Corporate Social Responsibility and good Corporate Governance practices in Spanish Ethical Mutual Funds: Analysis of investee companies

Responsabilidad social empresarial y buenas prácticas de gobierno corporativo en fondos de inversión éticos en España: análisis de las compañías beneficiarias

RESPONSABILIDADE SOCIAL EMPRESARIAL E BOAS PRÁTICAS DE GOVERNO CORPORATIVO EM FUNDOS DE INVESTIMENTO ÉTICOS NA ESPANHA: ANÁLISE DAS COMPANHIAS BENEFICIÁRIAS

DOI:

https://doi.org/10.15446/innovar.v27n65.65068Palabras clave:

Ethical Mutual Funds, Corporate Social Responsibility, Corporate Governance, Organizational Structure, accessibility and performance (en)fondos de inversión éticos, Responsabilidad Social Empresarial, Gobierno Corporativo, estructura organizacional, accesibilidad y desempeño (es)

acessibilidade e desempenho, estrutura organizacional, fundos de investimento éticos, Governo Corporativo, Responsabilidade Social Empresarial (pt)

Descargas

Ethical Mutual Funds (EMF) stand out for their investments in companies that develop strategies based on Corporate Social Responsibility (CSR) through good practices of Corporate Governance (CG). The aim of this paper is to analyze the types of companies that make up the portfolio of Spanish EMF, taking into account their cg model, their organizational structure and their economic and financial aspects. The results obtained show that the Spanish EMF prefer companies that promote the participation of stakeholders in their organizational structure and accessibility to their information. Additional evidence shows that the development of good cg practices in the context of CSR favors access to financing provided by financial markets and, within them, the EMF.

Los fondos de inversión éticos se destacan por realizar inversiones en compañías que construyen su estrategia bajo criterios de Responsabilidad Social Empresarial (RSE) y buenas prácticas de Gobierno Corporativo (CG). El objetivo de este artículo es analizar los tipos de compañías que conforman el portafolio de los fondos de inversión éticos españoles a partir del modelo de cg, la estructura organizacional y ciertos aspectos económicos y financieros de estas empresas. Los resultados obtenidos muestran que los fondos de inversión éticos españoles se inclinan por compañías en donde se promueve la participación de los stakeholders dentro de la estructura organizacional y la facilidad de acceso a su información. Evidencia complementaria señala que el desarrollo de buenas prácticas de cg en el contexto de la RSE favorece el acceso al financia-miento otorgado por los mercados financieros y, como parte de estos, a los fondos de inversión éticos.

Recibido: de junio de 2014; Aceptado: de mayo de 2016

ABSTRACT

Ethical Mutual Funds (EMF) stand out for their investments in companies that develop strategies based on Corporate Social Responsibility (CSR) through good practices of Corporate Governance (CG). The aim of this paper is to analyze the types of companies that make up the portfolio of Spanish EMF, taking into account their cg model, their organizational structure and their economic and financial aspects. The results obtained show that the Spanish EMF prefer companies that promote the participation of stakeholders in their organizational structure and accessibility to their information. Additional evidence shows that the development of good cg practices in the context of CSR favors access to financing provided by financial markets and, within them, the EMF.

KEYWORDS:

Ethical Mutual Funds, Corporate Social Responsibility, Corporate Governance, Organizational Structure, accessibility and performance.RESUMEN

Los fondos de inversión éticos se destacan por realizar inversiones en compañías que construyen su estrategia bajo criterios de Responsabilidad Social Empresarial (RSE) y buenas prácticas de Gobierno Corporativo (CG). El objetivo de este artículo es analizar los tipos de compañías que conforman el portafolio de los fondos de inversión éticos españoles a partir del modelo de cg, la estructura organizacional y ciertos aspectos económicos y financieros de estas empresas. Los resultados obtenidos muestran que los fondos de inversión éticos españoles se inclinan por compañías en donde se promueve la participación de los stakeholders dentro de la estructura organizacional y la facilidad de acceso a su información. Evidencia complementaria señala que el desarrollo de buenas prácticas de cg en el contexto de la RSE favorece el acceso al financia-miento otorgado por los mercados financieros y, como parte de estos, a los fondos de inversión éticos.

PALABRAS CLAVE:

fondos de inversión éticos, Responsabilidad Social Empresarial, Gobierno Corporativo, estructura organizacional, accesibilidad y desempeño.RESUMO

Os fundos de investimento éticos são destacados por realizar investimentos em companhias que constroem sua estratégia sob criterios de Responsabilidade Social Empresarial (RSE) e boas práticas de Governo Corporativo (GC). O objetivo deste artigo é analisar os tipos de companhias que conformam o portfólio dos fundos de investimento éticos espanhóis a partir do modelo de GC, a estrutura organizacional e certos aspectos econômicos e financeiros dessas empresas. Os resultados obtidos mostram que os fundos de investimento éticos espanhóis estão inclinados por companhias em que se promovem a participação dos stakeholders dentro da estrutura organizacional e a facilidade de acesso à sua informação. Evidência complementar indica que o desenvolvimento de boas práticas de CG no contexto das RSE favorece o acesso ao financiamento outorgado pelos mercados financeiros e, como parte destes, aos fundos de investimento éticos.

PALAVRAS-CHAVE:

acessibilidade e desempenho, estrutura organizacional, fundos de investimento éticos, Governo Corporativo, Responsabilidade Social Empresarial.RÉSUMÉ

Les fonds d'investissement éthique se caractérisent par des investissements dans des compagnies qui construisent leur stratégie sur des critères de responsabilité sociale des entreprises (RSE) et des bonnes pratiques de gouvernance d'entreprise (CE). Le but de cet article est d'analyser les types de sociétés qui composent le portefeuille des fonds d'investissement éthiques espagnols en partant du modèle de ce, la structure organisationnelle et certains aspects économiques et financiers de ces entreprises. Les résultats montrent que les fonds d'investissement éthique espagnols préfèrent les entreprises où l'on encourage la participation des parties prenantes au sein de la structure organisationnelle, et la facilité d'accès aux informations. D'autres preuves indiquent que le développement des bonnes pratiques de ce dans le cadre de la RSE favorise l'accès au financement accordé par les marchés financiers et, appartenant à ces derniers, aux fonds d'investissement éthique.

MOTS-CLÉ:

fonds d'investissement éthique, responsabilité sociale des entreprises, gouvernance d'entreprise, structure organisationnelle, accessibilité et performance.Introduction

Over the last few years the economic literature has used the term "Socially Responsible Investment" (SRI). Among the financial products linked to the SRI1, we have the Ethical Mutual Funds (EMF). An EMF offers to its investors a portfolio of stocks and investments which, in addition to generating financial results equal to those of the market, assures its participants their savings go to socially responsible companies (Aslaksen & Synnestvedt, 2003; Camino, 1993; García-de-Maradiaga & Valor, 2006, 2007; Sparkes & Cowton, 2004; Valor et al, 2009). The main characteristic of an EMF is the use of non-financial criteria in the selection of socially responsible companies for its portfolio (Renneboog et al., 2008; Signori, 2009), where a key aspect for a company to be considered as socially responsible is the development of good cc practices (Kolk & Pinkse, 2010). Thus, CSR and, within it, cc represent essential criteria for emf in their selection of investees (Capelle-Blancard & Monjon, 2012; Muñoz-Torres, Fernández-Izquierdo & Balaguer-Franch, 2004; Perera & Cortés 2006).

The aim of this paper is to study the type of company that Spanish EMF perceive as socially responsible. Therefore, in this study, we identify the qualities of the companies that Spanish EMF prefer when making up their portfolio. These qualities are verified by the information published by these companies on their cc model, their organizational structure and their economic and financial efficiency. In the design of the portfolio managers of EMF often use databases or ethical indexes (DJSI, FTSE4 Good Index and Domini Social Index, among others). These ethical indexes filter the companies following the arbitrary criteria of the creating agency (Székely & Knirsch, 2005). Given the limitations of socially responsible indexes, public information could be an alternative in the selection of companies for an EMF's portfolio. To achieve this, we have used cluster analysis and two regression models.

Currently, there are fifteen registered and marketed EMF in Spain. In 2012, the average rate of return was of 0.16%, with total assets valued at 132,968,000 euros; which, according to EUROSIF (2012), means Spain is one of Europe's fastest growing markets in the future, thus justifying the location of this study. Our results show there is a significant relationship between cc practices involving stakeholders and the preferences of EMF. As its main contribution, this paper shows the role of financial results as a key aspect for an organizational structure and cc model.

This paper is made up by five sections. The first section is introductory. The second reviews the research carried out in this field and of the various hypotheses studied in this paper. The third section introduces data, variables, descriptive statistics and results to corroborate the proposed hypotheses. In the fourth section we discuss the results. The last section provides conclusions based on the results obtained.

Background and Hypotheses

EMF'S investee companies are an example of the relationship between CSR and cc (Camino, 1993; Lizcano, 2006). Nowadays, one cannot conceive of a company qualified as socially responsible that does not have a good cc. The concept of cc has changed since Fama and Jensen (1983) to our days. In the last few years, cc has been defined as the complex set of restraints that shape the ex-post bargaining over the quasi-rents generated by a firm (Zingales, 1998); quasi-rents that are taken into consideration by different stakeholders (Armstrong, Guay & Weber, 2010; Suárez-Tirado, 2007; Fan, 2013). This would be the concept of cc from the point of view of the stakeholder theory (Jamali, 2008). Therefore, cc has now become a key tool in establishing CSR strategies with the participation of stakeholders.

This participation varies in intensity and impact on the management model. So, based on the cc model, the stakeholders' participation can be understood as an element of legal accountability, where stakeholders develop a passive behavior (DiMaggio & Powell, 1983; Meyer & Rowan, 1977). However, the role of stakeholders in projects and groups in an organization could also show an active behavior that enables the collaboration and integration of their real needs (Aras & Crowther, 2008; Di Domenico, Haugh & Tracey, 2010). In that sense, the participation of stakeholders could be as much an institutional mandate as a strategic tool of the organization. Consequently, the accessibility to information will depend on the intensity of the participation that is determined by the CSR strategy.

Generally speaking, companies adopt different CSR strategies depending on the cc system applied. The latter is conditioned by cultural aspects, market development and legal regulations of the country in which the company operates, as well as by the influence and concentration of foreign capital on its shareholders (Cuervo, 2002; Weimer & Pape, 1999). Despite this, some authors hold that there is a single model of cc at international level, where the specific aspects of the Anglosphere dominate (Belloc & Pagano 2013; Bozec & Día, 2012; Gilson, 2001; Hansmann & Kraakman 2001; Khanna, Kogan & Palepu, 2006). Against this trend, other authors maintain that the single cc model does not exist in practice, given the idiosyncrasies among different countries and societies (La Porta et al., 1997, 1998; Lubatkin et al., 2007; Reaz & Hossain, 2007).

Along these lines, we find research that only distinguishes between the Anglo-Saxon model and the continental one (Chan & Cheung, 2012; De Andrés & Vallelado, 2008; García-Castro et al., 2008; La Porta et al., 1997, 1998; Roe, 1993; Sarkar, 2011). However, this categorization is not considered exhaustive, and others extend the proposal of cc models. In particular, some authors conclude in their studies that the continental model actually conceals two categories, the German model and the French one (Blazy et al., 2012; Briano, 2012; Ewmi, 2005; Gourevitch, 2003; Licht, Gold-schmith & Schwartz, 2005; Tròger, 2005).

In other studies, the existence of the Japanese cc model as an alternative in the Asian region is detected; some authors associate this model with characteristics of the Anglo-Saxon and French models (Briano, 2012; Yoshikawa, 2007). In this respect, Young et al. (2008), Chung and Luo (2008) and Peters, Miller and Kusyk (2011) detected the existence of a cc model that is typical of emerging countries (such as Colombia, Argentina, Brazil, Chile and Mexico), defined with German and French influences. Finally, another trend was identified as a hybrid of the Anglo-Saxon and German model, which is used in the Scandinavian countries (Briano, 2012; De Andrés & Santamaría, 2010).

The differences between these six models are analyzed in figure 1. As we can observe, the Anglo-Saxon model is characterized by a Common Law legal system against the Civil Law system of the other models. In relation to the stakeholders' participation, it is possible to observe different behaviors. Anglo-Saxon model has a low level of participation, while the highest level is found in the German model. This degree of participation is directly related to the equity concentration and the minority investor protection.

Figure 1: Main characteristics of cc models. Source: Own elaboration.

In the Anglo-Saxon model we detect low concentration and high protection to the minority investor; while in the French model we can identify the opposite behavior. Finally, and like a tangential aspect, orientation is different, since the Anglo-Saxon model is characterized by a market orientation, while the models closer to the Continental model take into account aspects related to the internal organization of the entity (management orientation). Moreover, we can observe that the Scandinavian model, the Emergent model and the Japanese model are a mixture of the previous characteristics. All these characteristics impact the level of performance achieved by the organization (La Porta et al.,1997, 1998).

In addition, several authors have studied which conditional factors -external and internal- influence a company's choice for a cc model. Among the external factors, the following have been identified as influential: the legal tradition (De Andrés & Santamaría, 2010), the supervisory authority of the stock market in which the company participates (Pucko, 2005) and the stock market liquidity in which the company is listed (Briano, 2012). Among the internal factors, we find: the management model of the organization and its market orientation (Briano, 2012; Pucko, 2005; Reaz & Hossain, 2007).

To this day, there are no studies on the type of cc model applied by investee companies or the factors associated with this choice. This study is an opportunity to take into account, in addition to the internal and external factors proposed by other authors, economic and financial results and corporate structure as determinants in choosing a cc model in the context of emf. Consequently, our first two working hypotheses are:

hi: The EMF'S investee companies use different cg models.

h2: The financial results and corporate structure are factors that affect the choice of cg model in investee companies.

Previously and in a general framework, different papers have studied the relationship between corporate structure and the cc model implemented by the organization. La Porta et al. (1998) and, more recently, López and Liduina (2006), conclude by stating the existence of a unidirectional causality in which the cc model determines the corporate structure of the organization. However, other authors, such as Coffee (2000) and Johnson et al. (2000), indicate the existence of an inverse relationship; that is, cc models are the result of the various forms of organization adopted by firms. It is not the purpose of this paper to contrast these claims, but, given the duality of opinions, we assume that the factors that affect the choice for a cc model should also affect the shaping of a company's corporate structure. In particular, the economic and financial results could be a determining factor, which leads to the third hypothesis:

h3: Economic and financial results and the cg model chosen are the factors that determine the degree of development of the corporate structure of investee companies.

Methodology

In this paper, we have used data from transverse cuts of biannual public reports from 2012 deposited by the EMF at the National Stock Market Commission (Comisión Nacional de Mercado de Valores - CNMV, in Spanish). Currently, there are 15 EMF on the Spanish market. There is no public data found for other Collective Investment Institutions (CII), probably due to restrictions imposed by commercial regulations.

Andreu-Sânchez, Ortiz-Lázaro and Sarto-Marzal (2010) suggest analyzing the composition of the portfolio versus the aggregate figures when studying the investment policy of a mutual fund. The portfolio of Spanish EMF is made up of different assets. Mostly, these assets are invested in fixed income (57%), although the percentage invested in variable income (43%) is not insignificant. This investment is particularly interesting, since it is where the participation of shareholders makes sense. At the moment, Spanish EMF have 174 investee companies, most of them located in four countries: the usa (37.76%), the UK (16.57%), Spain (9.91%) and Germany (9.79%). These 174 companies represent our sample.

For this paper, we have chosen to use audited information found on each company's website (Balance, Income Statement, Notes, Management Report, Audit Reports and Annual Report). We have studied two broad categories of variables: CG variables and corporate-financial information variables.

Regarding CG, five variables have been categorized by principal component analysis taking as starting point twenty items. The evaluation of the items is based on the OEED 2004 Report in this area2. These CG variables are: a) Operation of governing bodies; b) Board of Management; c) Support committees; d) General Meeting or similar; and e) Internal control systems.

The corporate-financial information variables are:

-

Proposed in other studies: market value (Farag, 2009; Wu & Wei, 1998), size (Black, Jang & Kim, 2006; Berglöf & Pajuste, 2005; Briano, 2012; Holder-Webb, Cohen & Wood, 2008; Samaha et al., 2012), liability (Briano, 2012; Kirkos, Spathis & Manolopoulos, 2007), performance (Belkaoui & Pavlik, 1992; Ghafouri, 2014; Shin, 2001) and financial-legal system (Berglöf & Pajuste, 2005).

-

Proposed by the authors: Organizational Structure of Company (ose) and Level of Accessibility to the Information (LAI). The ose item is a continuous variable (from 0 to 1) that measures the degree of development of the decision and control system of the company, understood as the level of participation of different stakeholders and obtained from the Annual Report of each one. Thus, the osc variable measures the global structure of the firm, without discriminating between the possible aspects that distinguish the type of cg. The LAI represents the degree of access to audited information on the companies' websites (Likert scale 1-7).

The stated hypotheses require different techniques for contrast. In order to analyze the existence of different cg models we used cluster analysis. The test of the second hypothesis was carried out using the logistic regression model3. For the third one we used the OLS regression model with the ls and 2sls estimators. The endogenous variable is Corporate Structure, the exogenous variables are the cg model and the instrumental variables are the other financial information variables. Data was analyzed using SPSS 19.0 and Stata 14.0.

Results

Descriptive Analysis

This section reveals a first approximation of the data. The descriptive statistics of the items of the cg variables show important differences. For example, items related to split voting, or separate voting on separate matters, reach levels of compliance greater than 90%. Nevertheless, other items, such as gender diversity, do not reach 25%. In addition, we can observe that, except for the anti-takeover measures (63.8%), items related to the Board present a degree of compliance inferior to (statistical rank = 64.9%) the ones presented by the items of General Meeting (statistical rank = 30.5%) or Support Committees (statistical rank = 12.6%).

With regard to the financial information variables (table 1), we observe that firms in the portfolio of the EMF are large-sized (mean = 25.2), with a great number of multinationals and a high level of solvency (mean in (Equity) = 23.8), and that they also tend to be efficient companies (mean in(NP) = 20.40). Among these variables, we have observed low dispersion (SD < 3), except in performance (SD = 5.65). The dispersion detected in this last variable could be caused by the strong geographical diversity in the sample.

Note. This table contains a description of variables and measurement criteria of each variable. It also shows the mean, standard deviation (SD), maximum (Max) and minimum (Min) values. Source: Own elaboration.Table 1:

Descriptive statistics of economic and financial information.

Finally, the financial-legal system variable indicates that 36% of the companies in the sample are located in countries of the Anglo-Saxon legal tradition. Furthermore, the firms studied reach a compliance of 75% of the practices suggested in the OECD Code 2004, while the quality of access to information via the website reaches a level of 67% in the sample.

Do the EMF'S Investee Companies Use Different CC Models?

Cluster analysis results are shown in graph 1. In this chart we can see the position of the companies that make up the portfolio of Spanish EMF. The Governing Bodies' factor is related to equity concentration, while the Board Composition factor could be identified with the stakeholder orientation.

Graph 1: Cluster analysis results. Note. This graph shows the three groups analyzed and, in addition, includes the centroids, in order to allow a more rapid identification of the groups. Source: Own elaboration.

We can observe three groups with different characteristics:

-

Companies with the Anglo-Saxon cc model: Governing Bodies are found to be very developed, dealing with companies that respect the rights of the minority shareholder (low equity concentration), allowing split voting or separate voting on separate matters.

-

Companies with the German cc model: Social Bodies function correctly, but the Board of Management composition is different because there is high stakeholders' participation, especially among employees.

-

Companies with the French cc model: This third group comprises companies with few Governing Bodies (high equity concentration and poor stakeholder participation). These are companies that have statutory barriers (anti-takeover measures, limitation on the right to vote, lack of information on proposed agreements).

The origin of these companies is diverse. Countries from the Anglo-Saxon sphere make up the first group. USA and UK companies tend to position themselves together, and in the highest ranking. Certain companies from the Nordic countries (Norway and Sweden) are also included in this cluster, as well as companies from the Commonwealth, such as Australia and Canada. The second group is composed of German, Spanish, Danish and certain American companies. North American companies in this cluster are, in all cases, companies with strong roots in Europe (J&J, Coca-Cola, and Cisco). Finally, French, Italian, Portuguese and Japanese companies form the third group.

By using non-parametric Kruskal-Wallis and median tests (table 2), at a 5% significance level, we can see how the Governing Bodies, Board of Management, Support Committees and Audit variables take on different values in each one of the groups analyzed. That is, there are three cc models with differentiated characteristics, although this conclusion could be different in matters specific to the General Meeting.

Note. In panel A, we can observe the Kruskall-Wallis test for Governing Bodies, Board of Management, Support Committees, General Meeting and Audit and Internal Control. In panel B we observe the Median test for the same variables. In the first column, the statistic chi-squared, degrees of freedom and asymptotic significance are shown. Source: Own elaboration.Table 2:

Non-parametric contrasts between groups.

As for Spanish Ethic Mutual Fund investees, most companies use the German model (49.43%), while the French model tends to remain in a lower position (13.22%). To confirm this conclusion, we conducted a t-test for difference in means. The results show a p-value = 0.000 for pairs of models. Therefore, EMF would tend to consider the cc model when selecting their investments. Particularly, Spanish EMF would favor the investment where an active role of the stakeholders in the projects of the organization is promoted.

Are the Financial Results and Corporate Structure Factors that Affect the Choice of CG Model in the Investee Companies?

In all models (table 3), the OSC indicator is a critical variable at a 5% significance level. That is, the items related to the operation of the General Meeting, Board of Management and Support Committees explain the probability of belonging to a specific cc model. In addition, we can observe that the variable takes different signs in the studied models. The positive sign (β = 0.17) is typical of the AngloSaxon model, while the negative sign manifests in the rest of the models (β = -0.025 in the German model or β = -0.195 for the French model). Therefore, the unit increases of the OSC indicator lower the probability of belonging to the French and German models.

The Anglo-Saxon model introduces two additional explanatory variables: market orientation (β = -0.296) and legal tradition of the country (β = -1.528). Both variables favor belonging to the Anglo-Saxon model (see column Exp (β), table 3), but to a lesser extent than the OSC of the company. The German model lists three variables of its own, which favor its choice: legal tradition (β = l .626), liability (β = 0.402) and, to a smaller degree, performance (β = -0.286). We can observe that legal tradition is the most significant variable in both models, but with opposite signs. In the French model, the only significant variable is the OSC (β = -0.195).

Note. This table contains the logit regression for each Corporate Governance model (Anglo-Saxon model, German model and French model). In the Variables column, we can observe the variables that characterize the models (Organizations Structure of Corporation (ose), market orientation, legal tradition, level of liability and performance). These variables are measured by different indicators that appear in the next column. Finally, we can see the parameter (3), exponential change Exp(3) and level of significance (Sig.). Source: Own elaboration.Table 3:

Binary logistic regression coefficients.

As shown in table 4, all models achieved an appropriate fit in terms of R2 of Cox and Snell (R2CS) and Nagelkerke's R2 (R2N).

Note. This table 4 contains information about the goodness of fit of each proposed model. We have used two indicators: R2 of Cox and Snell and R2 of Nagelkerke. Source: Own elaboration.Table 4:

Model fit.

Thus, the Anglo-Saxon model would be considered a market-oriented model, the German would be a funding-oriented model and the French one would remain a specifically management-oriented model. As consequence, the stakeholders' role is different. In the Anglo-Saxon model this participation comes from market although it is weak, while in the German model the participation has its origin in the financial institutions. In both cases we can observe an active role in the participation of stakeholders, which will be more intense in the case of German model due to its stakeholders are supporting the financial sustainability of the entity. Finally, the French model would be characterized by a passive role in the participation of stakeholders since it does no promote an external orientation.

What are the Factors that Determine the Degree of Development of the Corporate Structure of the Investee Companies?

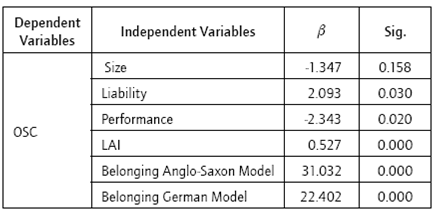

Table 5 shows the defining variables of CG practices within a company. In addition to the proposed variables, variables belonging to the Anglo-Saxon model and the German model have been added.

Note. This table shows the results of the OLS regression model. This model relates the Organizational Structure of Corporation (ose) with factors which determine it (size, liability, performance, level of accessibility to information (lai) and belonging to a particular model of CG). The parameters are represented by 3, being sig. the level of significance. Source: Own elaboration.Table 5:

Results bilateralized cosines regression model.

As significant variables we have liability (β = 2.093), LAI (β = 0.527) and, especially, belonging to a particular model of government (β = 31.032, Anglo-Saxon model, and β = 22.402, German model). The positive signs of the coefficients indicate that companies that are more indebted develop more cc practices, offer greater accessibility to their information and follow a behavior proper to German model where the stakeholders' participation is strengthened.

Size (β = -1.347) and performance (β = -2.343) variables contradict the expected results. Size is not a significant variable (sig = 0.158), while the coefficient associated with performance is negative. Consequently, the cc practices of more efficient firms tend to be less developed.

Regarding the goodness of fit of the model, the quadratic residues (F-Snedecor = 2962.929) are statistically significant at 1% level. Therefore, the model captures the most important explanatory variables of the degree of development of cc practices reached by the companies analyzed.

Finally, we tested the previous model using the 2SLS estimator. The results of this model confirmed previous results (annex 1).

Discussion

As indicated, in recent years, six CG models have been identified: Anglo-Saxon, German, French, Japanese, Emerging and Scandinavian (Krambia & Psaros, 2006; Jong, 1991; Moerland, 1995; Scott, 1985). Each model promotes a different tendency in the stakeholders' participation. In this study, evidence shows that companies with EMF investments match the characteristics of the three basic models: Anglo-Saxon, German and French. The Anglo-Saxon model is characterized by granting more protection to the minority shareholders against the power enjoyed by majority models are based on the dichotomy between the shareholders/owners of the capital, and the company managers. The difference is that the French model aims to protect the concentration of capital, while the German encourages an active stakeholder participation in the management bodies (Cazorla, 2012; Lopez & Liduina, 2006; Reynolds & Flores, 1989; Sava, 2002).

Regarding the Japanese model, Ooghe and De Langhe (2002), García-Castro et al. (2008) and Briano (2012) consider it is not a model of its own, since the companies that apply it essentially follow the guidelines of the French model. We share the view of these authors, since cluster analysis results show that the Japanese firms in the sample follow the French model. Referring to the Emerging and Scandinavian models, Weimer and Pape (1999) argue these are variations of the Anglo-Saxon, German and French models.

The use of binary logistic regressions allowed us to reveal the factors that explain the probability of belonging to the proposed models. Thus, market value, organizational structure and the Common Law legal system explain the belonging to the Anglo-Saxon model where the stakeholders' participation is favored. On the contrary, the German model is based on variables related to financial and economic results, as well as the organizational structure and the system of Roman civil law, whereas the French model would be more focused on the organizational structure of the company. So the second working hypothesis is not rejected; that is, organizational structure and financial results are factors that determine the belonging to a particular model in addition to other components, such as legal tradition, proposed in previous studies (De Andrés & Santamaría, 2010; Salas, 2002). Moreover, we identify that the Anglo-Saxon and German models favor the participation of different stakeholders. The German model is centered in the financial institutions, while the Anglo-Saxon model takes a broader point of view.

In the contrast of the second hypothesis, the organizational structure appears as a determining factor in the choice of the cc model. However, previous studies have shown the possible existence of an inverse relationship (Coffee, 2000; Johnson et al., 2000). The results of our study show a two-way relationship and, ultimately, the financial and economic results and the accessibility to the information are the factors that explain both the organizational structure and the cc model chosen. Thus, our results disagree with authors who claim that the organizational structure predetermines the choice of model and those who suggest that the cc model predetermines the organizational structure chosen.

Also, unlike previous studies (Berglóf & Pajuste, 2005; Briano, 2012; Samaha et al., 2012), size is an insignificant variable in determining corporate structure. Furthermore, in relation to the performance variable, we observe a negative effect on the organizational structure, which confirms the approach by Cabeza and Gómez (2007). We agree with these authors that an overly-developed corporate structure may be causing undesirable changes in the performance of the company. This circumstance could be justified by the existence of high costs associated with Support Committees formation (Giráldez & Hurtado, 2014).

Finally, if we combine our working hypothesis we obtain the next conclusion. Spanish EMF tend to fund companies that promote a German model of Corporate Governance. This model stimulates the participation of financial stakeholders. Then, as consequence, Spanish EMF invests in companies that promote an active participation of the stakeholders where the EMF will assume its role as a financial stakeholder.

Conclusions

The main objective of this paper has been to analyze the intrinsic characteristics of the companies receiving financial investment from Spanish EMF based on the information published by these companies. Results show how Spanish EMF invest in companies with different CG models, being the organizations under the German model the favorite, followed by those under the Anglo-Saxon model. The French model is clearly a minor choice among Spanish EMF managers. The German and Anglo-Saxon models tend to protect the interests of a wide range of stakeholders; minority shareholders, employees, creditors and other social stakeholders.

Each model is characterized by different aspects. The German model integrates employees, creditors and social stakeholders within its management bodies. The main reason for this integration can be found in the cultural values contained in its legal tradition, which permeate the organizational structure of investee companies. The AngloSaxon model is also influenced by the legal tradition, but with a higher interest in the protection of minority shareholders' interests. Consequently, Spanish EMF tend to make up their portfolios with companies that promote the integration of stakeholders in the organization and safeguard the minority shareholder.

Moreover, the analysis suggests that corporate results, cc model and accessibility to the information are the aspects that underlie and explain the organizational structure of companies. This result generalizes the conclusions suggested by Kelton and Yang (2008) on the relationship between organizational structure and accessibility to accounting information via the Internet.

Spanish EMF perceive a company as socially responsible, with the best cc practices, if it provides greater accessibility to its information. Moreover, Spanish EMF managers do not prefer to have participation in more efficient companies. In fact, one can observe how the more efficient the company is, the smaller its need to invest in improving the standard of good cc. Therefore, we believe that the degree of development of organizational structure and the investee's cc model will be conditioned by their financial needs. Thus, CSR and good cc practices are essential tools for attracting funding and guaranteeing the sustainability of the company.

However, this last statement must be ascertained. Among the investee companies we found different ways of understanding CSR and good cc: those where good cc and CSR are part of corporate culture, compared to the ones replicating this behavior out of strategic necessity. An EMF may not be able to distinguish between the two types of companies. A future line of work should focus on the development of criteria that help EMF to distinguish between both behaviors. It would also be necessary, in future research studies, to analyze the level of efficiency of the stock market in relation to the value of CSR policies implemented by companies that claim to be socially responsible.

References

Annex 1. Results of Bilateralized Cosines Regression Model. Estimator 2sls.i

Note. This table shows the result of the OLS regression model under 2sls estimator. This model relates the Organizational Structure of Corporation (osc) with factors which determine it (Size, liability, level of accessibility of information (LAI) and belonging to a particular model of cc. Size, liability and LAI have been considered independent variables, while belonging to a particular model of cc has been instrumentalized taken into account the previous logit regression. The parameters are represented by 3, being sig. the level of significant. Endogenity test: x2(2): 2.388; p-value: 0.303, Sargan test: x2(2): 0.432; p-value: 0.8058.

Referencias

Andreu-Sánchez, L, Ortiz-Lázaro, C., & Sarto-Marzal, J. L. (2010). Inter-nacionalización de la industria española de fondos de inversión y cambios de categorías. Innovar, 20(37), 195-206.

Aras, G., & Crowther, D. (2008). Governance and sustainability: An investigation into the relationship between corporate governance and corporate sustainability. Management Decision, 46(3), 433-448.

Armstrong, C. S., Guay, W. R., & Weber, J. P. (2010). The role of information and financial reporting in corporate governance and contracting. Journal of Accounting and Economics, 50, 179-234.

Aslaksen, I., & Synnestvedt, T. (2003). Ethical investment and the incentives for corporate environmental protection and social responsibility. Corporate Social Responsibility and Environmental Management, 10(4), 212-223.

Belkaoui, A., & Pavlik, E. (1992). The effects of ownership structure and diversification strategy on performance. Managerial and Decision Economics, 13(4), 343-352.

Belloc, M., & Pagano, U. (2013). Politics-business coevolution paths: Worker's organization and capitalism concentration. International Review of Law and Economics, 33(March), 23-36.

Berglöf, E., & Pajuste, A. (2005). What do firms disclose and why? Enforcing corporate governance and transparency in central and Eastern Europe. Oxford Review of Economics Policy, 27(2), 1-20.

Black, B. S., Jang, H., & Kim, W. (2006). Does Corporate Governance Predict Firm's Market Value? Evidence from Korea. Journal of Law, Economics, and Organization, 22(2), 366-413.

Blazy, R., Boughanmi, A., Deffains, B., & Guigou, J. (2012). Corporate Governance and financial development: A study of the French case. European Journal of Law and Economics, 33(2), 399-445.

Bozec, R., & Día, M. (2012). Convergence of Corporate Governance practices in the post-Enron period: Behavioral transformation or box-checking exercise? Corporate Governance, 72(2), 243-257.

Briano, G. C. (2012). Institutional factors that influence on the Corporate Governance transparency: A study of Latin American listed companies. International Doctoral Thesis (Ph.D.). University of Cantabria, Spain.

Cabeza, L., & Gómez, S. (2007). Análisis de la influencia del Gobierno Corporativo en la performance empresarial. XXI Congreso Anual AEDEM. Universidad Rey Juan Carlos, Madrid, España.

Camino, D. (1993). Ethical Mutual Funds. Spanish Review of Finance and Accounting, 23(75), 397-417.

Capelle-Blancard, G., & Monjon, S. (2012). Trends in the literature on socially responsible i nvestment: looking for the keys under the lamppost. Business Ethics: A European Review, 27(3), 239-250.

Cazorla, L. (2012). Presidente ejecutivo y Gobierno Corporativo de sociedades cotizadas en España: Una aproximación al estado de la cuestión al hilo del reciente libro verde sobre Gobierno corporativo de la Unión Europea. Documentos de Trabajo del Departamento de Derecho Mercantil, 45, 1-45.

Chan, A. W. H., & Cheung, Y. H. (2012). Cultural dimensions, ethical sensitivity and corporate governance. Journal of Business Ethics, 770, 45-59.

Chung, C. N., & Luo, X. (2008). Institutional logics or agency costs: The influence of corporate governance models on business group restructuring in emerging economies. Organization Science, 79(5),766-784.

Coffee, J. C. (2000). Class action accountability: Reconciling exit, voice, and loyalty in representative litigation. Columbia Law Review, 700(2), 370-439.

Cuervo, A. (2002). Corporate governance mechanisms: a plea for less code of good governance and more market control. Corporate Governance: An International Review, 70(2), 84-93.

De Andrés, P., & Santamaría, M. (2010). Un paseo por el concepto de Gobierno corporativo. Revista de Responsabilidad Social de la Empresa, 2(2), 15-34.

De Andrés, P., & Vallelado, E. (2008). Corporate Governance in banking: The role of the board of directors. Journal of Banking & Finance,32, 2570-2580.

De Madariaga, J. G., & Valor, C. (2007). Stakeholders management systems: Empirical insights from relationship marketing and market orientation perspectives. Journal of Business Ethics, 77(4), 425-439.

DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48, 147-160.

Di Domenico, M., Haugh, H., & Tracey, P. (2010). Social bricolage: Theorizing social value creation in social enterprises. Entrepreneurship Theory and Practice, 34(4), 681-703.

European Social Investment Forum [EUROSIF] (2012). European SRI Study. 2072 Report. Retrieved from: http://www.eurosif.org/research/eurosif-sri-study/sri-study-2012. [URL]

Ewmi, P. F. (2005). Three models of Corporate Governance from developed capital markets. Lectures on Corporate Governance , December, 1-14.

Fama, E., & Jensen, M. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325.

Fan, S. (2013). Corporate Governance and information content of stock trades: Evidence from S&P100 companies. The International Journal of Business and Finance Research, 7(3), 41-56.

Farag, H. (2009). Collaborative Value Creation: An Empirical Analysis of the European Biotechnology Industry. Berlin: Springer Science & Business Media.

García-de-Madariaga, J., & Valor, C. (2006). Stakeholders management systems: empirical insights from relationship marketing and market orientation perspectives. Journal of Business Ethics, 77,425-239.

García-Castro, R., Ariño, M. A., Rodríguez, M. A., & Ayuso, S. (2008). A cross-national study of corporate governance and employment contracts. Business Ethics: A European Review, 77(3), 259-284.

Ghafouri, H. (2014). Investigating the Effect of Different Methods of Financial Supply on the Profitability Ratios of Companies Accepted in Tehran Stock Exchange. European. Journal of Business and Management, 6(37), 261-268.

Gilson, R. J. (2001). Globalizing Corporate Governance: Convergence of form or function. The American Journal of Comparative Law, 49(2), 329-357.

Giráldez, P., & Hurtado, J. M. (2014). Do independent directors protect shareholder value? Business Ethics: A European Review, 23(1),91-107.

Gourevitch, P. A. (2003). The politics of corporate governance regulation. The Yale Law Journal, 772(7), 1829-1880.

Hansmann, H., & Kraakman, R. (2001). The end of history of corporate law. Georgetown Law Journal, 89, 439-468.

Holder-Webb, L., Cohen, J., Nath, L., & Wood, D. (2008). A survey of Governance Disclosures among us firms. Journal of Business Ethics,83(3), 543-563.

Jamali, D. (2008). A stakeholder approach to corporate social responsibility: A fresh perspective into theory and practice. Journal of Business Ethics, 82(1), 213-231.

Johnson, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2000). Tunnelling. American Economic Review Papers and Proceedings,90(2), 22-27.

Jong, H. W. (1991). The takeover market in Europe: Control structures and the performance of large companies compares. Review of Industrial Organizations, 7, 1-18.

Karlsson, K. (2006). Avlatsindustrin-etiki fonder ochföretag. Stockholm: Timbro.

Kelton, A. S., & Yang, Y. W. (2008). The impact of corporate governance on Internet financial reporting. Journal of Accounting and Public Policy, 27(1), 62-87.

Khanna, T., Kogan, J., Palepu, K. (2006). Globalization and similarities in Corporate Governance: A cross-country analysis. Review of Economics and Statistics, 88(1), 69-90.

Kirkos, E., Spathis, C., & Manolopoulos, Y. (2007). Data mining techniques for the detection of fraudulent financial statements. Expert Systems with Applications, 32(4), 995-1003.

Krambia, M., & Psaros, J. (2006). The implementation of corporate governance principles in an emerging economy: A critique of the situation in Cyprus. Corporate Governance: An International Review, 74(2), 126-139.

Kolk, A., & Pinkse, J. (2010). The integration of corporate governance in corporate social responsibility disclosures. Corporate Social Responsibility and Environmental Management, 77(1), 15-26.

La Porta, R., López de Silanes, F., Shleifer, A., Vishny, R. (1997). Legal determinants of external finance. Journal of Finance, 52(3), 1131-1150.

La Porta, R., López de Silanes, F., Shleifer, A., Vishny, R. (1998). Law and Finance, Journal of Political Economy, 706(6), 1113-1115.

Licht, A. M., Goldschmidt, C., Schwartz, S. H. (2005). Culture, Law and Corporate Governance. International Review of Law and Economics, 25, 229-255.

Lizcano, J. L. (2006). Buen gobierno y responsabilidad social corporativa. Partida Doble, 782, 20-35.

López, F. J., & Liduina, M. (2006). Codes of good governance: An international analysis. Universia Business Review, 77, 10-21.

Lubatkin, M., Lane, P. J., Collin, S., & Very, P. (2007). An embeddedness framing of governance and opportunism: towards a cross-nationally accommodating theory of agency. Journal of Organizational Behavior,28(1), 43-58.

Meyer, J. W., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology,83(2), 340-363.

Moerland, P. W. (1995). Corporate ownership and control structures: An international comparison. Review of Industrial Organization,70(4), 443-464.

Muñoz-Torres, M. J., Fernández-Izquierdo, M. A., Balaguer-Franch, M. R. (2004). The social responsibility performance of ethical and solidarity funds: an approach to the case of Spain. Business Ethics: A European Review, 72(2-3), 200-218.

Ooghe, H., & De Langhe, T. (2002). The Anglo-American versus the continental European corporate governance model: empirical evidence of board composition in Belgium. European Business Review, 74(6), 437-449.

Organisation for Economic Cooperation and Development [OECD] (2004). OECD Principles of Corporate Governance. Retrieved from: http://www.oecd.org/corporate/ca/corporategovernanceprin-ciples/31557724.pdf. [URL]

Perera, C., & Cortés, J. J. T. (2006). Cómo son los pequeños accionistas en España. Revista Mensual de Bolsas y Mercados Españoles, 757,14-17.

Peters, S., Miller, M., & Kusyk, S. (2011). How relevant is corporate governance and corporate social responsibility in emerging markets? Corporate governance, 77(4), 429-445.

Pucko, D. (2005). Corporate Governance in European transition economics: Emerging models. Management, 70(1), 1-21.

Reaz, M., & Hossain, M. (2007). Corporate Governance around the World: An Investigation. Journal of American Academy of Business, 77 (2), 169-175.

Renneboog, L., Horst, J. T., & Zhang, C. (2008). Socially responsible investments: Institutional aspects, performance, and investor behaviour. Journal of Finance & Banking, 32, 1723-1742.

Roe, M. (1993). Some differences in corporate structure in Germany, Japan and the United States. Yale Law Journal, 702(8), 1927-2003.

Reynolds, T. H., & Flores, A. A. (1989). Foreign law: current sources of codes and basic legislation in jurisdictions of the world. Littleton, co, usa: F.B. Rothman.

Sava, T. (2002). Gobierno Corporativo en los Estados Unidos a comienzos del s. XXI y su posición en el ámbito global. Revista chilena de Derecho, 29(3), 661-671.

Salas, V. (2002). El gobierno de la empresa. Barcelona: Servicio de Estudios La Caixa.

Samaha, K., Dahawy, K., Hussainey, K., & Stapleton, P. (2012). The extent of corporate governance disclosure and its determinants in a developing market: The case of Egypt. Advances in Accounting, 28(1), 168-178.

Sarkar, P. (2011). Common Law vs. Civil Law: Which system provides more protection to shareholders and promotes financial development. Journal of Advanced Research in Law and Economics, 2(4), 143-161.

Scott, W. G. (1985). Organizational Revolution: An End to Managerial Orthodoxy. Administration & Society, 77(2), 149-170.

Shin, N. (2001). The impact of information technology on financial performance: the importance of strategic choice. European Journal of Information Systems, 70(4), 227-236.

Signori, S. (2009). Ethical (SRI) funds un Italy: a review. Business Ethics: A European Review, 78(2), 145-164.

Sparkes, R., & Cowton, C. J. (2004). The maturing of socially responsible investment: A review of the developing link with corporate social responsibility. Journal of Business Ethics, 52(1), 45-57.

Suárez-Tirado, J. (2007). Relaciones entre organizaciones y stakeholders: necesidad de una interacción mutua entre los diversos grupos de interés. Innovar, 77(30), 153-158.

Székely, F., & Knirsch, M. (2005). Responsible Leadership and Corporate Social Responsibility: Metrics for Sustainable Performance. European Management Journal, 23(6), 628-647.

Tröger, T. H. (2005). Choice of jurisdiction in European corporate law. Perspectives of European corporate governance. European Business Organization Law Review, 6(1), 3-64.

Valor, C., De la Cuesta, M., & Fernández, B. (2009). Understanding Demand for Retail Socially Responsible Investments: A Survey for individual investors and financial consultants. Corporate Social Responsibility and Environmental Managements, 76, 1-14.

Weimer, J., & Pape, J. C. (1999). A taxonomy of systems of corporate governance. Corporate governance: An international review, 7(2),152-166.

Wu, C. Y., & Wei, K. C. (1998). Cooperative r&d and the Value of the Firm. Review of Industrial Organization, 73, 425-446.

Yoshikawa, T. (2007). Corporate Governance in Japan: Flexible Adoption of Shareholder-Oriented Practices. In Gonzalez, E. T. (Ed.), Best Practices in Asian Corporate Governance (pp. 63-91). Tokyo: Asian Productivity Organization.

Young, M. N., Peng, M. W., Ahlstrom, D., Bruton, G. D., & Jiang, Y. (2008). Corporate governance in emerging economies: A review of the principal perspective. Journal of Management Studies,45(1), 196-220.

Zingales, L. (1998). Corporate Governance. In P. Newman (Ed.), The New Palgrave Dictionary of Economics and Law. London: McMillan.

Zysman, J. (1983). Governments, markets and growth: Financial systems and the politics of industrial change. Ithaca: Cornell University Press.

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

CrossRef Cited-by

1. Francisco J. Lopez-Arceiz, Ana J. Bellostas, Jose M. Moneva. (2021). Accounting Standards for European Non-profits. Reasons and Barriers for a Harmonisation Process. Accounting in Europe, 18(1), p.43. https://doi.org/10.1080/17449480.2020.1795215.

2. Francisco J. López‐Arceiz, Cristina Del Río, Ana J. Bellostas. (2020). Sustainability performance indicators: Definition, interaction, and influence of contextual characteristics. Corporate Social Responsibility and Environmental Management, 27(6), p.2615. https://doi.org/10.1002/csr.1986.

3. Xixiang Sun, Gen Li, Kuruva Lakshmanna. (2022). The Core Value Strategy and Mentality Evolution of the New Era of Corporate Social Responsibility. Wireless Communications and Mobile Computing, 2022(1) https://doi.org/10.1155/2022/4122334.

4. Paola Reyes, Robinson Leal. (2019). Responsabilidad social corporativa desde la contabilidad: un mapeo sistemático de la literatura para Colombia. Apuntes Contables, (24), p.179. https://doi.org/10.18601/16577175.n24.11.

Dimensions

PlumX

Visitas a la página del resumen del artículo

Descargas

Licencia

Derechos de autor 2017 Innovar

Esta obra está bajo una licencia internacional Creative Commons Reconocimiento-NoComercial-CompartirIgual 3.0.

Todos los artículos publicados por Innovar se encuentran disponibles globalmente con acceso abierto y licenciados bajo los términos de Creative Commons Atribución-No_Comercial-Sin_Derivadas 4.0 Internacional (CC BY-NC-ND 4.0).

Una vez seleccionados los artículos para un número, y antes de iniciar la etapa de cuidado y producción editorial, los autores deben firmar una cesión de derechos patrimoniales de su obra. Innovar se ciñe a las normas colombianas en materia de derechos de autor.

El material de esta revista puede ser reproducido o citado con carácter académico, citando la fuente.

Esta obra está bajo una Licencia Creative Commons: