medium-sized non-family firms which take a high entrepreneurial risk, whereas the least innovative are small family firms taking little entrepreneurial risk. There are other features that characterize each cluster, such as age, past financial performance and liquidity; these are least determinant in characterizing each group given that, in general, all firms in the sample are middle-aged with a negative past financial performance and a high liquidity ratio.

Considering the before mentioned, looking for a profile of innovative firms, from the analysis in tables 4 and 5 we can conclude that in the sample of Spanish biotech firms there is a relationship between family ownership and innovative activity, given that family firms develop the least innovative activity (40 in cluster 3), whereas non-family firms (166 in cluster 1 and 2) develop the highest innovative activity or a medium-low innovative activity. Therefore, this result clarifies the profile of the firms of the sample and corroborates the stream in family firms research area mentioned in the introduction, stating the negative link between family firm and innovation (Carney, 2005; Naldi et al., 2007; Classen et al., 2014).

Source: Own elaboration.Table 5:

Typology of Spanish biotech firms based on their characteristics.

Conclusion and Limitations

Our proposal has been to identify the profile of innovative firms and analyze a sample of biotechnological firms in order to determine whether ownership, specifically family ownership, is a characteristic related to their innovative activity. We conducted the empirical analysis based on a sample of innovative firms for several factors related to the relevance of the family business regarding innovation activity, the significance of innovation to the firms and to the growth of economies, the inconclusive literature about the relationship between innovative activity and family ownership and the relevance of distinguishing types of organizations for innovation research. Additionally, we have proposed to conduct our empirical study on a specific industry in which innovation is a decisive and core aspect, that is, biotechnology industry.

Thus, following the rbv of the firm and judging innovation as a key element for firms' success, we have researched about the variables that better explain firms' results, looking at their very heart. Additionally, we have examined the linkage between family firm ownership and innovation activity, supporting the research in the idea of integration and extending both research areas, and thus shedding some light on the mixed empirical results concerning such relation (Carnes & Ireland, 2013; Penney & Combs, 2013).

To achieve the objective of formulating a taxonomy for biotechnology firms, we have employed a cluster analysis using a combination of two methods, obtaining the advantages of the hierarchical cluster analysis for continuous variables along with the strengths of the two-step cluster analysis for continuous and categorical variables. In addition, the novelty of employing these two approaches at the same time has allowed us to provide reliability to the analysis and corroborate results.

After conducting this analysis, we concluded that the most innovative Spanish biotech firms are medium size non-family firms, which report taking the highest entrepreneurial risk within this industry, while the least innovative firms are small family firms taking little risk. On the other hand, most Spanish biotech businesses that develop a medium-low innovative activity are small non-family firms which take the least entrepreneurial risk of the industry. Therefore, we can conclude that the innovative Spanish biotech firms are non-family firms, whereas the least innovative are the family firms.

These results clarify the profile of the analyzed firms and corroborate the stream in family firms' research area that points out the negative linkage between innovation and family ownership (Carney, 2005; Classen et al., 2014; Naldi et al., 2007). This negative relation could be due to the fact that family firms within biotech industry become conservative or develop inefficiencies, avoiding the entrepreneurial risk-taking associated with innovation; however, these two factors are core characteristics to develop key resources and capabilities to implement strategies difficult to imitate and acquire competitive advantages.

This conclusion is important for family firms since it could help stakeholders and policy-makers to make decisions about investments, knowledge transfer, training or subsidies which would help firms grow and act orderly, promoting socio-economic changes and improving competitiveness and economic growth. We consider this analysis will also help innovative firms' stakeholders and policy-makers to clarify and understand the dynamics and the profiles of this kind of firms and make decisions accordingly when acknowledging the relationship between ownership and the innovative activity of a firm. This first analysis of characterizing family firms and innovation phenomenon is especially relevant for the biotechnological industry. Let us remember the potential of this industry for the innovation process of developing a knowledge-based economy and overcoming the global recession.

To conclude, in order to overcome the limitations of this study, we propose an in-depth analysis of innovation resources and capabilities identified in the typology suggested in table 5, which leads family firms to gain competitive advantages. Currently, the main analysis of the paper is based on the rbv to find a profile of innovative family firms without looking for correlations or interactions between variables. However, this is a future alternative analysis to find explanations to the negative relation between innovative activity and family ownership.

Future research agendas may consider an alternative approach, e.g. socioemotional wealth, to study if this negative relation can be validated. This would provide a better understanding of the inefficiencies and reasons for some family firms to become conservative and avoid innovation-related risk-taking. In addition, it would be interesting to extend this analysis to other industries in order to generalize results, contributing to clarify the conflicting relations between innovation and family ownership.

References

Referencias

Andriopoulus. C, & Lewis, M.W (2010). Managing innovation paradoxes: am-bidexterity lessons from leading product design companies. Long Range Planning, 43(1), 104-122. doi 10.1016/j.lrp.2009.08.003.

Astrachan, J. H., Zahra, S. A., & Sharma, P. (2003). Family-sponsored ventures. Kansas: Kauffman Foundation.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. doi: 10.1177/014920639101700108.

Baysinger, B. D., & Hoskisson, R. E. (1989). Diversification strategy and R&D intensity in multiproduct firms. Academy of Management Journal, 32(2), 310-332. doi: 10.2307/256364.

Baysinger, B. D., Kosnik, R. D., & Turk, T. A. (1991). Effects of Board and Ownership Structure on Corporate r&d Strategy. Academy of Management Journal, 34(1), 205-214. doi: 10.2307/256308.

Berchicci, L. (2013). Towards an open r&d system: internal r&d investment, external knowledge acquisition and innovative performance. Research Policy 42(1), 17-127. doi 10.1016/j.respol.2012.04.017.

Berger, A. N., & Udell, G. F. (1998). The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in the Financial Growth Cycle. Journal of Banking and Finance, 22(6-8), 613-673. doi 10.1016/S0378-4266(98)00038-7.

Buesa, M., Heijs, J., Pellitero, M., & Baumert, T. (2006). Regional systems of innovation and the knowledge production function: The Spanish case. Technovation, 26(4), 463-472. doi 10.1016/j.technovation.2004.11.007.

Cabrales, A., Dolado, J. J., Felgueroso, F., & Vázquez, P. (Coordinadores) (2009). La Crisis de la Economía Española-Lecciones y Propuestas. Madrid: Fundación de Estudios de Economía Aplicada- fedea. Accessed in December, 2014 from: Accessed in December, 2014 from: http://www.crisis09.es/ebook/ . [Full Text]

Cairncross, F. (1992). Costing the earth. Boston: Harvard Business School Press.

Carnes, C. M., & Ireland, R. D. (2013). Familiness and Innovation: Resource Bundling as the Missing Link. Entrepreneurship Theory and Practice, 37(6), 1399-1419. doi: 10.1111/etap.12073.

Carney, M. (2005). Corporate governance and competitive advantage in family-controlled firms. Entrepreneurship: Theory and Practice(May), 249-265. doi: 10.1111/j.1540-6520.2005.00081.x.

Chen, V. Y. S., Tsao, S., & Chen, G. (2013). Founding family ownership and innovation. Asia - Pacific Journal of Accounting & Economics, 20(4), 429-456. doi: 10.1080/16081625.2012.762971.

Classen, N., Carree, M., Van-Gils, A., & Peters, B. (2014). Innovation in family and non-family smes: an exploratory analysis. Small Business Economics, 42(3), 595-609. doi: 10.1007/s11187-013-9490-z.

Colli, A., Fernandez-Perez, P., & Rose, M. (2003). National determinants of family firm development: Family firms in Britain, Spain and Italy in the 19th and 20th centuries. Enterprise & Society, 4(1), 28-65. doi:10.1093/es/4.1.28.

Craig, B. L., & Moores, K. (2006). A 10-year longitudinal investigation of strategy, systems, and environment on innovation in family firms. Family Business Review, 19(1), 1-10. doi: 10.1111/j.1741-6248.2006.00056.x.

Craig, J., & Dibrell, C. (2006). The natural environment, innovation, and firm performance: A comparative study. Family Business Review, 19(4), 275-288. doi: 10.1111/j.1741-6248.2006.00075.x.

Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555-590.

David, P., Hitt, M. A., & Gimeno, J. (2001). The influence of activism by institutional investors on r&d. Academy of Management Journal, 44(1), 144-157. doi: 10.2307/3069342.

Drucker, P. (1993). Post-capitalist Society. Oxford: Butterworth-Hainemann.

Drucker, P. (2001). The next society. The Economist. November 3rd, 3-22. Accessed December 2014 from: Accessed December 2014 from: http://www.economist.com/node/770819 . [Full Text]

European Commission (2009). Overview of family-business-relevant issues: Research, networks, policy measures and existing studies. Brussels: European Commission.

Gomez-Mejia, L. R., Haynes, M., Nuñez-Nickel, K. J., Jacobson, L., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106-137. doi:10.2189/asqu.52.1.106.

Gomez-Mejia, L. R., Makri, M., & Larraza-Kintana, M. (2010). Diversification decisions in family controlled firms. Journal of Management Studies, 47(2), 223-252. doi: 10.1111/j.1467-6486.2009.00889.x.

Gottweis, H. (1998). The Political Economy of British Biotechnology. In A. Thackray (Ed.), Private Science: Biotechnology and the Rise of the Molecular Sciences (pp. 105-130). Philadelphia: University of Pennsylvania.

Hagedoorn, J., & Wang, N. (2012). Is there complementarity or substitutability between internal and external R&D strategies? Research Policy, 41(6), 1072-1083. doi 10.1016/j.respol.2012.02.012.

Hair, J. F., Anderson, E., Tatham, L., & Black, C. (1999). Análisis Multivariante. Madrid: Prentice-Hall.

Harris, R. (2001). The Knowledge-Based Economy: intellectual origins and new economic perspectives. International Journal of Management Reviews, 3(1), 21-40. doi: 10.1111/1468-2370.00052.

Hill, W. L. C., & Jones, G. R. (2008). Strategic Management. An integrated approach (8th Edition). Boston, ma, usa: Houghton Mifflin Company.

Hitt, M. A., Hoskisson, R. E., Johnson, R. A., & Douglas, D. M. (1996). The Market for Corporate Control and Firm Innovation. The Academy of Management Journal, 39(5), 1084-1119. doi: 10.2307/256993.

Hoogenboom, M., Trommel, W., & Bannink, D. (2008). European Knowledge Societies (plural): The Rise of New Knowledge Types and the Division of Labour in the eu. Intereconomics, 43(6), 359-370. doi: 10.1007/s10272-008-0269-4.

Jones, C. D., Makri, M., & Gomez-Mejia, L. R. (2008). Affiliate directors and perceived risk bearing in publicly traded, family-controlled firms: The case of diversification. Entrepreneurship: Theory and Practice, 32(6), 1007-1026. doi: 10.1111/j.1540-6520.2008.00269.x.

Kellermanns, F. W., Eddleston, K. A., Barnett, T., & Pearson, A. (2008). An exploratory study of family member characteristics and involvement: Effects ofentrepreneurial behavior in the family firm. Family Business Review, 21(1), 1-14. doi: 10.1111/j.1741-6248.2007.00107.x.

Kim, H., Kim, H., & Lee, P. M. (2008). Ownership structure and the relationship between financial slack and r&d investments: Evidence from Korean firms. Organization Science, 19(3), 404-418. doi: 10.1287/orsc.1080.0360.

Krugman, P. (2012). End This Depression Now. New York: W. W. Norton & Company.

Lehmann, D. R., Gupta, S., & Steckel, J. H. (1998). Marketing Research. Addison-Wesley New York: Educational Publishers.

Lodh, S., Nandy, M., & Chen, J. (2014). Innovation and Family Ownership: Empirical Evidence from India. Corporate Governance: An International Review, 22(1), 4-23. doi: 10.1111/corg.12034.

Mayer, K., Somaya, D., & Williamson, I. (2012). Firm-specific, industry-specific and occupational human capital, and the sourcing of knowledge work. Organization Science, 23(5), 1311-1329. doi: 10.1287/orsc.1110.0722.

Muñoz-Bullón, F., & Sanchez-Bueno, M. J. (2011). The impact of family involvement on the r&d intensity of publicly traded firms. Family Business Review, 24(1), 62-70. doi: 10.1177/0894486510396870.

Naldi, L., Nordqvist, M., Sjoberg, K., & Wiklund, J. (2007). Entrepreneurial orientation, risk taking, and performance in family firms. Family Business Review, 20(1), 33-47. doi: 10.1111/j.1741-6248.2007.00082.x.

Nonaka, I. (1994). A Dynamic Theory of Organizational Knowledge Creation. Organization Science, 5(1), 14-37. doi: 10.1287/orsc.5.1.14.

Penney, C. R., & Combs, J. G. (2013). Insights From Family Science: The Case of Innovation. Entrepreneurship Theory and Practice, 37(6), 1421-1427. doi: 10.1111/etap.12074.

Renko, M., Carsrud, A., & Brännback, M. (2009). The effect of market orientation, entrepreneurial orientation, and technological capability on innovativeness: A study of young biotechnology ventures in the United States and in Scandinavia. Journal of Small Business Management, 47(3), 331-369. doi: 10.1111/j.1540-627X.2009.00274.x.

Santesmases, M. (2009). Dyane versión 4. Diseño y análisis de encuestas en investigación social y de mercados. Madrid: Pirámide.

Sathe, V. (2003). Corporate Entrepreneurship: Top managers and new business creation. Cambridge: Cambridge University Press.

Sawang, S., & Unsworth, K. (2011). Why adopt now? Multiple case studies and survey studies comparing small, medium and large firms. Tech-novation, 31, 554-559. Doi 10.1016/j.technovation.2011.06.002.

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency Relationships in Family Firms: Theory and Evidence. Organization Science, 12(2), 99-116. doi: 10.1287/orsc.12.2.99.10114.

Schumpeter, J. (1939). Business Cycles. New York: McGrawHill.

Spender, J. C. (1996). Making Knowledge the Basic of a Dynamic Theory of the Firm. Strategic Management Journal, 17, 45-62. doi: 10.1002/smj.4250171106.

Teece, D. J. (2010). Business models, business strategyand innovation. Long Range Planning, 43(2-3), 172-194. doi 10.1016/j.lrp.2009.07.003.

Uriel, E., & Aldás, J. (2005). Análisis Multivariante Aplicado. Madrid: Thomson.

Zahra, S. A. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18(1), 23-40. doi: 10.1111/j.1741-6248.2005.00028.x.

Zahra, S. A., Hayton, J. C., & Salvato, C. (2004). Entrepreneurship in family vs non-family firms: A resource-based analysis of the effect of organizational culture. Entrepreneurship: Theory and Practice, 28(4), 363-381. doi: 10.1111/j.1540-6520.2004.00051.x.

Zahra, S. A., Neubaum, D. O., & Larrañeta, B. (2007). Knowledge sharing and technological capabilities: The moderating role of family involvement. Journal of Business Research, 60(10), 1070-1079. doi 10.1016/j.jbusres.2006.12.014.

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

CrossRef Cited-by

1. Cristina Aibar-Guzmán, Francisco M. Somohano-Rodríguez. (2021). Do Consumers Value Environmental Innovation in Product?. Administrative Sciences, 11(1), p.33. https://doi.org/10.3390/admsci11010033.

2. César Camisón, Alba Puig-Denia. (2020). Competitiveness, Organizational Management, and Governance in Family Firms. Advances in Business Strategy and Competitive Advantage. , p.90. https://doi.org/10.4018/978-1-7998-1655-3.ch004.

3. Maithm Khaghaany, Ameer Saheb Shaker, Anmar Noori Dawood, Akeel Hamza Almagtome. (2024). Sustainability, Innovation, and Value Creation in Developing Countries: Evidence from Iraq. Innovar, 34(94), p.e116817. https://doi.org/10.15446/innovar.v34n94.116817.

4. Mary A Barrett, Ken Moores. (2020). The what and how of Family business paradox: Literature-inspired distillations and directions. International Small Business Journal: Researching Entrepreneurship, 38(3), p.154. https://doi.org/10.1177/0266242619892149.

5. Andrea Calabrò, Mariangela Vecchiarini, Johanna Gast, Giovanna Campopiano, Alfredo De Massis, Sascha Kraus. (2019). Innovation in Family Firms: A Systematic Literature Review and Guidance for Future Research. International Journal of Management Reviews, 21(3), p.317. https://doi.org/10.1111/ijmr.12192.

Dimensions

PlumX

Visitas a la página del resumen del artículo

Descargas

Licencia

Derechos de autor 2017 Innovar

Esta obra está bajo una licencia internacional Creative Commons Reconocimiento-NoComercial-CompartirIgual 3.0.

Todos los artículos publicados por Innovar se encuentran disponibles globalmente con acceso abierto y licenciados bajo los términos de Creative Commons Atribución-No_Comercial-Sin_Derivadas 4.0 Internacional (CC BY-NC-ND 4.0).

Una vez seleccionados los artículos para un número, y antes de iniciar la etapa de cuidado y producción editorial, los autores deben firmar una cesión de derechos patrimoniales de su obra. Innovar se ciñe a las normas colombianas en materia de derechos de autor.

El material de esta revista puede ser reproducido o citado con carácter académico, citando la fuente.

Esta obra está bajo una Licencia Creative Commons: